Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REQUIREMENTS WAREN'S YEAR-END PROCEDURES employees. You are to assume the roles of Ray Kramer, Nancy Ford, and Jim Adams and Below are the procedures

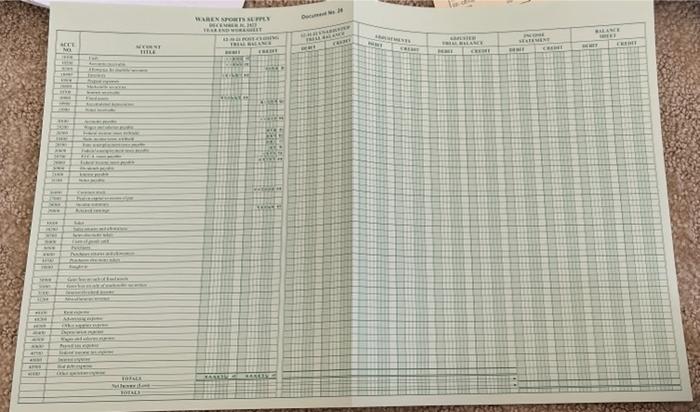

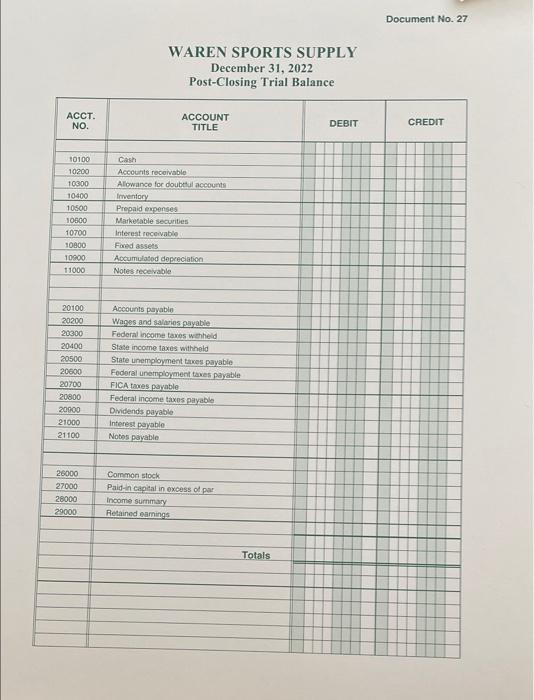

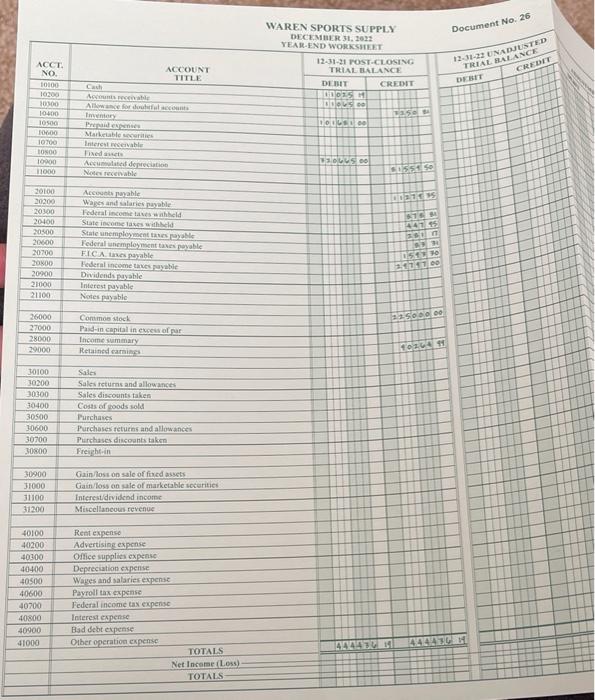

REQUIREMENTS WAREN'S YEAR-END PROCEDURES employees. You are to assume the roles of Ray Kramer, Nancy Ford, and Jim Adams and Below are the procedures followed at the end of each year by Waren Sports Supply's perform each of these year-end procedures for 2022. The only materials needed are Waren's closing trial balance (Doc. No. 27). All other items can be permanently filed in the envelope. All December month-end procedures must be completed before the year-end procedures are done. metho sheet, and statement of cash flows (indirect of income and He uses the formats suggested in the Systems Understanding Aid Reference book. 6. Nancy Ford prepares three supplementary reports as of December 31, which will serve as valuable information for management and the external auditors: an accounts receivable aging report, an accounts payable report, and a fixed assets report. (See pages 45, 46, and 61 of the Systems Understanding Aid Reference book for information to help you prepare these reports.) She reconciles each of these reports to the general ledger. She indicates that she has performed the reconciliations by putting her initials to the right of the total on each report. Tim Adama www. ACCE NO www. LAY WERE SOFALE BOTALS WAREN SPORTS SUPPLY L Documento 2 FREE BALANCE CHAMY BALANCE TRIAL BALANCE HILL CREME ACCT. NO. 10100 10200 Cash WAREN SPORTS SUPPLY December 31, 2022 Post-Closing Trial Balance ACCOUNT Accounts receivable TITLE 10300 Allowance for doubtful accounts 10400 Inventory 10500 Prepaid expenses 10600 Marketable securities 10700 Interest receivable 10800 Fixed assets 10900 Accumulated depreciation 11000 Notes receivable 20100 20200 20300 20400 20500 20600 20700 20800 20000 Accounts payable Wages and salaries payable Federal income taxes withheld State income taxes withheld State