Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need ASAP 30 minutes On December 2, 2020, Troll Company, a U.S. company, sold machinery to Amigo, a Mexican company, with payment due on March

Need ASAP 30 minutes

Need ASAP 30 minutes

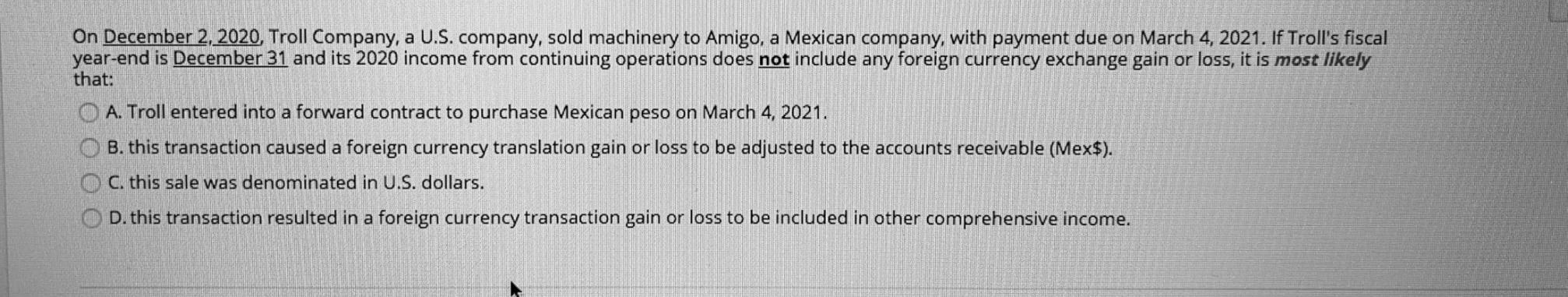

On December 2, 2020, Troll Company, a U.S. company, sold machinery to Amigo, a Mexican company, with payment due on March 4, 2021. If Troll's fiscal year-end is December 31 and its 2020 income from continuing operations does not include any foreign currency exchange gain or loss, it is most likely that: A. Troll entered into a forward contract to purchase Mexican peso on March 4, 2021. B. this transaction caused a foreign currency translation gain or loss to be adjusted to the accounts receivable (Mex$). C. this sale was denominated in U.S. dollars. D. this transaction resulted in a foreign currency transaction gain or loss to be included in other comprehensive income. OO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started