Need help answersing these four questions

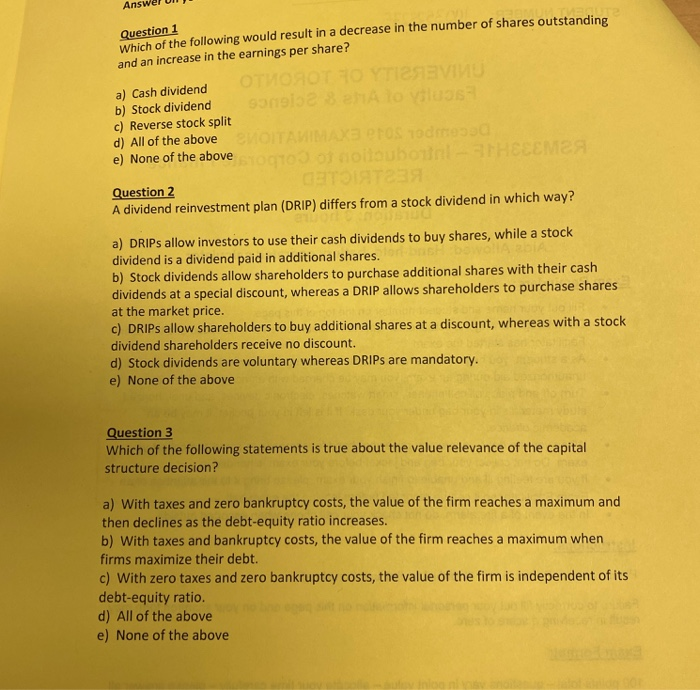

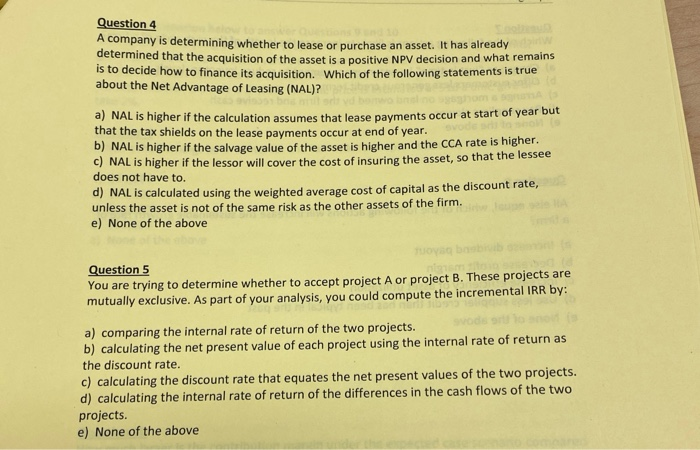

Ans Question 1 Which of the following would result in a decrease in the number of shares outstanding and an increase in the earnings per share? O TEV sanei8 ehA a) Cash dividend b) Stock dividend c) Reverse stock split d) All of the above MOITAMIMAX3 Pros 1odmes e) None of the above lo yiluas qrod of noiloubotnl-3HECEMEA CETOIATE3R Question 2 A dividend reinvestment plan (DRIP) differs from a stock dividend in which way? a) DRIPS allow investors to use their cash dividends to buy shares, while a stock dividend is a dividend paid in additional shares. b) Stock dividends allow shareholders to purchase additional shares with their cash dividends at a special discount, whereas a DRIP allows shareholders to purchase shares at the market price. c) DRIPS allow shareholders to buy additional shares at a discount, whereas with a stock dividend shareholders receive no discount. d) Stock dividends are voluntary whereas DRIPS are mandatory. e) None of the above owallA Question 3 Which of the following statements is true about the value relevance of the capital structure decision? a) With taxes and zero bankruptcy costs, the value of the firm reaches a maximum and then declines as the debt-equity ratio increases. b) With taxes and bankruptcy costs, the value of the firm reaches a maximum when firms maximize their debt. c) With zero taxes and zero bankruptcy costs, the value of the firm is independent of its debt-equity ratio. d) All of the above e) None of the above Question 4 A company is determining whether to lease or purchase an asset. It has already determined that the acquisition of the asset is a positive NPV decision and what remains is to decide how to finance its acquisition. Which of the following statements is true about the Net Advantage of Leasing (NAL)? a) NAL is higher if the calculation assumes that lease payments occur at start of year but that the tax shields on the lease payments occur at end of year. b) NAL is higher if the salvage value of the asset is higher and the CCA rate is higher. c) NAL is higher if the lessor will cover the cost of insuring the asset, so that the lessee does not have to. d) NAL is calculated using the weighted average cost of capital as the discount rate, unless the asset is not of the same risk as the other assets of the firm. e) None of the above Tuoyan Question 5 You are trying to determine whether to accept project A or project B. These projects are mutually exclusive. As part of your analysis, you could compute the incremental IRR by: nigem a) comparing the internal rate of return of the two projects. b) calculating the net present value of each project using the internal rate of return as the discount rate. c) calculating the discount rate that equates the net present values of the two projects. d) calculating the internal rate of return of the differences in the cash flows of the two projects. e) None of the above