unemployment taxes payable Federal unemployment taxes payable FICA taxes payable Federal income taxes payable Dividends payable 21000 Interest payable 21100 Notes payable 26000 27000 Common stock Paid-in capital in excess of par 28000 Income summary 29000 Retained earnings Totals Document No. 27 DEBIT CREDIT ACCT. NO. 10100 10200 10300 Cash Accounts receivable ACCOUNT TITLE Allowance for doubtful accounts Inventory 10400 10500 Prepaid expenses 10600 10700 10800 Marketable securities Interest receivable Fixed assets Accumulated depreciation WAREN SPORTS SUPPLY DECEMBER 31, 2022 YEAR-END WORKSHEET 12-31-21 POST-CLOSING TRIAL BALANCE Document No. 26 12-31-22 UNADJUSTED TRIAL BALANCE CREDIT DEBIT 11015 H CREDIT DEBIT C350 B 10165100 10900 11000 Notes receivable 20100 Accounts payable 20200 Wages and salaries payable 20300 20400 20500 20600 20700 20800 20900 21000 21100 Federal income taxes withheld State income taxes withheld State unemployment taxes payable Federal unemployment taxes payable FICA taxes payable Federal income taxes payable Dividends payable Interest payable Notes payable 80554 50 ST 441 95 261 17 A 1513 30 2171700 26000 Common stock 335000.00 27000 Paid-in capital in excess of par 28000 Income summary 29000 Retained earnings 10204 91 30100 Sales 30200 Sales returns and allowances 30300 Sales discounts taken 30400 Costs of goods sold 30500 30600 Purchases Purchases returns and allowances 30700 Purchases discounts taken 30800 Freight-in 30900 31000 31100 31200 Gain/loss on sale of fixed assets Gain/loss on sale of marketable securities Interest/dividend income Miscellaneous revenue 40100 Rent expense 40200 Advertising expense 40300 Office supplies expense 404001 Depreciation expense 40500 Wages and salaries expense 40600 Payroll tax expense 40700 Federal income tax expense 40800 Interest expense 40900 Bad debt expense 41000 Other operation expense TOTALS 444430 14 444430 H Net Income (Loss)- TOTALS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete question 6 as Nancy Ford follow these steps to prepare three supplementary reports for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started