Answered step by step

Verified Expert Solution

Question

1 Approved Answer

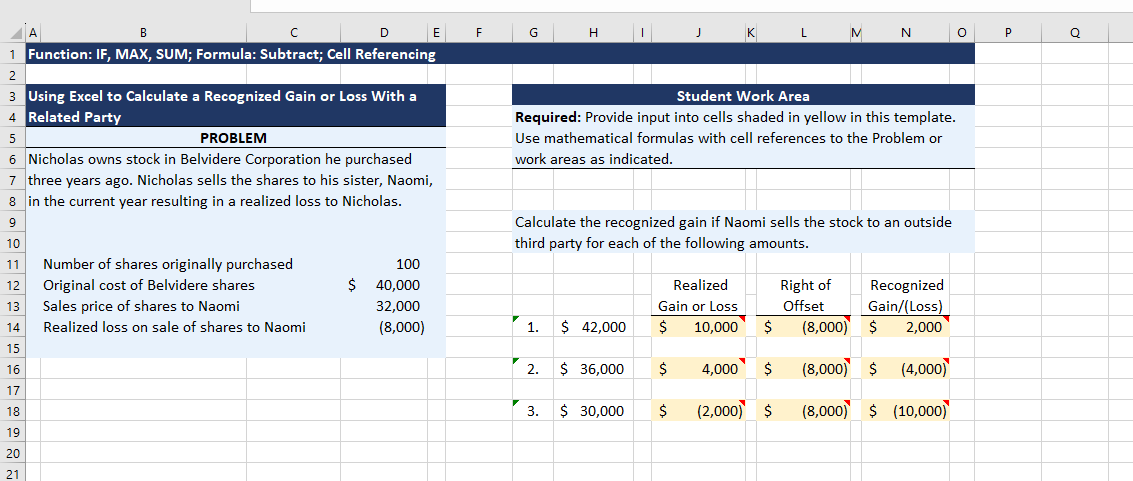

Need assistance with the Right of Offset Cells. Need to use an IF, MAX formula to calculate the correct values. Answers should be -8,000, -4,000,

Need assistance with the Right of Offset Cells. Need to use an IF, MAX formula to calculate the correct values. Answers should be -8,000, -4,000, and 0. Recognized Gain/Loss should be $2,000, 0, -2,000, this is based off a sum formula.

A B C D E F G H J Function: IF, MAX, SUM; Formula: Subtract; Cell Referencing 2 3 Using Excel to Calculate a Recognized Gain or Loss With a Student Work Area 4 Related Party PROBLEM Required: Provide input into cells shaded in yellow in this template. 5 Use mathematical formulas with cell references to the Problem or Nicholas owns stock in Belvidere Corporation he purchased work areas as indicated. 7 three years ago. Nicholas sells the shares to his sister, Naomi, 8 in the current year resulting in a realized loss to Nicholas. 9 10 Number of shares originally purchased Original cost of Belvidere shares Sales price of shares to Naomi Realized loss on sale of shares to Naomi 100 40,000 32,000 (8,000) Calculate the recognized gain if Naomi sells the stock to an outside third party for each of the following amountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started