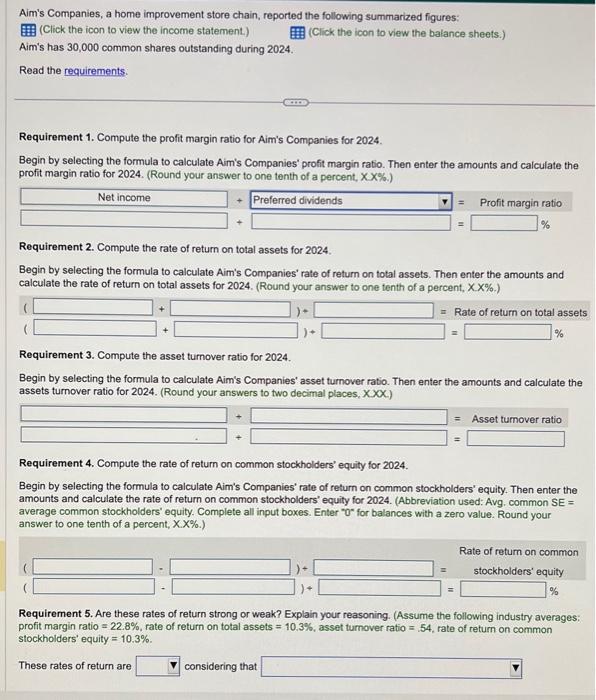

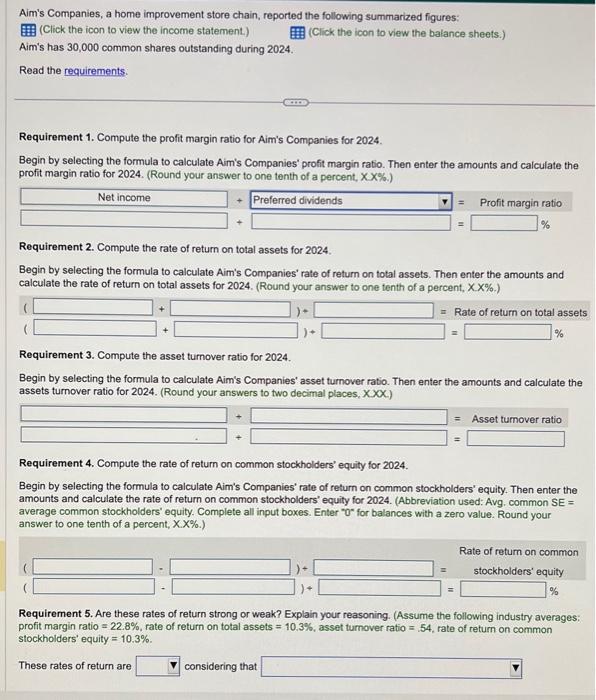

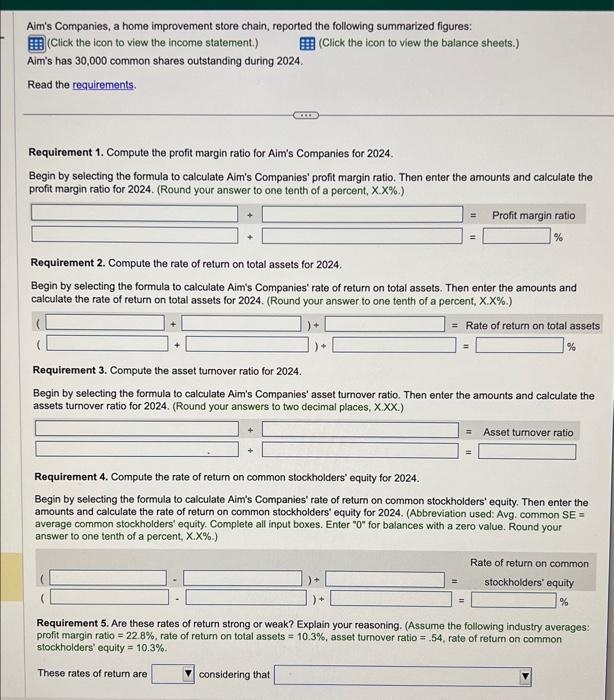

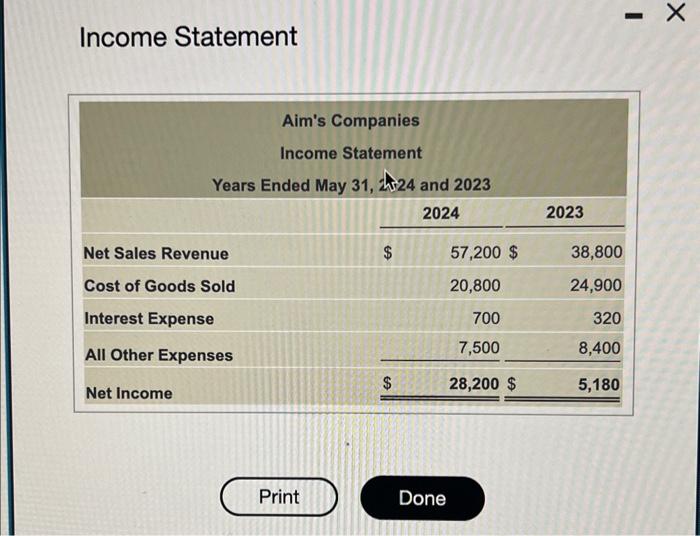

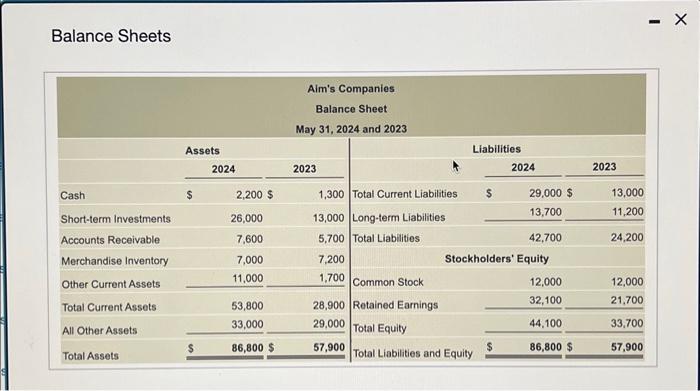

Aim's Companies, a home improvement store chain, reported the following summarized figures: (Click the icon to view the income statement.) (Click the icon to view the balance sheets.) Aim's has 30,000 common shares outstanding during 2024. Read the requirements: Requirement 1. Compute the profit margin ratio for Aim's Companies for 2024. Begin by selecting the formula to calculate Aim's Companies' profit margin ratio. Then enter the amounts and calculate the profit margin ratio for 2024. (Round your answer to one tenth of a percent, %.) Requirement 2. Compute the rate of return on total assets for 2024. Begin by selecting the formula to calculate Aim's Companies' rate of return on total assets. Then enter the amounts and calculate the rate of return on total assets for 2024 . (Round your answer to one tenth of a percent, %.) Requirement 3. Compute the asset turnover ratio for 2024. Begin by selecting the formula to calculate Aim's Companies' asset turnover ratio. Then enter the amounts and calculate the assets turnover ratio for 2024 . (Round your answers to two decimal places, X XXX. Requirement 4. Compute the rate of return on common stockholders' equity for 2024. Begin by selecting the formula to calculate Aim's Companies' rate of return on common stockholders' equity. Then enter the amounts and calculate the rate of return on common stockholders' equity for 2024. (Abbreviation used: Avg. common SE = average common stockholders' equity. Complete all input boxes. Enter "O" for balances with a zero value. Round your answer to one tenth of a percent, X.X%.) Requirement 5. Are these rates of return strong or weak? Explain your reasoning. (Assume the following industry averages: profit margin ratio =22.8%, rate of return on total assets =10.3%, asset turnover ratio =.54, rate of