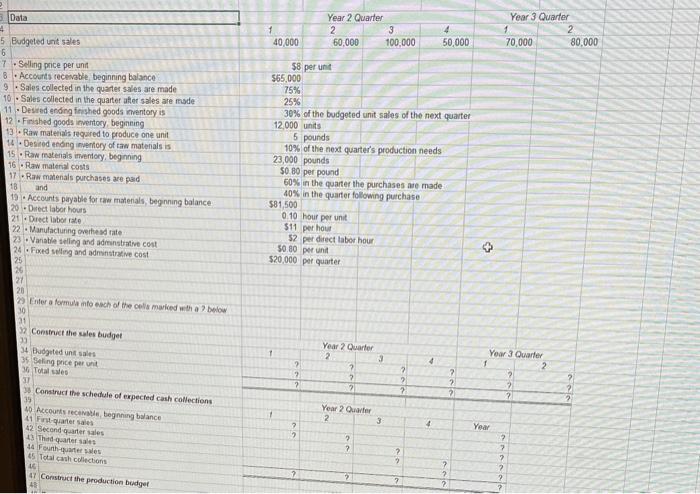

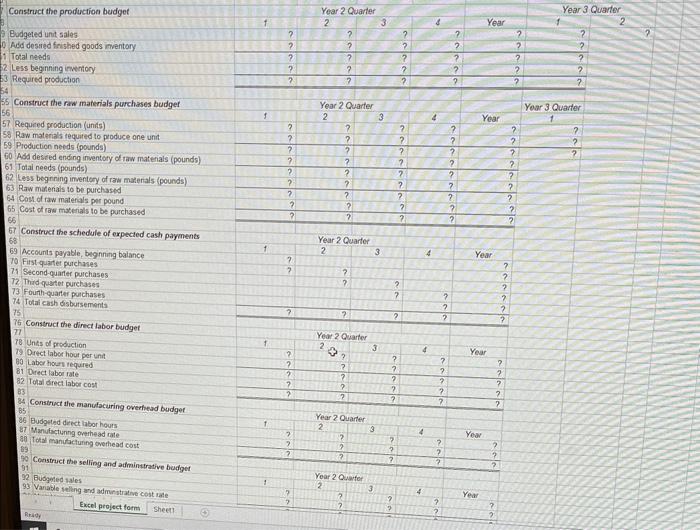

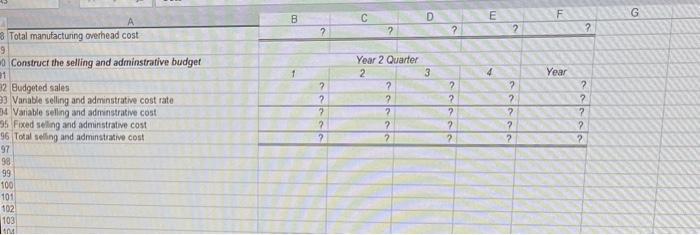

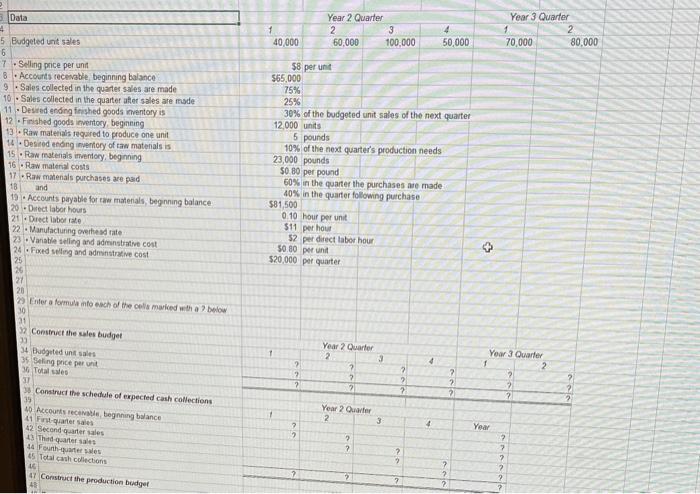

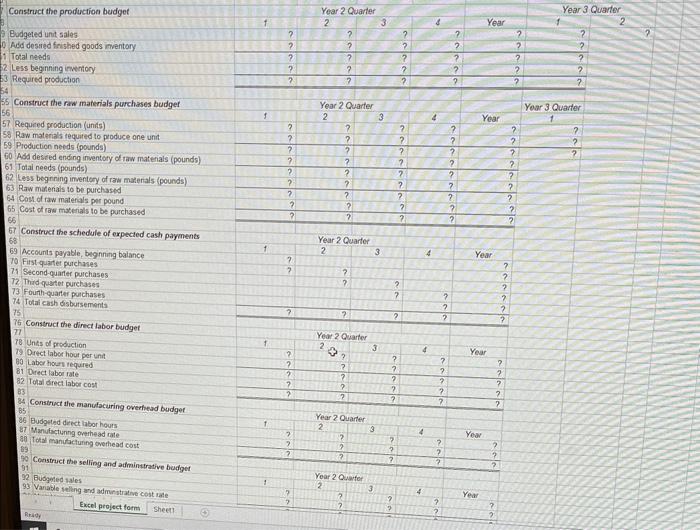

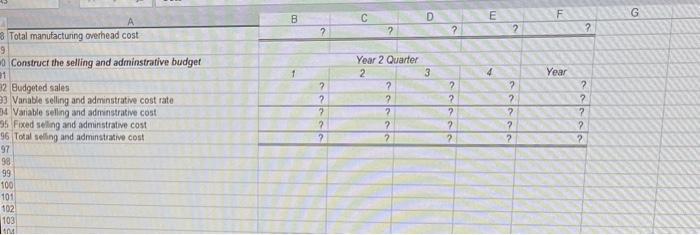

Data Budgeted unt sales \begin{tabular}{|c|c|c|c|c|c|} \hline 1 & 2 & 3 & 4 & 1 & 2 \\ \hline 40,000 & 60,000 & 100,000 & 50,000 & 70,000 & 80,000 \\ \hline \end{tabular} 7 . Selling price per unt 58 per unit 8 - Accourts recenable beginning balance 555,000 - Sales collected in the quater sales are made 16 - Sales collected in the quarter ather sales are made 25% 11 - Desred eoding firished goods inventory is 30% of the budgeted unit sales of the next quarter 12. Finished goods invertocy, begining 12,000 units 13. Raw matetials requred to produce one unit 5 pounds 14. Desied enoing inyentory of taw materials is 15 - Pon materials inveriory, beginning 10% of the next quarter's production needs 16 - Raw material costs 23,000 pounds 17 . Raw materials purchases are pad 50. 80 per pound 18 and 60% in the quarter the purchases aue made 19 - Accounts payable for take matenals, begnning balance 40% in the quarter following purchase 20 - Decect labor hours $81,500 21 - Duect labor rate 0.10 hour per unit 22 - Manulaciuning oreitesd rate $11 per hout 23 . Variatle selling and adrinstrative coet 52 per direct tabor hour - Foxed seling and admentstrative cost 25262121 50.80 per unh $20.000 per quarter Eiter a formula into esch of the cels marked with a ? below 31 Constrict the sales budget 39 Accourtr recindile, begnning balance 41 Firh-quarec sales 42 Second quarter sales 43 Thid-quarter salos 