need G please

need G please

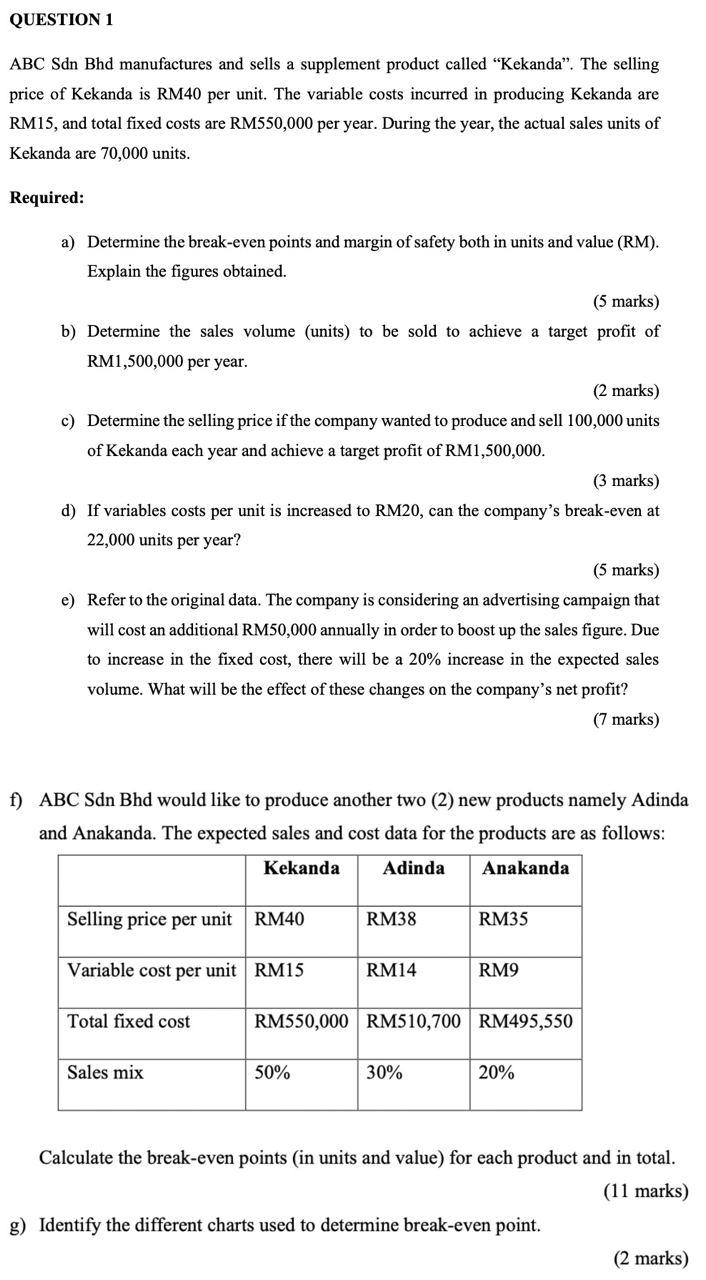

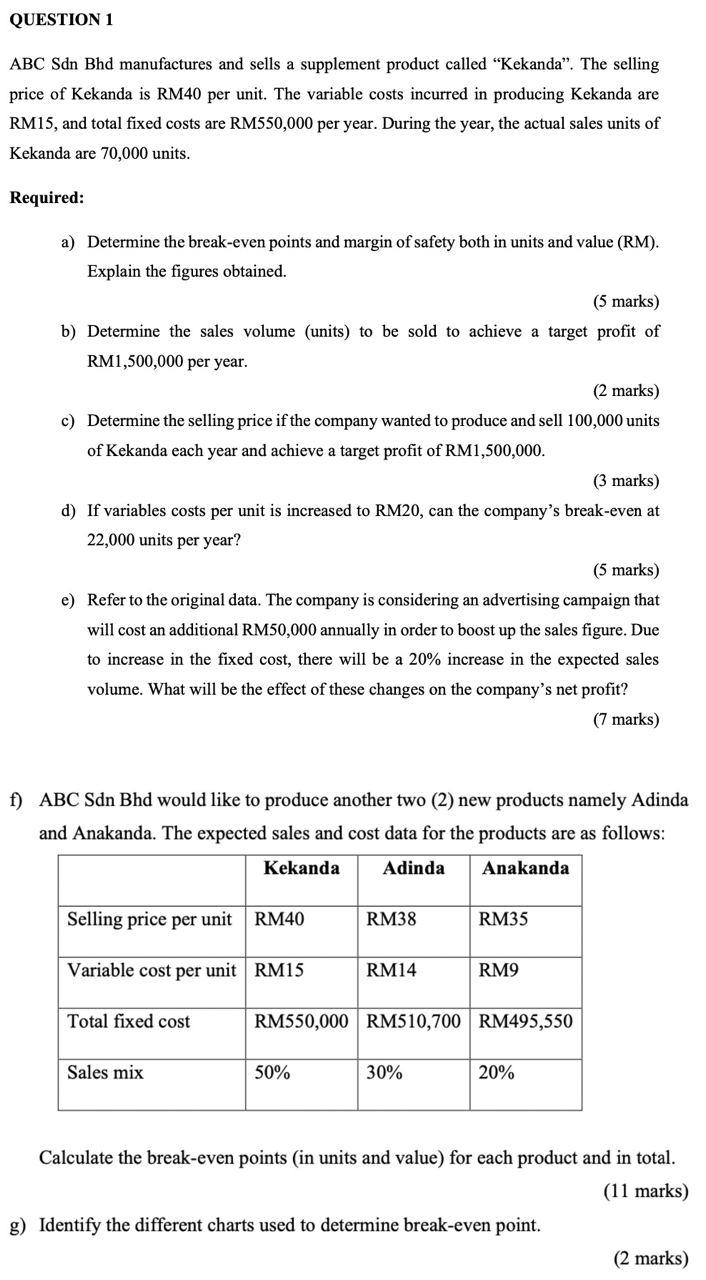

QUESTION 1 ABC Sdn Bhd manufactures and sells a supplement product called "Kekanda. The selling price of Kekanda is RM40 per unit. The variable costs incurred in producing Kekanda are RM15, and total fixed costs are RM550,000 per year. During the year, the actual sales units of Kekanda are 70,000 units. Required: a) Determine the break-even points and margin of safety both in units and value (RM). Explain the figures obtained. (5 marks) b) Determine the sales volume (units) to be sold to achieve a target profit of RM1,500,000 per year. (2 marks) c) Determine the selling price if the company wanted to produce and sell 100,000 units of Kekanda each year and achieve a target profit of RM1,500,000. (3 marks) d) If variables costs per unit is increased to RM20, can the company's break-even at 22,000 units per year? (5 marks) e) Refer to the original data. The company is considering an advertising campaign that will cost an additional RM50,000 annually in order to boost up the sales figure. Due to increase in the fixed cost, there will be a 20% increase in the expected sales volume. What will be the effect of these changes on the company's net profit? (7 marks) f) ABC Sdn Bhd would like to produce another two (2) new products namely Adinda and Anakanda. The expected sales and cost data for the products are as follows: Kekanda Adinda Anakanda Selling price per unit RM40 RM38 RM35 Variable cost per unit RM15 RM14 RM9 Total fixed cost RM550,000 RM510,700 RM495,550 Sales mix 50% 30% 20% Calculate the break-even points in units and value) for each product and in total. (11 marks) g) Identify the different charts used