return on common stockholders' equity =10.3%. These rates of return are considering that Aim's Companies, a home improvement store chain, reported the following summarized figures: (Click the icon to view the income statement.) (Click the icon to view the balance sheets.) Aim's has 30,000 common shares outstanding during 2024. Read the requirements. Requirement 1. Compute the profit margin ratio for Aim's Companies for 2024. Begin by selecting the formula to calculate Aim's Companies' profit margin ratio. Then enter the amounts and calculate the profit margin ratio for 2024. (Round your answer to one tenth of a percent, X.X%.) Requirement 2. Compute the rate of return on total assets for 2024. Begin by selecting the formula to calculate Aim's Companies' rate of return on total assets. Then enter the amounts and calculate the rate of return on total assets for 2024 . (Round your answer to one tenth of a percent, X.X%.) Requirement 3. Compute the asset turnover ratio for 2024. Begin by selecting the formula to calculate Aim's Companies' asset turnover ratio. Then enter the amounts and calculate the assets turnover ratio for 2024. (Round your answers to two decimal places, X.XX.) Requirement 4. Compute the rate of return on common stockholders' equity for 2024. Begin by selecting the formula to calculate Aim's Companies' rate of return on common stockholders' equity. Then enter the amounts and calculate the rate of return on common stockholders' equity for 2024. (Abbreviation used: Avg. common SE = average common stockholders' equity. Complete all input boxes. Enter " 0 " for balances with a zero value. Round your answer to one tenth of a percent, X.X%.) Requirement 5. Are these rates of return strong or weak? Explain your reasoning. (Assume the following industry averages: profit margin ratio =22.8%, rate of return on total assets =10.3%, asset turnover ratio =.54, rate of return on common stockholders' equity =10.3%. These rates of return are considering that Income Statement Balance Sheets