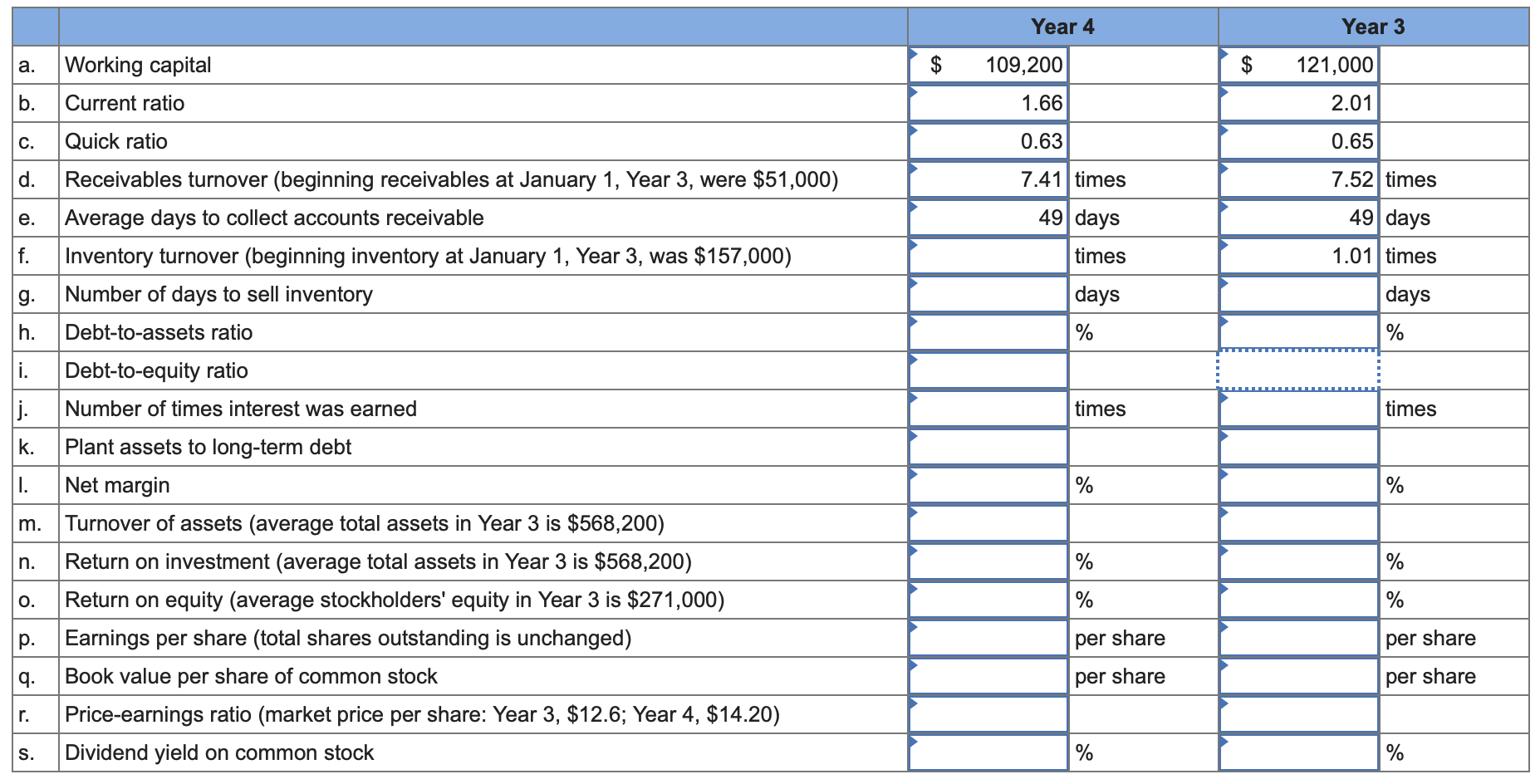

