Answered step by step

Verified Expert Solution

Question

1 Approved Answer

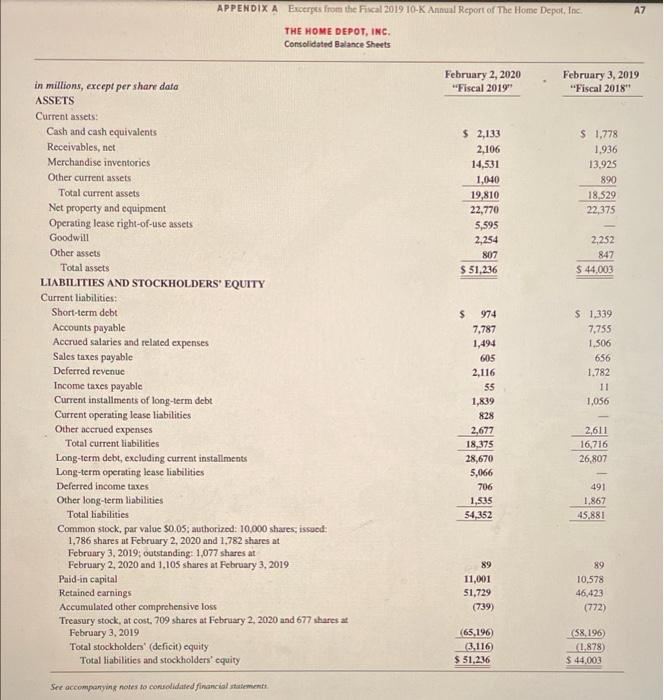

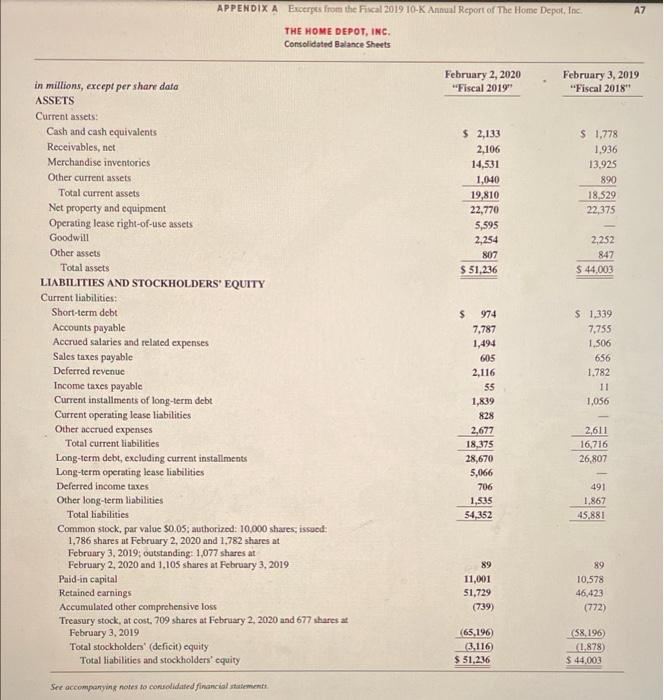

need help on all APPENDIX A Excerpts from the Fiscal 2019 10-K Annual Report of The Home Depot, Inc. A7 THE HOME DEPOT, INC. Consolidated

