need general journal, adjusted income statement, balance sheet, and analysis

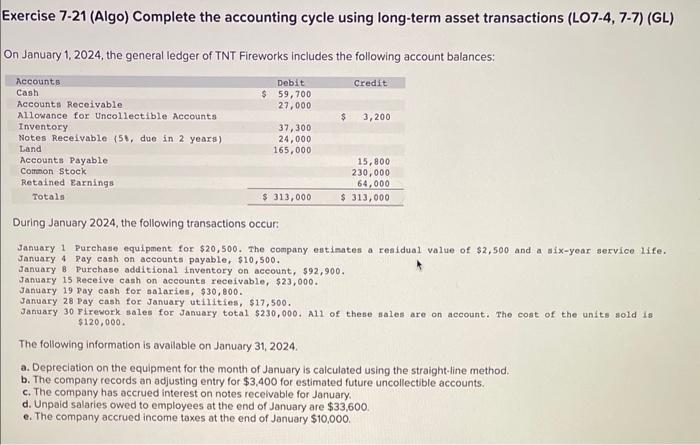

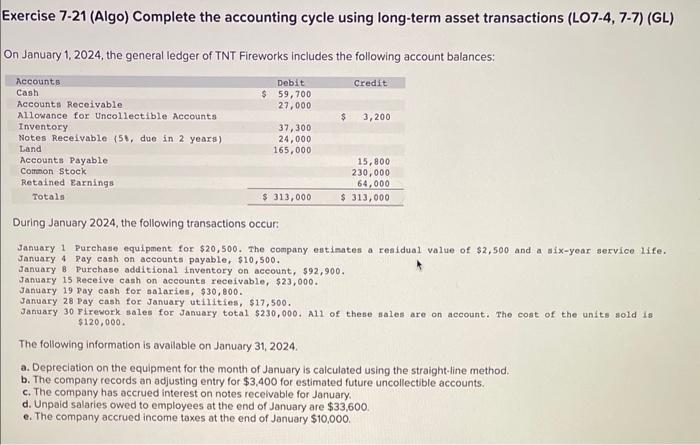

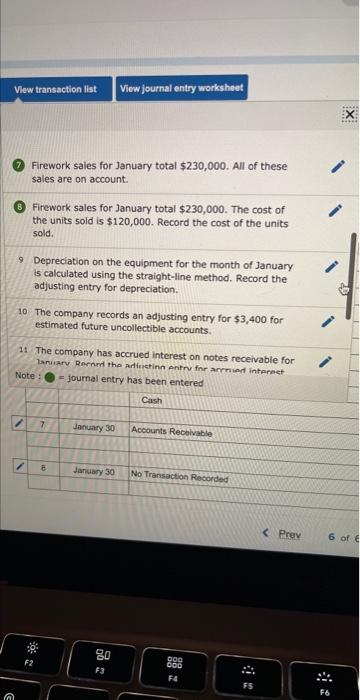

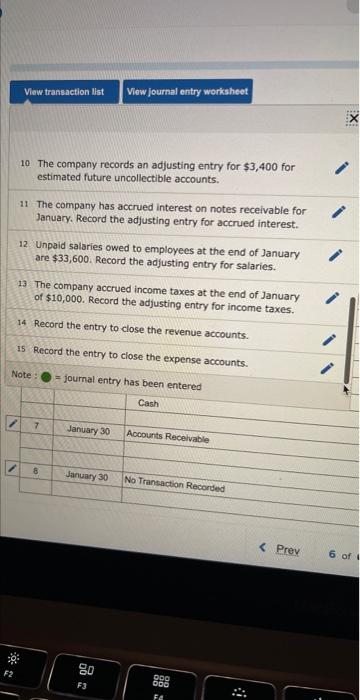

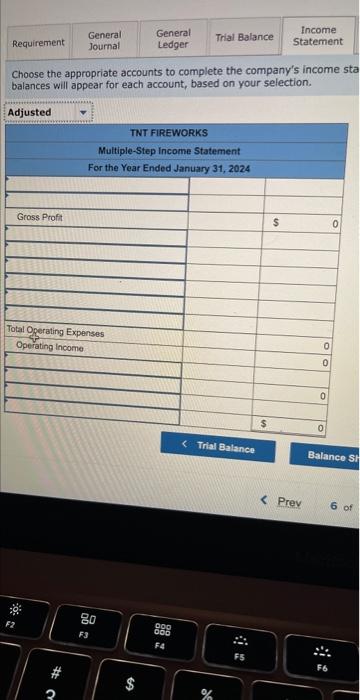

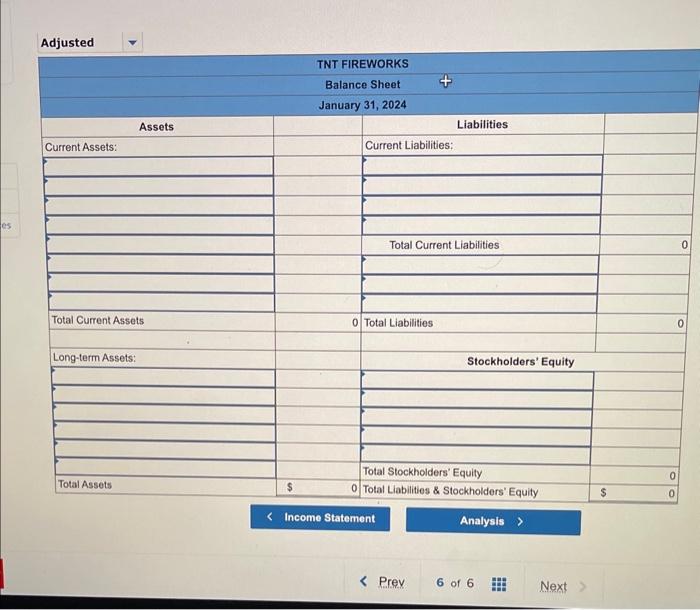

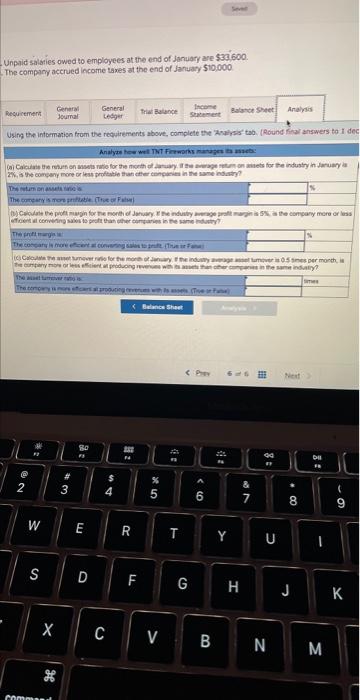

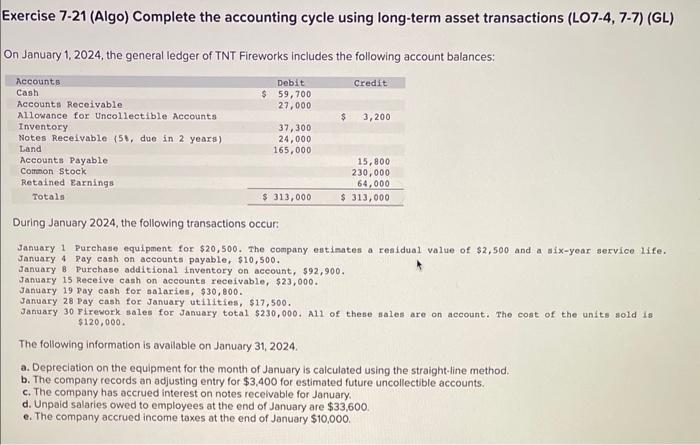

Exercise 7-21 (Algo) Complete the accounting cycle using long-term asset transactions ( LO7-4, 7-7) (GL) On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: During January 2024, the following transactions occur: January 1 Purchase equipment for $20,500. The company estimates a reaidual value of $2,500 and a six-year servico 1ife. January 4 pay eash on accounts payable, $10,500. January 8 Purchase additional inventory on account, $92,900. January is Receive cash on accounts receivable, $23,000. January 19 Pay cash for salaries, $30,800. January 28 pay cash for January utilities, $17,500. January 30 Firesork sales for January total $230,000. A11 of these sales are on account. The cost of the units sold is The following information is available on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $3,400 for estimated future uncollectible accounts. c. The company has accrued interest on notes recelvable for January. d. Unpaid salaries owed to employees at the end of January are $33,600. e. The company accrued income taxes at the end of January $10,000. Firework sales for January total $230,000. All of these sales are on account. Firework sales for January total $230,000. The cost of the units sold is $120,000. Record the cost of the units sold. 9 Depreciation on the equipment for the month of January is calculated using the straight-line method. Record the adjusting entry for depreciation. 