Answered step by step

Verified Expert Solution

Question

1 Approved Answer

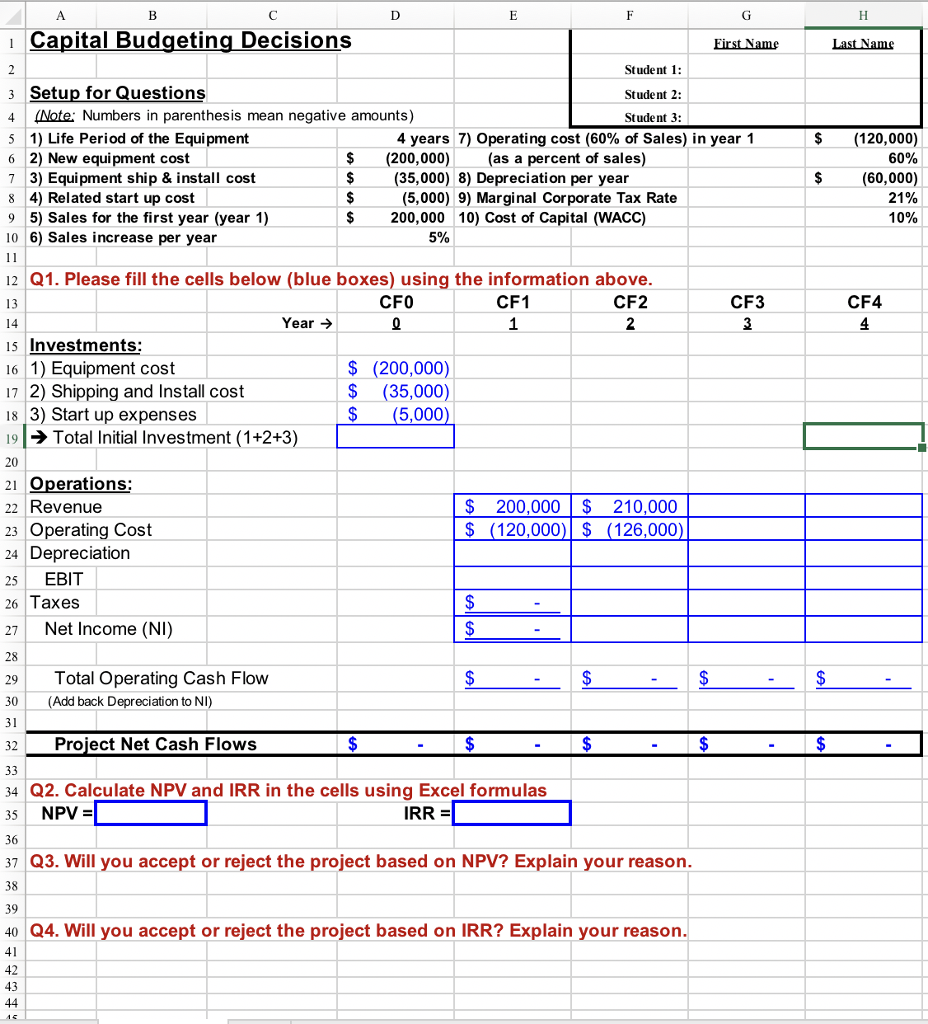

NEED EXCEL FORMULAS FOR EACH CELL AND REASONING FOR QUESTION 3 AND 4 Capital Budgeting Decisions Student 1: Student 2: Student 3: 3 Setup for

NEED EXCEL FORMULAS FOR EACH CELL AND REASONING FOR QUESTION 3 AND 4

Capital Budgeting Decisions Student 1: Student 2: Student 3: 3 Setup for Questions 4 (Note Numbers in parenthesis mean negative amounts) 5 1) Life Period of the Equipment 6 2) New equipment cost 7 3) Equipment ship & install cost 8 4) Related start up cost 95) Sales for the first year (year 1) 10 6) Sales increase per year $(120,000) 60% 60,000) 21% 10% 4 years 7) Operating cost (60% of Sales) in year 1 $(200,000)(as a percent of sales) (35,000) 8) Depreciation per year (5,000) 9) Marginal Corporate Tax Rate $200,000 10) Cost of Capital (WACC) 5% 2 Q1. Please fill the cells below (blue boxes) using the information above 13 CF0 CF1 CF2 CF3 CF4 Year -> 15 Investments: 16 1) Equipment cost 17 2) Shipping and Install cost 18 3) Start up expenses 9 Total Initial Investment (1+2+3 20 21 Operations; 22 Revenue 23 Operating Cost 24 Depreciation 25 EBIT 26 Taxes $ (200,000) $ (35,000) $(5,000) $ 200,000$ 210,000 $ (120,000)$(126,000 27Net Income (NI) 28 29 otal Operating Cash Flow 30 (Add back Depreciation to NI) 32 Project Net Cash Flows 34 Q2. Calculate NPV and IRR in the cells using Excel formulas 35 NPV- 36 37Q3. Will you accept or reject the project based on NPV? Explain your reason 38 39 40 Q4. Will you accept or reject the project based on IRR? Explain your reason IRR 42 43Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started