need help on all

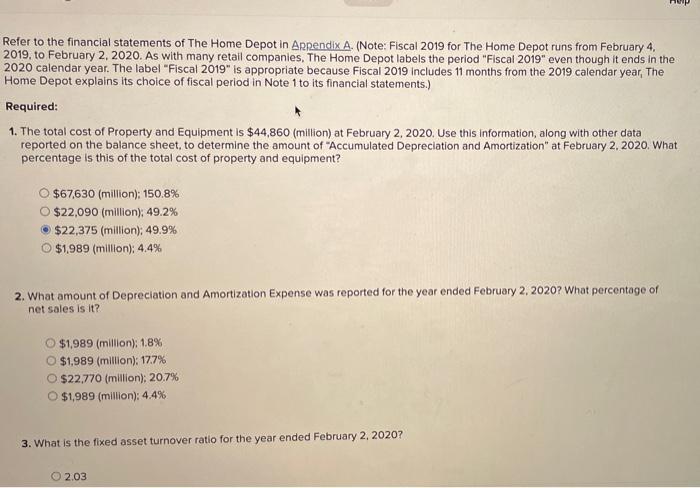

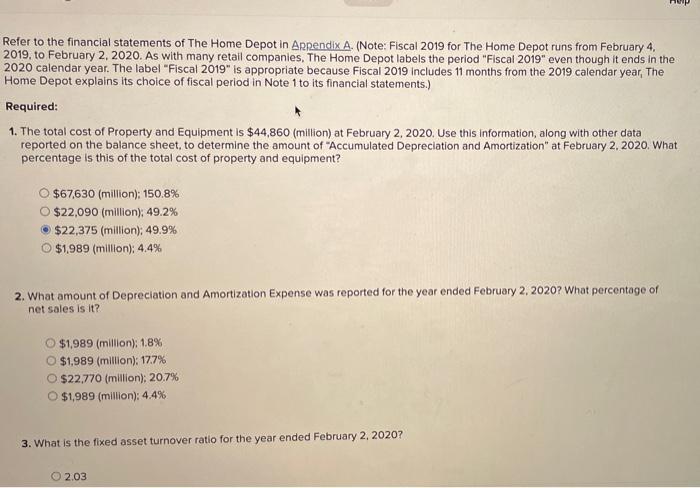

APPENDIX A Excerpts from the Fiscal 2019 10-K Annual Report of The Home Depot, Inc. A7 THE HOME DEPOT, INC. Consolidated Balance Sheets February 2, 2020 "Fiscal 2019 February 3, 2019 "Fiscal 2018" $ 2,133 2,106 14,531 1,040 19,810 22,770 5,595 2,254 807 $ 51,236 $ 1.778 1.936 13.925 890 18.529 22,375 2,252 847 $ 44,003 in millions, except per share data ASSETS Current assets: Cash and cash equivalents Receivables, nct Merchandise inventories Other current assets Total current assets Net property and equipment Operating lease right-of-use assets Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Short-term debt Accounts payable Accrued salaries and related expenses Sales taxes payable Deferred revenue Income taxes payable Current installments of long-term debt Current operating lease liabilities Other accrued expenses Total current liabilities Long-term debt, excluding current installments Long-term operating Icase liabilities Deferred income taxes Other long-term liabilities Total liabilities Common stock, par value 50.05; authorized: 10,000 shares, issued 1.786 shares at February 2, 2020 and 1.782 shares at February 3, 2019, outstanding: 1,077 shares at February 2, 2020 and 1,105 shares at February 3, 2019 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 709 shares at February 2, 2020 and 677 shares at February 3, 2019 Total stockholders' (deficit) equity Total liabilities and stockholders' equity $ 1,339 7,755 1.506 656 1.782 11 1,056 $ 974 7,787 1,494 605 2,116 55 1,839 828 2.677 18,375 28,670 5,066 706 1,535 54,352 2,611 16.716 26,807 491 1.867 45.881 89 11,001 51,729 (739) 89 10,578 46,423 (772) (65.196) (3,116) $ 51,236 58,196) (1 878) $ 44,003 See accompanying notes to consolidated financial statements Refer to the financial statements of The Home Depot in Arpendix A. (Note: Fiscal 2019 for The Home Depot runs from February 4, 2019. to February 2.2020. As with many retail companies, The Home Depot labels the period "Fiscal 2019" even though it ends in the 2020 calendar year. The label "Fiscal 2019" is appropriate because Fiscal 2019 includes 11 months from the 2019 calendar year, The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.) Required: 1. The total cost of Property and Equipment is $44,860 (million) at February 2, 2020. Use this information, along with other data reported on the balance sheet, to determine the amount of Accumulated Depreciation and Amortization" at February 2.2020. What percentage is this of the total cost of property and equipment? O $67,630 (million): 150.8% O $22,090 (million): 49.2% $22,375 (million); 49.9% O $1,989 (million); 4.4% 2. What amount of Depreciation and Amortization Expense was reported for the year ended February 2, 2020? What percentage of net sales is it? $1,989 (million); 1.8% $1,989 (million): 177% $22,770 (million); 20.7% O $1,989 (million): 4.4% 3. What is the fixed asset turnover ratio for the year ended February 2, 2020? 