need anwers of the two box marked with red cross.

need explanation step by step

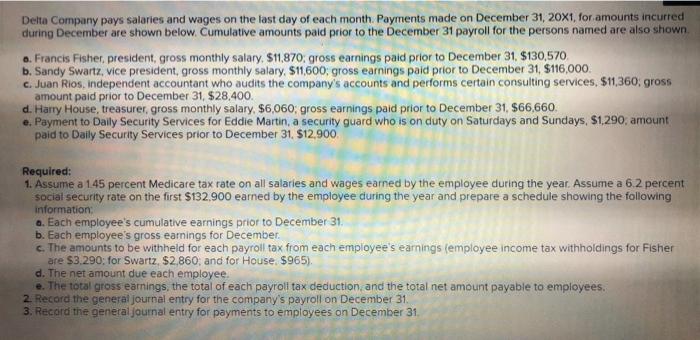

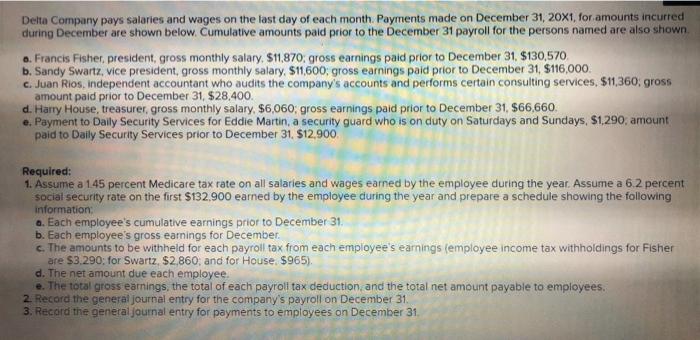

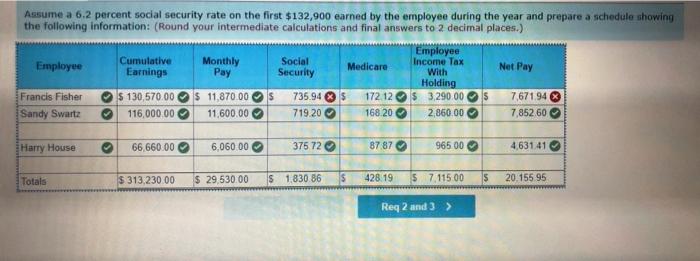

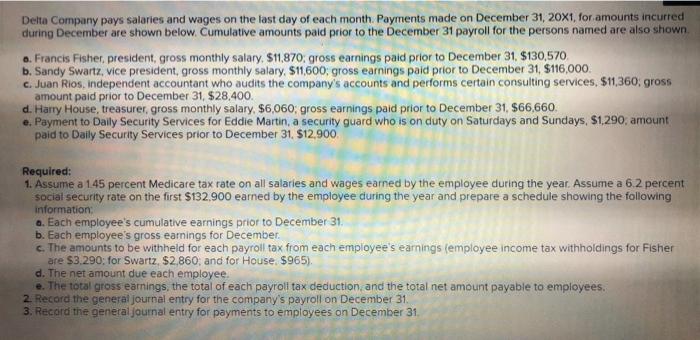

Delta Company pays salaries and wages on the last day of each month Payments made on December 31, 20x1, for amounts incurred during December are shown below. Cumulative amounts paid prior to the December 31 payroll for the persons named are also shown o. Francis Fisher, president, gross monthly salary, $11,870. gross earnings paid prior to December 31, $130,570 b. Sandy Swartz, vice president, gross monthly salary, $11,600 gross earnings paid prior to December 31, $116,000. c. Juan Rios, independent accountant who audits the company's accounts and performs certain consulting services, $11,360 gross amount paid prior to December 31, $28,400. d. Harry House, treasurer, gross monthly salary, $6,060, gross earnings paid prior to December 31, $66,660 e. Payment to Daily Security Services for Eddie Martin, a security guard who is on duty on Saturdays and Sundays, $1.290, amount paid to Daily Security Services prior to December 31. $12.900 Required: 1. Assume a 145 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Assume a 6.2 percent social security rate on the first $132.900 earned by the employee during the year and prepare a schedule showing the following information: a. Each employee's cumulative earnings prior to December 31. b. Each employee's gross earnings for December c. The amounts to be withheld for each payroll tax from each employee's earnings (employee income tax withholdings for Fisher are $3.290: for Swartz. $2.860, and for House $965). d. The net amount due each employee. e. The total gross earnings, the total of each payroll tax deduction and the total net amount payable to employees. 2. Record the general journal entry for the company's payroll on December 31 3. Record the general journal entry for payments to employees on December 31 Assume a 6.2 percent social security rate on the first $132,900 earned by the employee during the year and prepare a schedule showing the following information: (Round your intermediate calculations and final answers to 2 decimal places.) Employee Cumulative Monthly Employee Social Income Tax Earnings Pay Security Medicare With Net Pay Holding Francis Fisher $ 130,570,00 $ 11,870.00 S 735.94 $ 172 12$ 3,290.005 7,67194 Sandy Swartz 116,000.00 11,600.00 719 20 168.20 2.860.00 7,852 60 Harry House > 66 660.00 6,060 00 375 72 87 87 965 00 4,631.41 Totals $ 313,230.00 $ 29,530.00 $ 1,830 86 $ 428.19 5 7.115 00 15 20.155 95 Req 2 and 3 >