Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help finishing this Polarix is a retailer of ATVs (all-terrain vehicles) and accessories. An income statement for its Consumer ATV Department for the current

need help finishing this

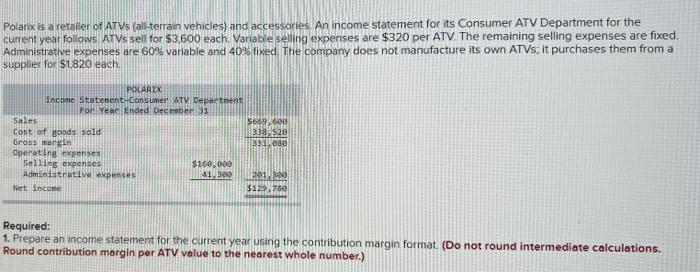

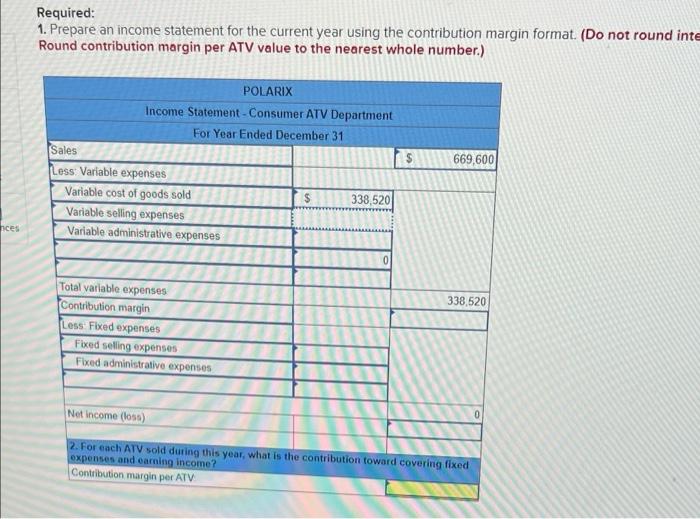

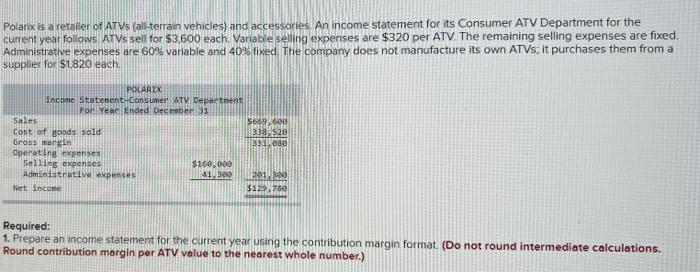

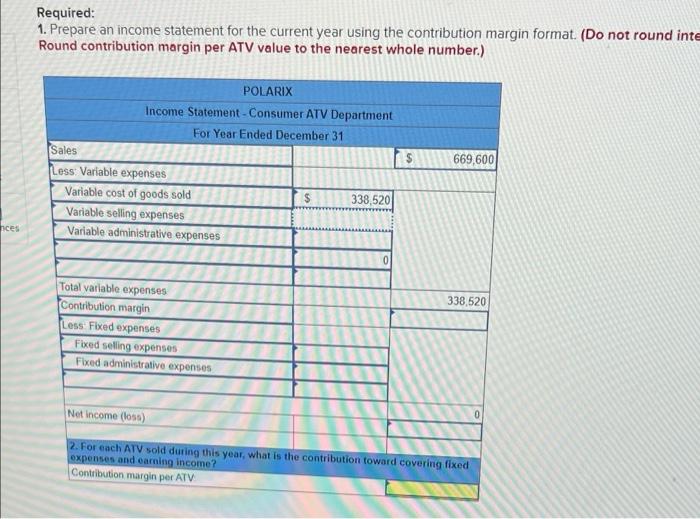

Polarix is a retailer of ATVs (all-terrain vehicles) and accessories. An income statement for its Consumer ATV Department for the current year follows. ATVs sell for $3,600 each. Variable selling expenses are $320 per ATV. The remaining selling expenses are fixed. Administrative expenses are 60% variable and 40% fixed. The company does not manufacture its own ATVs: it purchases them from a supplier for $1.820 each. POLAREX Income Statement Consumer ATV Departmen For Year Ended December 31 Sales Cost of goods sold Gross margin $669,600 338,528 331,080 Operating expenses Selling expenses $160,000 41,300 Administrative expenses 201, 200 $129,750 Net Income Required: 1. Prepare an income statement for the current year using the contribution margin format. (Do not round intermediate calculations. Round contribution margin per ATV value to the nearest whole number.) nces Required: 1. Prepare an income statement for the current year using the contribution margin format. (Do not round inte Round contribution margin per ATV value to the nearest whole number.) POLARIX Income Statement - Consumer ATV Department For Year Ended December 31 Sales 669,600 Less: Variable expenses 338,520 338,520 Fixed selling expenses Fixed administrative expenses Net income (loss) 2. For each ATV sold during this year, what is the contribution toward covering fixed expenses and earning income? Contribution margin per ATV Variable cost of goods sold Variable selling expenses Variable administrative expenses Total variable expenses Contribution margin Less Fixed expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started