need done tonight!

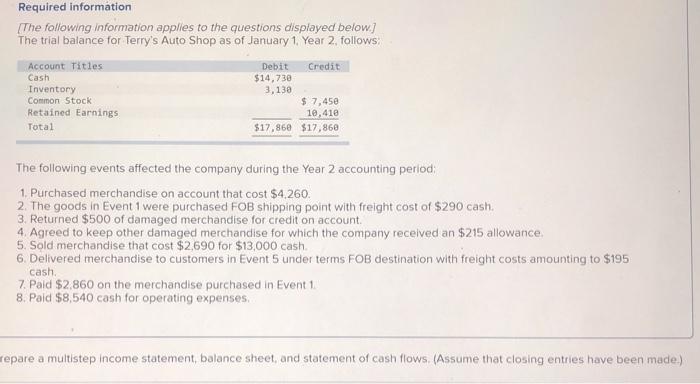

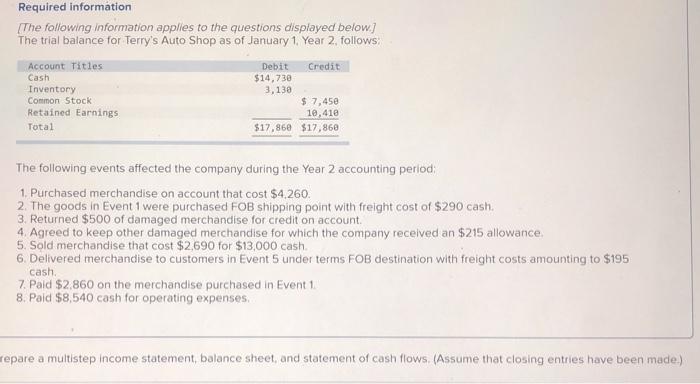

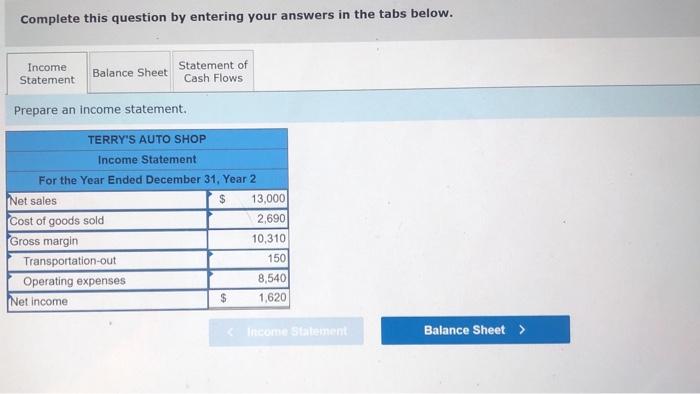

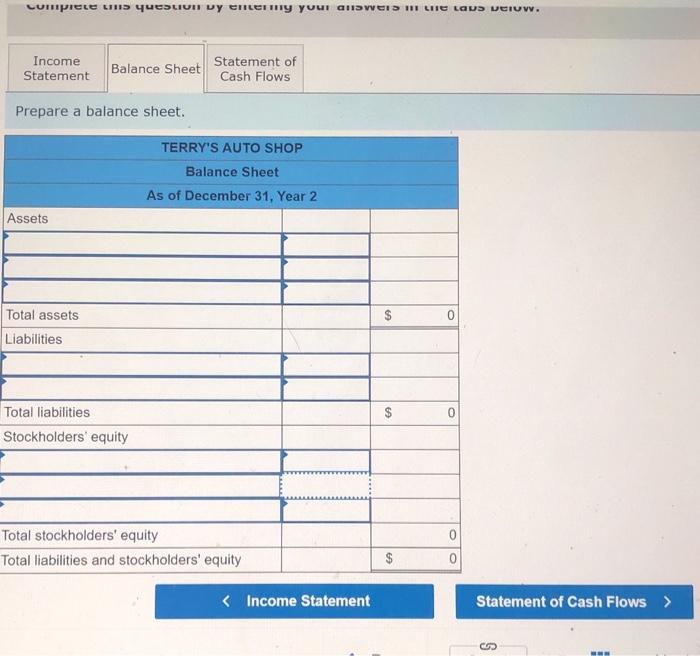

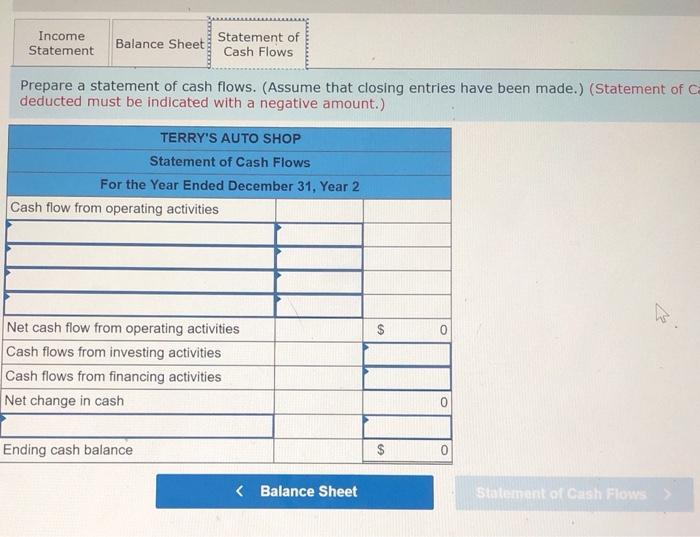

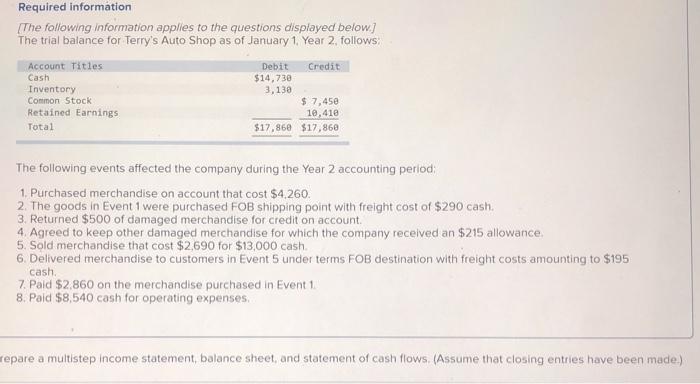

Required information The following information applies to the questions displayed below] The trial balance for Terry's Auto Shop as of January 1 Year 2 follows: Account Titles Debit Credit Cash $14,730 Inventory 3,130 Common Stock $ 7,450 Retained Earnings 10,410 Total $17,860 $17,860 The following events affected the company during the Year 2 accounting period 1. Purchased merchandise on account that cost $4.260. 2. The goods in Event 1 were purchased FOB shipping point with freight cost of $290 cash. 3. Returned $500 of damaged merchandise for credit on account 4. Agreed to keep other damaged merchandise for which the company received an $215 allowance 5. Sold merchandise that cost $2,690 for $13,000 cash 6. Delivered merchandise to customers in Event 5 under terms FOB destination with freight costs amounting to $195 cash 7 Paid $2,860 on the merchandise purchased in Event 1 8. Paid $8,540 cash for operating expenses. repare a multistep income statement, balance sheet and statement of cash flows. (Assume that closing entries have been made.) Complete this question by entering your answers in the tabs below. Income Statement Balance Sheet Statement of Cash Flows Prepare an income statement. TERRY'S AUTO SHOP Income Statement For the Year Ended December 31, Year 2 Net sales $ 13,000 Cost of goods sold 2,690 Gross margin 10,310 Transportation-out 150 Operating expenses 8,540 Net Income 1,620 (income Statement Balance Sheet > cumpele cins question by enter my your answer the laws venu. Income Statement Balance Sheet Statement of Cash Flows Prepare a balance sheet. TERRY'S AUTO SHOP Balance Sheet As of December 31, Year 2 Assets $ Total assets Liabilities $ 0 Total liabilities Stockholders' equity 0 Total stockholders' equity Total liabilities and stockholders' equity $ 0 Income Statement Balance Sheet Statement of Cash Flows Prepare a statement of cash flows. (Assume that closing entries have been made.) (Statement of C deducted must be indicated with a negative amount.) TERRY'S AUTO SHOP Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flow from operating activities $ 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Net change in cash Ending cash balance $