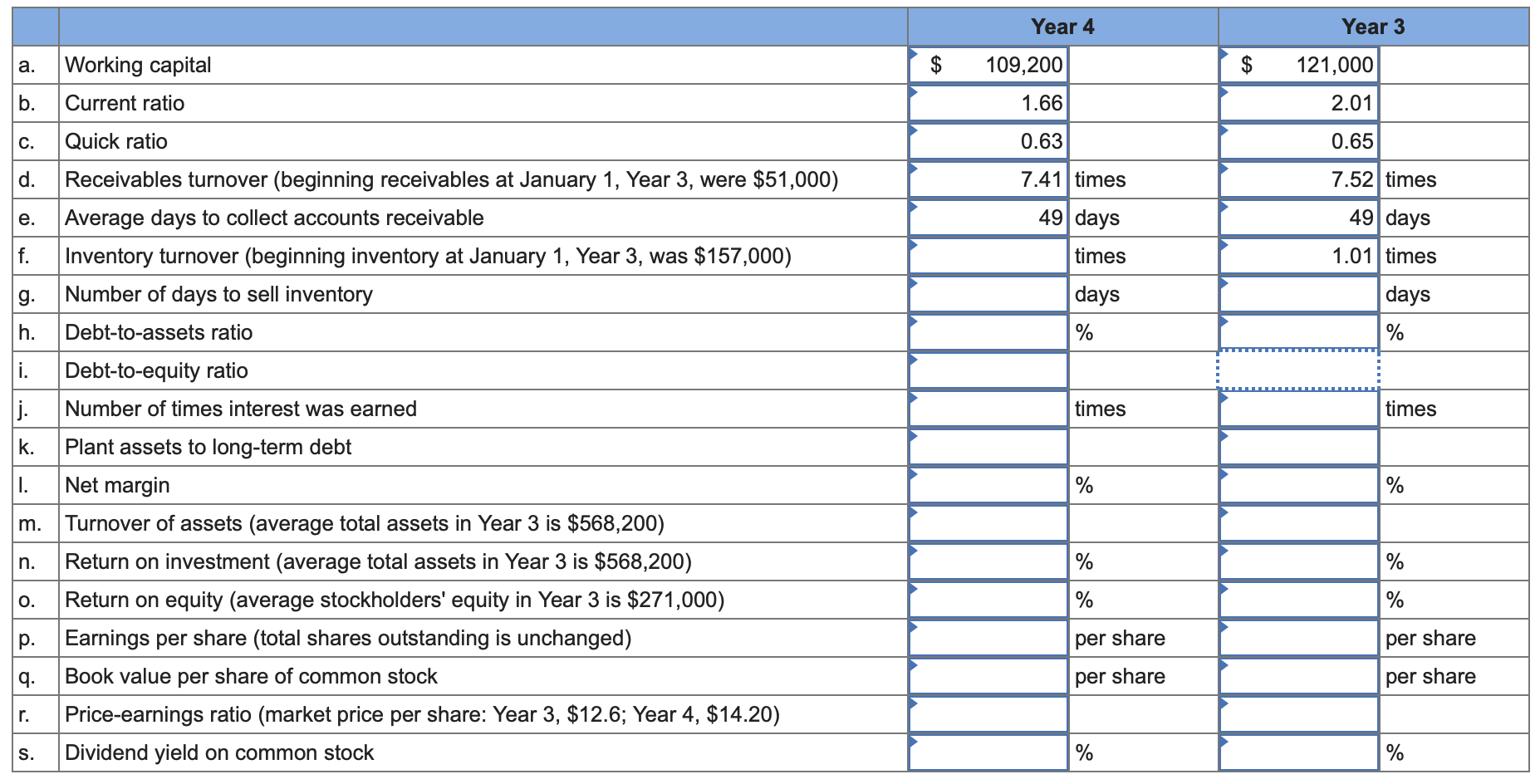

Need assistance with steps g-s.