to determine break-even point. (2 marks) QUESTION 1 ABC Sdn Bhd manufactures and sells a supplement product called "Kekanda. The selling price of Kekanda is RM40 per unit. The variable costs incurred in producing Kekanda are RM15, and total fixed costs are RM550,000 per year. During the year, the actual sales units of Kekanda are 70,000 units. Required: a) Determine the break-even points and margin of safety both in units and value (RM). Explain the figures obtained. (5 marks) b) Determine the sales volume (units) to be sold to achieve a target profit of RM1,500,000 per year. (2 marks) c) Determine the selling price if the company wanted to produce and sell 100,000 units of Kekanda each year and achieve a target profit of RM1,500,000. (3 marks) d) If variables costs per unit is increased to RM20, can the company's break-even at 22,000 units per year? (5 marks) e) Refer to the original data. The company is considering an advertising campaign that will cost an additional RM50,000 annually in order to boost up the sales figure. Due to increase in the fixed cost, there will be a 20% increase in the expected sales volume. What will be the effect of these changes on the company's net profit? (7 marks) f) ABC Sdn Bhd would like to produce another two (2) new products namely Adinda and Anakanda. The expected sales and cost data for the products are as follows: Kekanda Adinda Anakanda Selling price per unit RM40 RM38 RM35 Variable cost per unit RM15 RM14 RM9 Total fixed cost RM550,000 RM510,700 RM495,550 Sales mix 50% 30% 20% Calculate the break-even points in units and value) for each product and in total. (11 marks) g) Identify the different charts used to determine break-even point. (2 marks)

need G please

need G please