10 The company records an adjusting entry for $3,400 for estimated future uncollectible accounts. 11 The company has accrued interest on notes receivable for lanularv Roment the artivetinn entrv fine acrnied intereet. 10 The company records an adjusting entry for $3,400 for estimated future uncollectible accounts. 11 The company has accrued interest on notes receivable for January. Record the adjusting entry for accrued interest. 12. Unpaid salaries owed to employees at the end of January. are $33,600. Record the adjusting entry for salaries. 13. The company accrued income taxes at the end of January of $10,000. Record the adjusting entry for income taxes. Choose the appropriate accounts to complete the company's income sta balances will appear for each account, based on your selection. Adjusted Unpoid salbties owed to employees at the end of January are $39,600. The compacy acerued income taxes at the end of Januafy 510.000. Using the intermation from the requirements above, complete the 'Roulyss' tab, (Round firal answers to I d Analyde hew well TNT firsmorks navajes a aucb: The pritinatine Exercise 7-21 (Algo) Complete the accounting cycle using long-term asset transactions ( LO7-4, 7-7) (GL) On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: During January 2024, the following transactions occur: January 1 Purchase equipment for $20,500. The company estimates a reaidual value of $2,500 and a six-year servico 1ife. January 4 pay eash on accounts payable, $10,500. January 8 Purchase additional inventory on account, $92,900. January is Receive cash on accounts receivable, $23,000. January 19 Pay cash for salaries, $30,800. January 28 pay cash for January utilities, $17,500. January 30 Firesork sales for January total $230,000. A11 of these sales are on account. The cost of the units sold