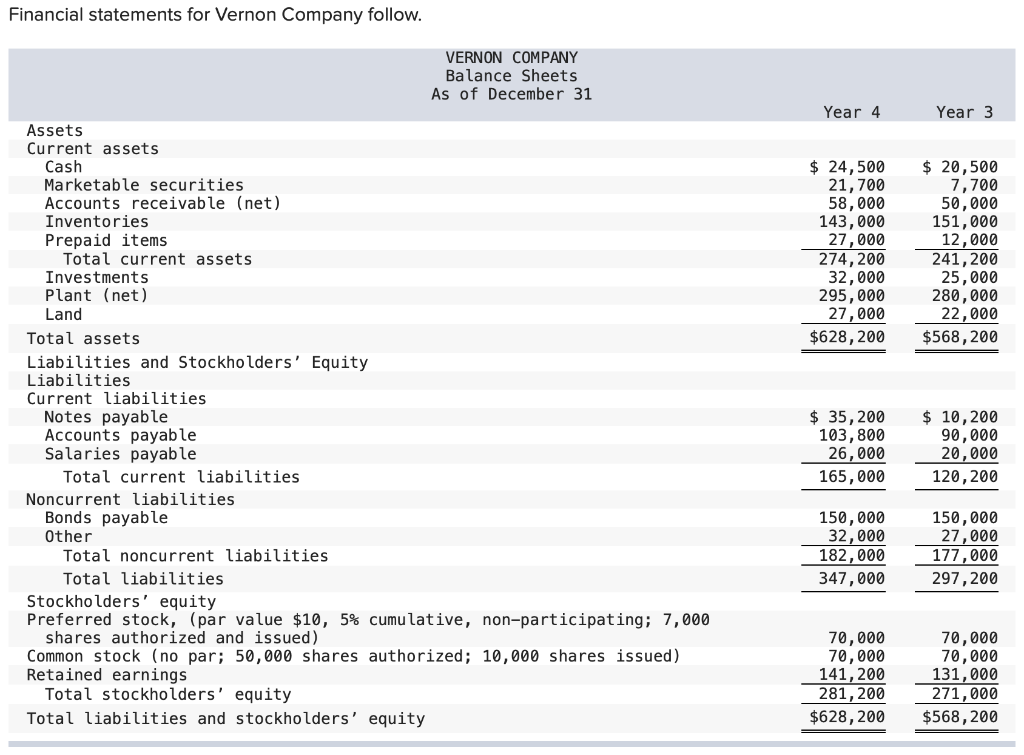

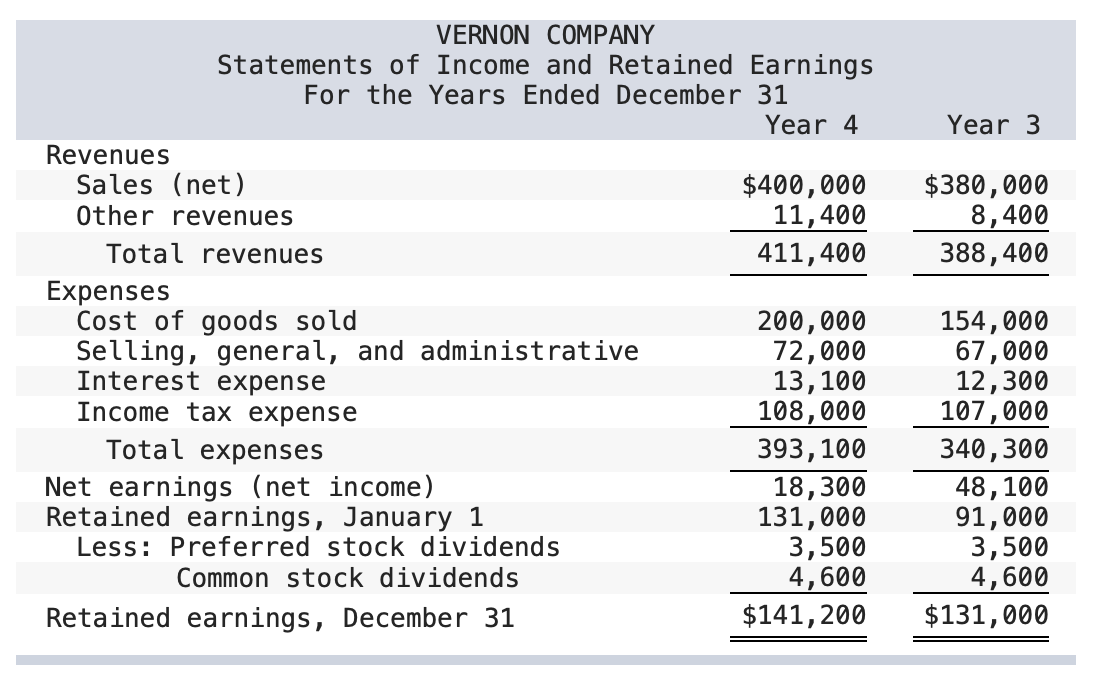

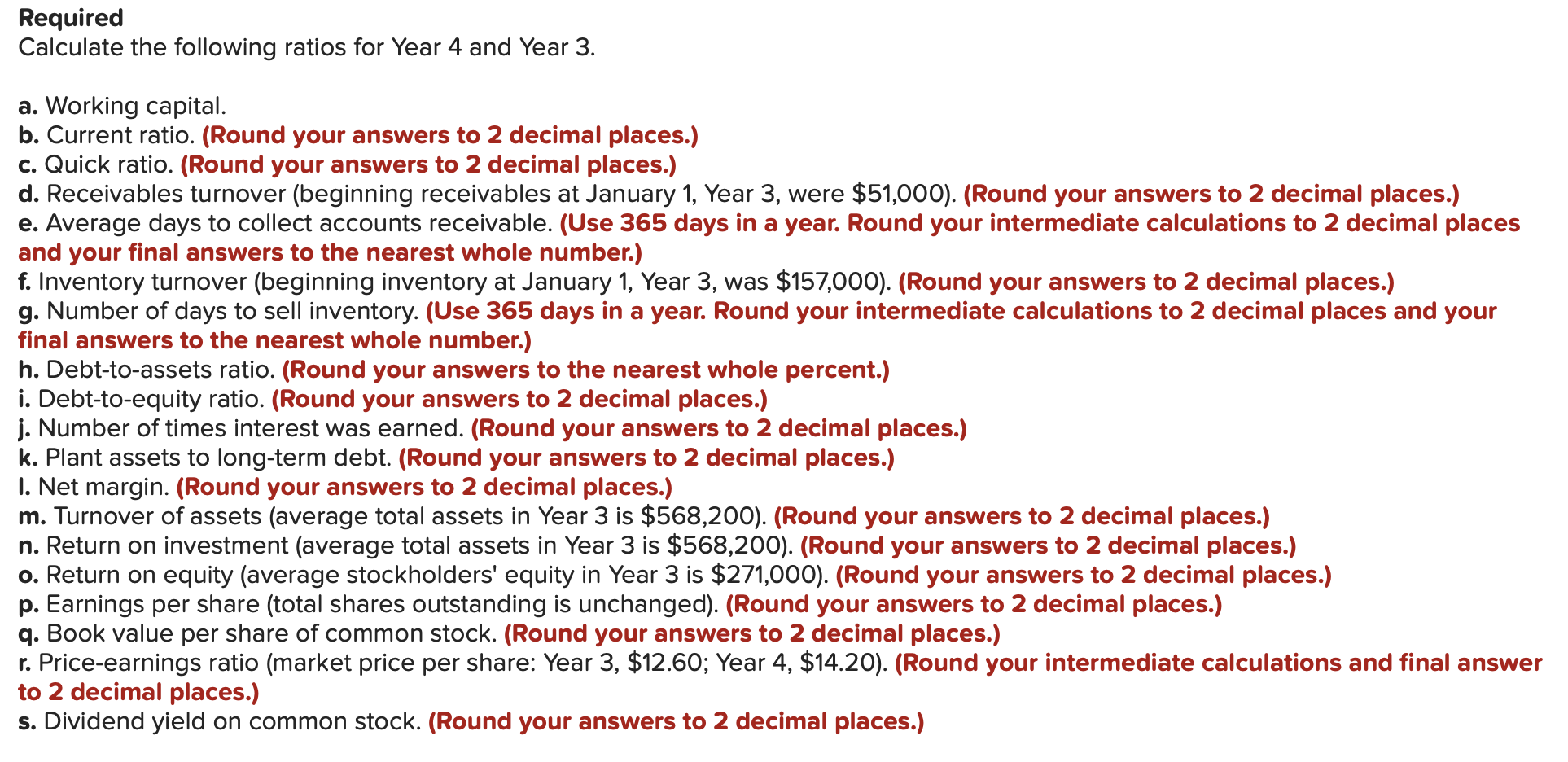

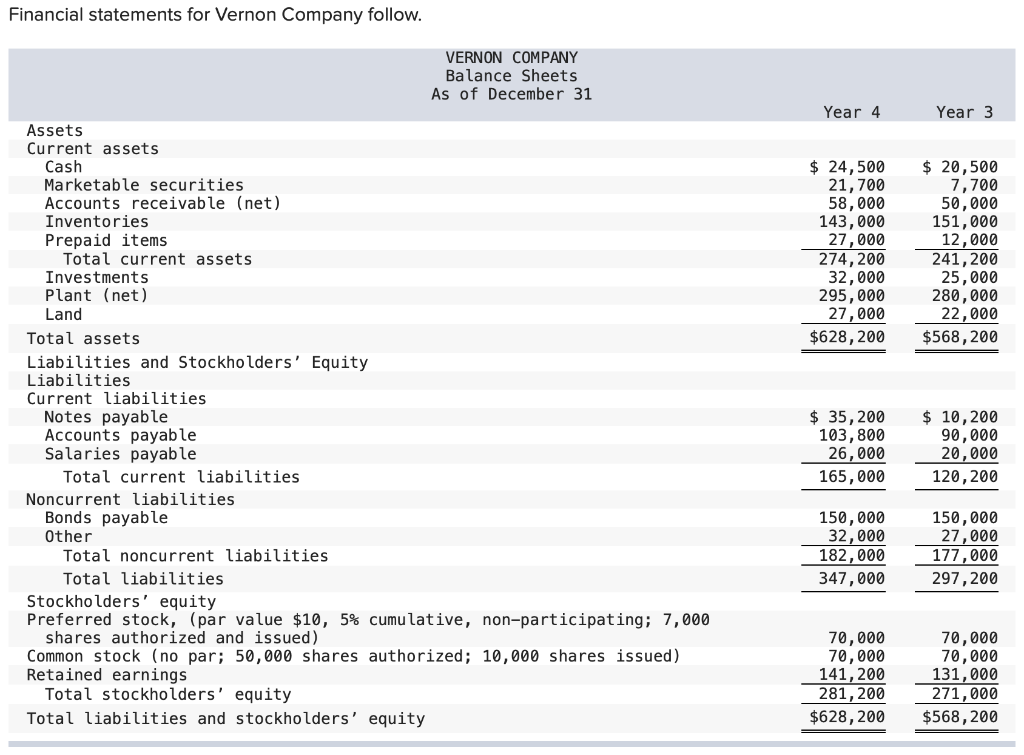

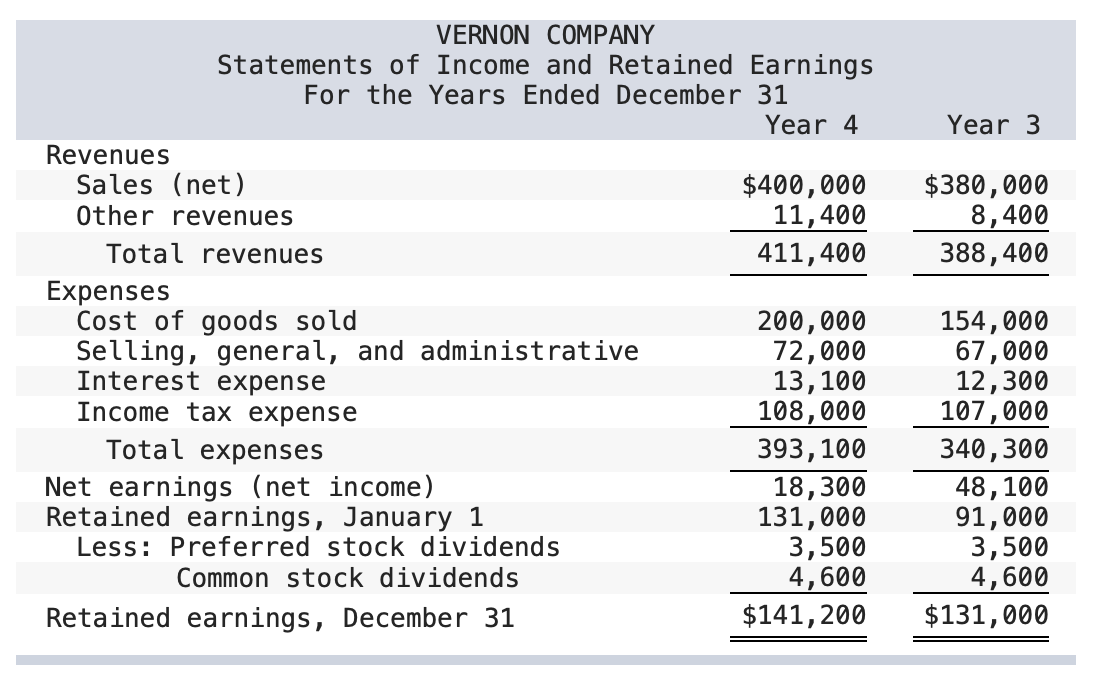

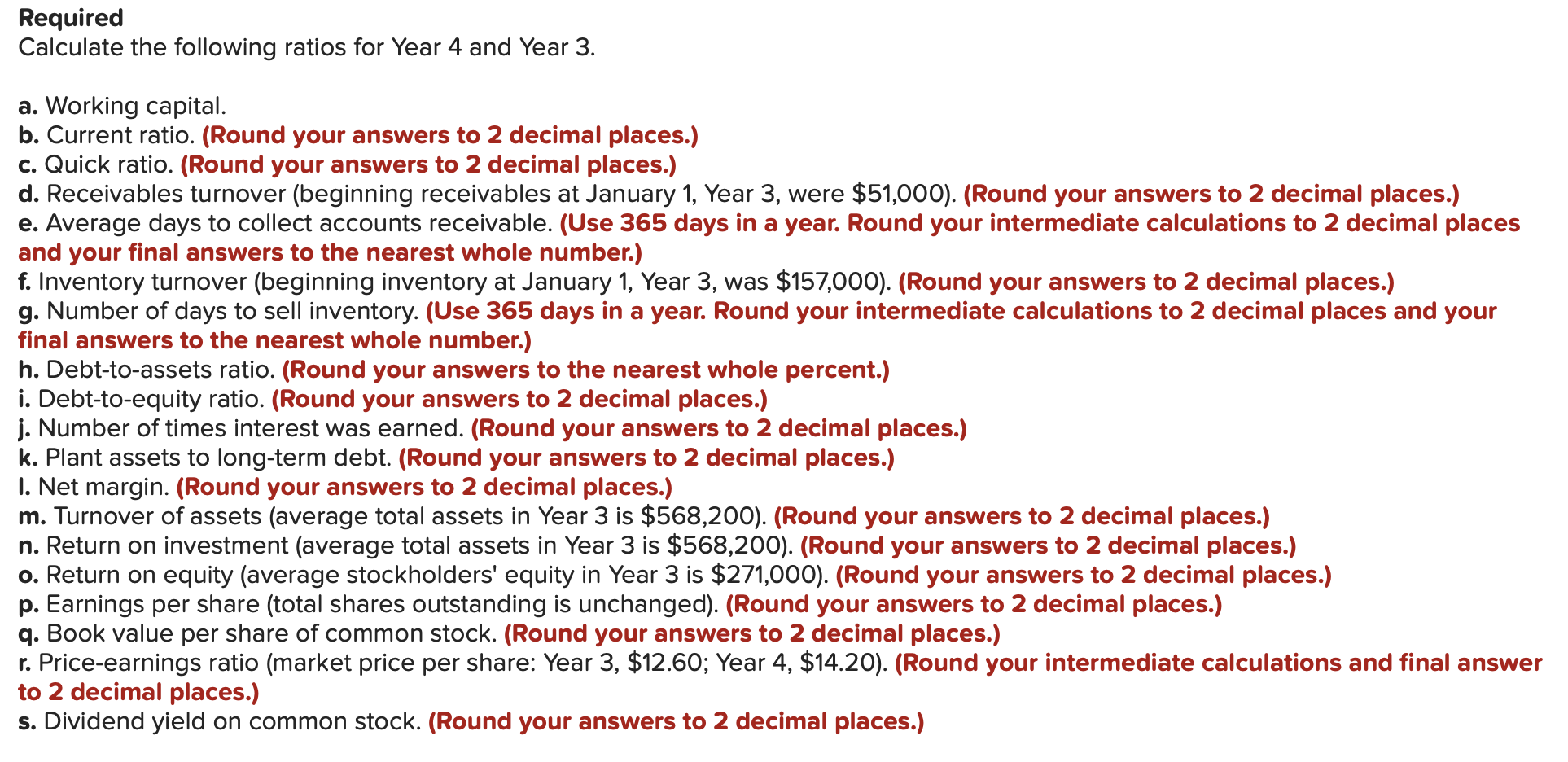

Financial statements for Vernon Company follow. VERNON COMPANY Balance Sheets As of December 31 Year 4 Year 3 Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable 0ther Total noncurrent liabilities Total liabilities Stockholders' equity