2.03 3. What is the fixed asset turnover ratio for the year ended February 2, 2020? O 2.03 O 3.11 4.84 O 4.88 APPENDIX A Excerpts from the Fiscal 2019 10-K Annual Report of The Home Depot, Inc. A7 THE HOME DEPOT, INC. Consolidated Balance Sheets February 2, 2020 "Fiscal 2019 February 3, 2019 "Fiscal 2018" $ 2,133 2,106 14,531 1,040 19,810 22,770 5,595 2,254 807 $ 51,236 $ 1.778 1.936 13.925 890 18.529 22,375 2,252 847 $ 44,003 in millions, except per share data ASSETS Current assets: Cash and cash equivalents Receivables, nct Merchandise inventories Other current assets Total current assets Net property and equipment Operating lease right-of-use assets Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Short-term debt Accounts payable Accrued salaries and related expenses Sales taxes payable Deferred revenue Income taxes payable Current installments of long-term debt Current operating lease liabilities Other accrued expenses Total current liabilities Long-term debt, excluding current installments Long-term operating Icase liabilities Deferred income taxes Other long-term liabilities Total liabilities Common stock, par value 50.05; authorized: 10,000 shares, issued 1.786 shares at February 2, 2020 and 1.782 shares at February 3, 2019, outstanding: 1,077 shares at February 2, 2020 and 1,105 shares at February 3, 2019 Paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 709 shares at February 2, 2020 and 677 shares at February 3, 2019 Total stockholders' (deficit) equity Total liabilities and stockholders' equity $ 1,339 7,755 1.506 656 1.782 11 1,056 $ 974 7,787 1,494 605 2,116 55 1,839 828 2.677 18,375 28,670 5,066 706 1,535 54,352 2,611 16.716 26,807 491 1.867 45.881 89 11,001 51,729 (739) 89 10,578 46,423 (772) (65.196) (3,116) $ 51,236 58,196) (1 878) $ 44,003 See accompanying notes to consolidated financial statements Refer to the financial statements of The Home Depot in Arpendix A. (Note: Fiscal 2019 for The Home Depot runs from February 4, 2019. to February 2.2020. As with many retail companies, The Home Depot labels the period "Fiscal 2019" even though it ends in the 2020 calendar year. The label "Fiscal 2019" is appropriate because Fiscal 2019 includes 11 months from the 2019 calendar year, The Home Depot explains its choice of fiscal period in Note 1 to its financial statements.) Required: 1. The total cost of Property and Equipment is $44,860 (million) at February 2, 2020. Use this information, along with other data reported on the balance sheet, to determine the amount of Accumulated Depreciation and Amortization" at February 2.2020. What percentage is this of the total cost of property and equipment? O $67,630 (million): 150.8% O $22,090 (million): 49.2% $22,375 (million); 49.9% O $1,989 (million); 4.4% 2. What amount of Depreciation and Amortization Expense was reported for the year ended February 2, 2020? What percentage of net sales is it? $1,989 (million); 1.8% $1,989 (million): 177% $22,770 (million); 20.7% O $1,989 (million): 4.4% 3. What is the fixed asset turnover ratio for the year ended February 2, 2020? 2.03 3. What is the fixed asset turnover ratio for the year ended February 2, 2020? O 2.03 O 3.11 4.84 O 4.88

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started