is The following information is available on January 31,2024. a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $3,400 for estimated future uncollectible accounts. c. The company has accrued interest on notes recelvable for January. d. Unpaid salaries owed to employees at the end of January are $33,600. e. The company accrued income taxes at the end of January $10,000. Firework sales for January total $230,000. All of these sales are on account. Firework sales for January total $230,000. The cost of the units sold is $120,000. Record the cost of the units sold. 9 Depreciation on the equipment for the month of January is calculated using the straight-line method. Record the adjusting entry for depreciation. 10 The company records an adjusting entry for $3,400 for estimated future uncollectible accounts. 11 The company has accrued interest on notes receivable for lanularv Roment the artivetinn entrv fine acrnied intereet. 10 The company records an adjusting entry for $3,400 for estimated future uncollectible accounts. 11 The company has accrued interest on notes receivable for January. Record the adjusting entry for accrued interest. 12. Unpaid salaries owed to employees at the end of January. are $33,600. Record the adjusting entry for salaries. 13. The company accrued income taxes at the end of January of $10,000. Record the adjusting entry for income taxes. Choose the appropriate accounts to complete the company's income sta balances will appear for each account, based on your selection. Adjusted Unpoid salbties owed to employees at the end of January are $39,600. The compacy acerued income taxes at the end of Januafy 510.000. Using the intermation from the requirements above, complete the 'Roulyss' tab, (Round firal answers to I d Analyde hew well TNT firsmorks navajes a aucb: The pritinatine