Preferred stock, (par value $10,5% cumulative, non-participating; 7,000 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Calculate the following ratios for Year 4 and Year 3. a. Working capital. b. Current ratio. (Round your answers to 2 decimal places.) c. Quick ratio. (Round your answers to 2 decimal places.) d. Receivables turnover (beginning receivables at January 1, Year 3 , were $51,000 ). (Round your answers to 2 decimal places.) e. Average days to collect accounts receivable. (Use 365 days in a year. Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number.) f. Inventory turnover (beginning inventory at January 1, Year 3, was \$157,000). (Round your answers to 2 decimal places.) g. Number of days to sell inventory. (Use 365 days in a year. Round your intermediate calculations to 2 decimal places and your final answers to the nearest whole number.) h. Debt-to-assets ratio. (Round your answers to the nearest whole percent.) i. Debt-to-equity ratio. (Round your answers to 2 decimal places.) j. Number of times interest was earned. (Round your answers to 2 decimal places.) k. Plant assets to long-term debt. (Round your answers to 2 decimal places.) I. Net margin. (Round your answers to 2 decimal places.) m. Turnover of assets (average total assets in Year 3 is $568,200). (Round your answers to 2 decimal places.) n. Return on investment (average total assets in Year 3 is $568,200 ). (Round your answers to 2 decimal places.) o. Return on equity (average stockholders' equity in Year 3 is $271,000 ). (Round your answers to 2 decimal places.) p. Earnings per share (total shares outstanding is unchanged). (Round your answers to 2 decimal places.) q. Book value per share of common stock. (Round your answers to 2 decimal places.) r. Price-earnings ratio (market price per share: Year 3, \$12.60; Year 4, \$14.20). (Round your intermediate calculations and final answer to 2 decimal places.) s. Dividend yield on common stock. (Round your answers to 2 decimal places.)