Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NEED HELP ASAP 8-10 GOD BLESS YOUR SOUL 8.2 points) Assume the one year forward rate between the U.S. and Japan is 120.38 - $1.

NEED HELP ASAP 8-10

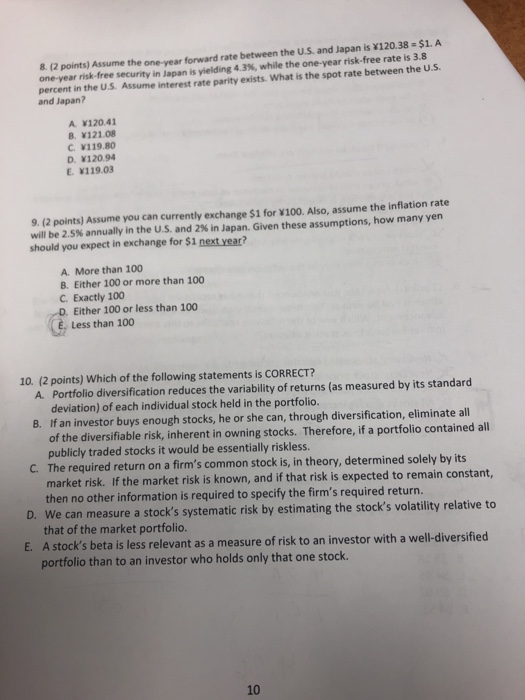

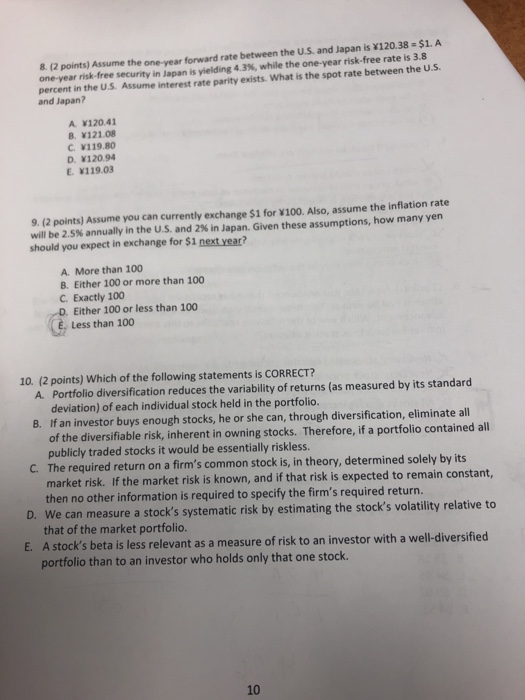

8.2 points) Assume the one year forward rate between the U.S. and Japan is 120.38 - $1. A one-year risk-free security in Japan is yielding 43%, while the one year risk.free rate is 3.8 percent in the US. Assume interest rate parity exists. What is the spot rate between the U.S. and Japan? A 1120.41 B. V121.08 C. V119.80 D. 1120.94 E. Y119.03 9.2 points) Assume you can currently exchange $1 for Y100. Also, assume the inflation rate will be 2.5 annually in the U.S. and 2 in Japan. Given these assumptions, how many yen should you expect in exchange for $1 next year? A. More than 100 B. Either 100 or more than 100 C. Exactly 100 D. Either 100 or less than 100 E. Less than 100 10. (2 points) Which of the following statements is CORRECT? A. Portfolio diversification reduces the variability of returns (as measured by its standard deviation) of each individual stock held in the portfolio. B. If an investor buys enough stocks, he or she can, through diversification, eliminate all of the diversifiable risk, inherent in owning stocks. Therefore, if a portfolio contained all publicly traded stocks it would be essentially riskless C. The required return on a firm's common stock is, in theory, determined solely by its market risk. If the market risk is known, and if that risk is expected to remain constant, then no other information is required to specify the firm's required return. D. We can measure a stock's systematic risk by estimating the stock's volatility relative to that of the market portfolio. E. A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only that one stock GOD BLESS YOUR SOUL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started