Need assistance with this capital budgeting problem. Will thumbs up!

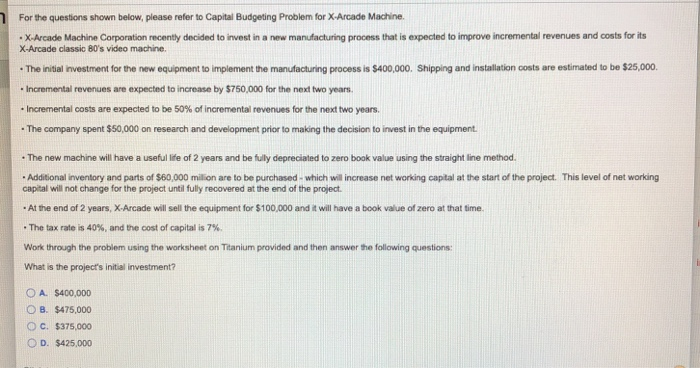

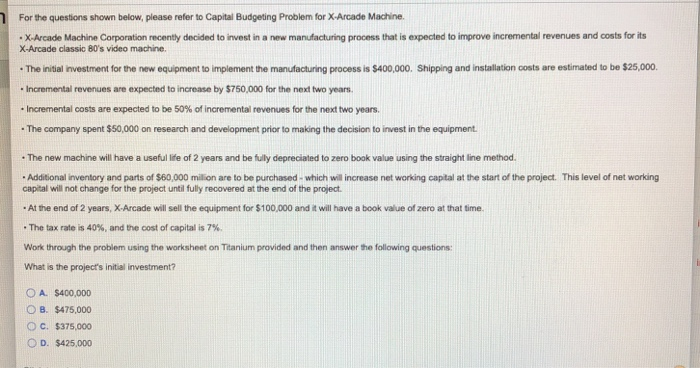

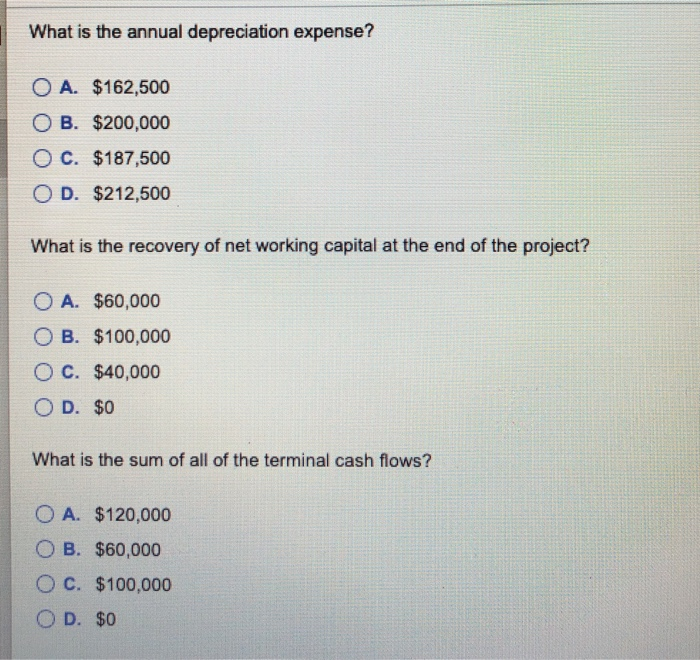

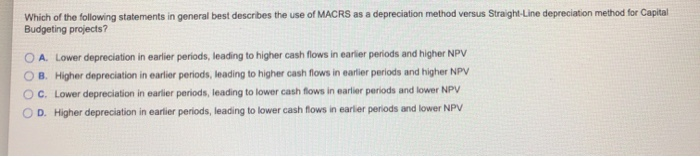

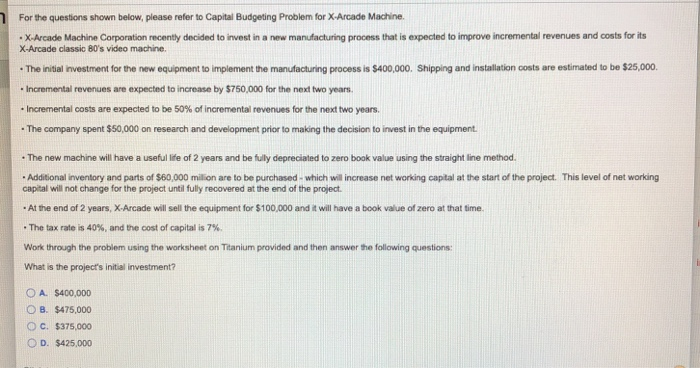

For the questions shown below, please refer to Capital Budgeting Problem for X Arcade Machine X Arcade Machine Corporation recently decided to invest in a new manufacturing process that is expected to improve incremental revenues and costs for its X-Arcade classic 80's video machine The initial investment for the new equipment to implement the manufacturing process is $400,000. Shipping and installation costs are estimated to be $25,000 Incremental revenues are expected to increase by $750,000 for the next two years Incremental costs are expected to be 50% of incremental revenues for the next two years. The company spent $50,000 on research and development prior to making the decision to invest in the equipment. The new machine will have a useful life of 2 years and be fully depreciated to zero book value using the straight line method Additional inventory and parts of $60,000 million are to be purchased - which will increase net working capital at the start of the project. This level of net working capital will not change for the project until fully recovered at the end of the project. At the end of 2 years, X-Arcade will sell the equipment for $100,000 and it will have a book value of zero at that time. The tax rate is 40%, and the cost of capital is 7% Work through the problem using the worksheet on Titanium provided and then answer the following questions: What is the project's initial investment? O A $400,000 OB. $475,000 OC. $375,000 OD. $425,000 What is the annual depreciation expense? O A. $162,500 O B. $200,000 O C. $187,500 OD. $212,500 What is the recovery of net working capital at the end of the project? O A. $60,000 O B. $100,000 O c. $40,000 OD. $0 What is the sum of all of the terminal cash flows? O A. $120,000 O B. $60,000 OC. $100,000 OD. $0 What is the Net Present Value of the Project (select closest answer)? O A. $164,536 O B. $171,347 O c. $187,471 OD. $180,298 What is the IRR of the project (select closest answer)? O A. 23.5% O B. 31.4% O c. 27.6% OD. 37.2% True or False: You would accept the project if the cost of capital was 28%. O O True False Which of the following statements in general best describes the use of MACRS as a depreciation method versus Straight-Line depreciation method for Capital Budgeting projects? O A. Lower depreciation in earlier periods, leading to higher cash flows in earlier periods and higher NPV OB Higher depreciation in earlier periods, leading to higher cash flows in earlier periods and higher NPV OC. Lower depreciation in earlier periods, leading to lower cash flows in earlier periods and lower NPV OD. Higher depreciation in earlier periods, leading to lower cash flows in earlier periods and lower NPV