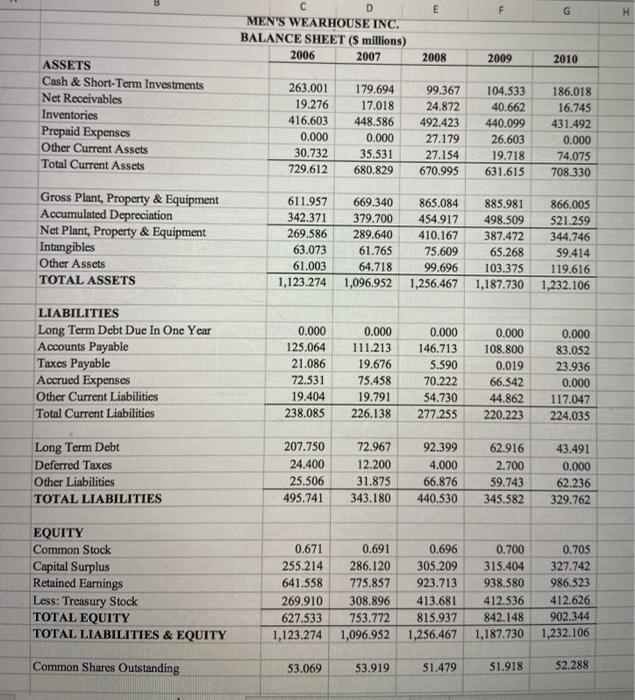

need help calculating week 7 and 8. Any explaination on what these ratios explain about the company would be helpful!

