Question

Need help asap pls Contract Size: 27,500 Board Feet Price: $.$$ Per 1,000 Board Feet Initial Margin is $3,000/contract, maintenance margin is $1,350/contract Current spot

Need help asap pls

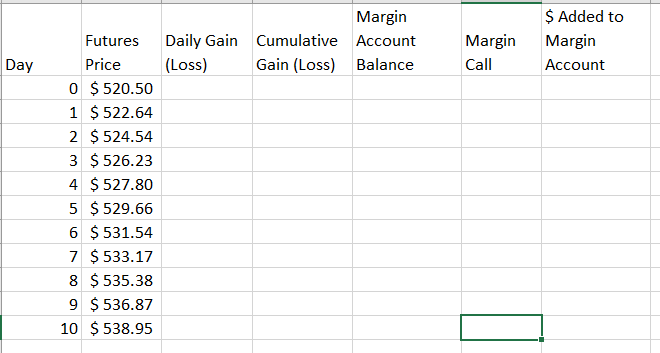

Contract Size: 27,500 Board Feet

Price: $.$$ Per 1,000 Board Feet

Initial Margin is $3,000/contract, maintenance margin is $1,350/contract

Current spot price (Feb. 2023): 520/1,000 board feet

Question 1: Your company receives lumber delivery of 1,000,000 board feet every other month, beginning in January.

Suppose that you will completely hedge (or as near as possible without going over) the May delivery using futures contracts. Using the data found in the Excel workbook (sheet: Q1) calculate the daily and cumulative gain/loss and the total amount in the margin account each day for the next ten days. Assume you use the minimum allowable margin when opening your position. The futures price on day 0 will be the price at which you will open your position. Settlement is daily. Any excess margin will be left in the margin account. No interest is earned.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started