44 Founh-quager wales 45. Total cavh collections 47 Construct the production beidger Construct the production bedget Budgeted unit sales Add desird frished goods inventory Total needo Less beginning inwentory Recured production i5 Construct the raw materials purchases budget 6 . Requiced production (units) 59 Raw materials required to produce one unit 59 Production needs (pounds) 60 Add descied ending inventory of raw materals (pounds) 61 Jotai needs (pounds) 61. Totai needs (pounds) 62. Less begnning imentory of raw materials (pounds). 63. Raw maferials to be purchased 64. Cost of raw materials por pound 65 Cost of raw materials to be purchased 65 67. Construct the schedule of expected cash payments 69 Accounis pyable, beginning balance. 70. Filst quarter purchases 71. Second-quarter purchases 72. Thidi-quatet purchases 73 Fourth-quarter puichases 74 Total cash disbursements 16 is 76 Construct the direct labior budget Ti Derect labor hout per init 60 Laber hourt requered 81 Direct labor rate 82. Total drect labor cost 84. Constrict the manubcuring overhead budger 92 Budgemed lales 93 Varable telles and admestrative cost rafe Total manufacturing overhead cost \begin{tabular}{rlrlrl|} \hline? & ? & ? & ? & ? \\ \hline \end{tabular} Construct the selling and adminstrative budget Gudgeted sales Vanable selling and adminstrative cost rate Variable seling and adrinstrative cost Foxed seling and adminstrative cost Toral seling and adminstrative cost \begin{tabular}{|c|c|c|c|c|} \hline 1 & 2 & 3 & 4 & Year \\ \hline? & ? & ? & ? & ? \\ \hline? & ? & ? & ? & ? \\ \hline? & ? & ? & ? & ? \\ \hline? & ? & ? & ? & ? \\ \hline \end{tabular}