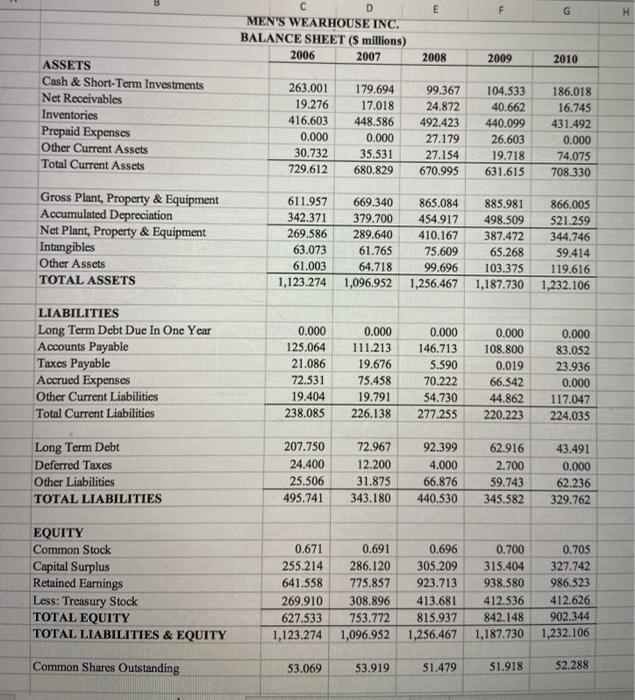

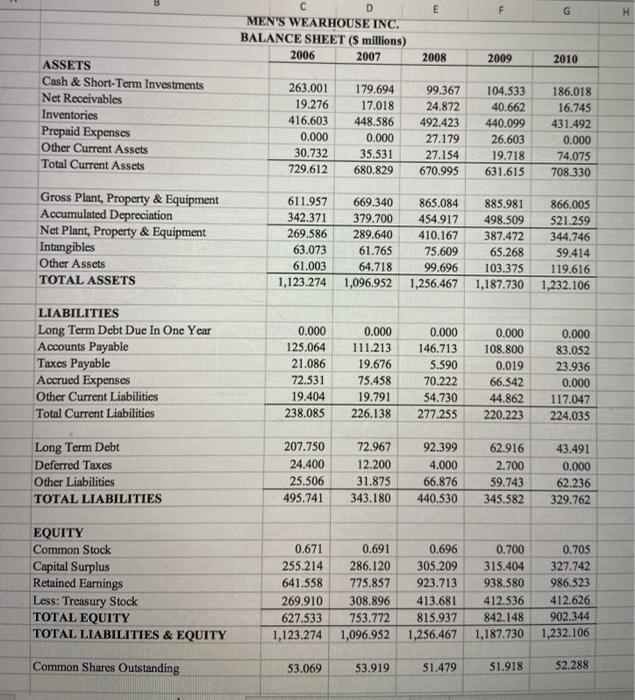

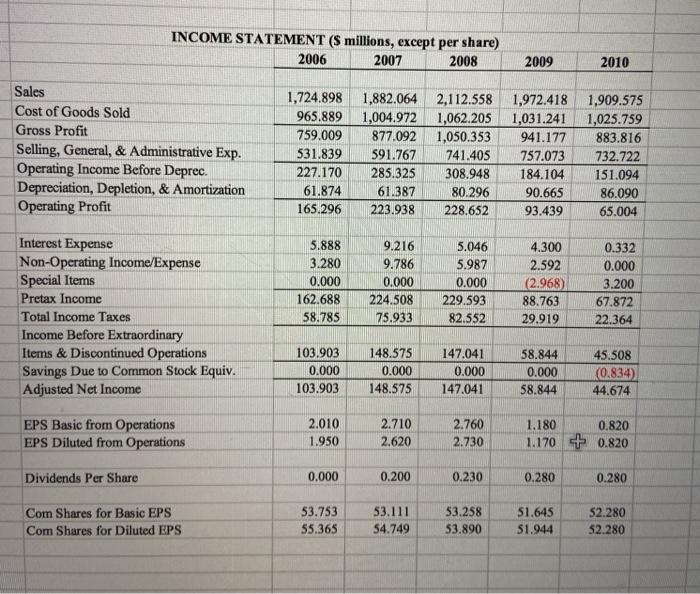

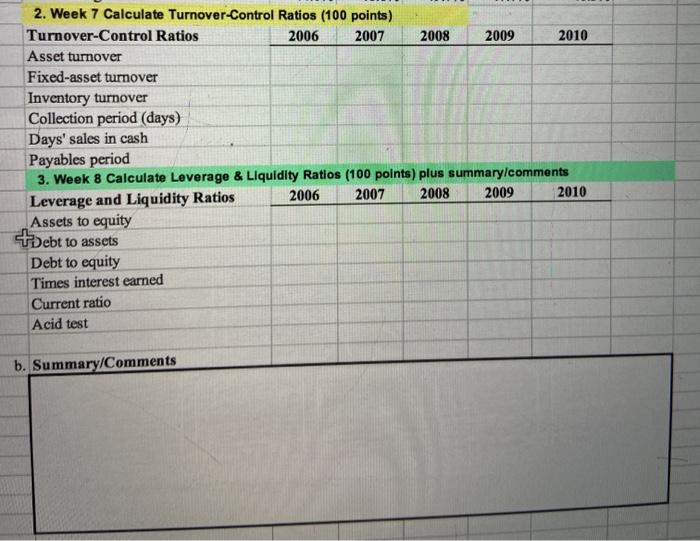

E F G D MEN'S WEARHOUSE INC. BALANCE SHEET (5 millions) 2006 2007 2008 2009 2010 ASSETS Cash & Short-Term Investments Net Receivables Inventories Prepaid Expenses Other Current Assets Total Current Assets 263.001 19.276 416.603 0.000 30.732 729.612 179.694 17.018 448.586 0.000 35.531 680.829 99.367 24.872 492.423 27.179 27.154 670.995 104.533 40.662 440.099 26.603 19.718 631.615 186.018 16.745 431.492 0.000 74.075 708.330 Gross Plant, Property & Equipment Accumulated Depreciation Net Plant, Property & Equipment Intangibles Other Assets TOTAL ASSETS 611.957 669.340 342.371 379.700 269.586 289.640 63.073 61.765 61.003 64.718 1,123.274 1,096,952 865.084 454.917 410.167 75.609 99.696 1,256,467 885.981 498.509 387.472 65.268 103.375 1,187.730 866.005 521.259 344.746 59.414 119.616 1,232.106 LIABILITIES Long Term Debt Due In One Year Accounts Payable Taxes Payable Accrued Expenses Other Current Liabilities Total Current Liabilities 0.000 125.064 21.086 72.531 19.404 238.085 0.000 111.213 19.676 75.458 19.791 226.138 0.000 146.713 5.590 70.222 54.730 277.255 0.000 108.800 0.019 66.542 44.862 220.223 0.000 83.052 23.936 0.000 117.047 224.035 Long Term Debt Deferred Taxes Other Liabilities TOTAL LIABILITIES 207.750 24.400 25.506 495.741 72.967 12.200 31.875 343.180 92.399 4.000 66.876 440.530 62.916 2.700 59.743 345.582 43.491 0.000 62.236 329.762 EQUITY Common Stock Capital Surplus Retained Earnings Less: Treasury Stock TOTAL EQUITY TOTAL LIABILITIES & EQUITY 0.671 255.214 641.558 269.910 627.533 1,123.274 0.691 286.120 775.857 308.896 753.772 1,096.952 0.696 305.209 923.713 413,681 815.937 1,256.467 0.700 315.404 938.580 412.536 842.148 1,187.730 0.705 327.742 986,523 412.626 902.344 1,232.106 Common Shares Outstanding 53.069 53.919 51.479 51.918 52.288 2. Week 7 Calculate Turnover-Control Ratios (100 points) Turnover-Control Ratios 2006 2007 2008 2009 2010 Asset turnover Fixed-asset turnover Inventory turnover Collection period (days) Days' sales in cash Payables period 3. Week 8 Calculate Leverage & Liquidity Ratios (100 points) plus summary/comments 2006 2007 2008 2009 2010 Leverage and Liquidity Ratios Assets to equity +Debt to assets Debt to equity Times interest earned Current ratio Acid test b. Summary/Comments