Need help on "Debt Repurchased" question.

Need help on question f.

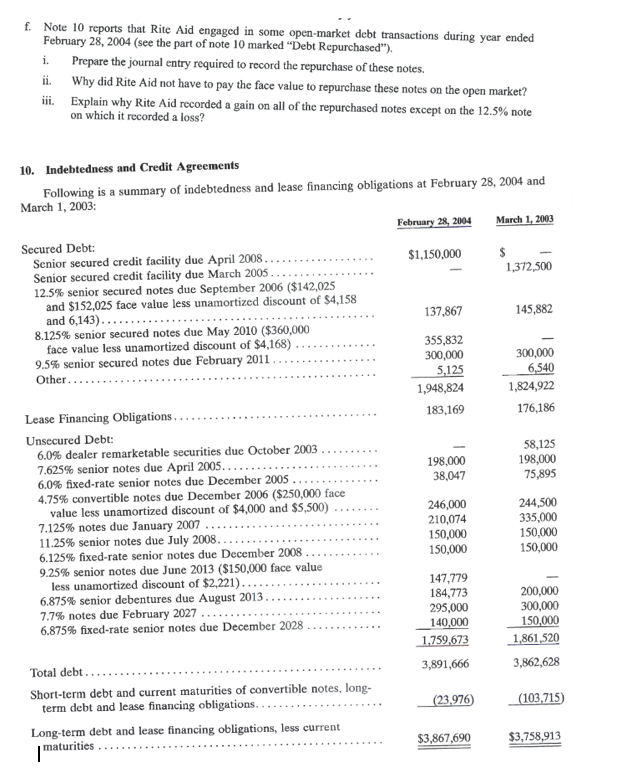

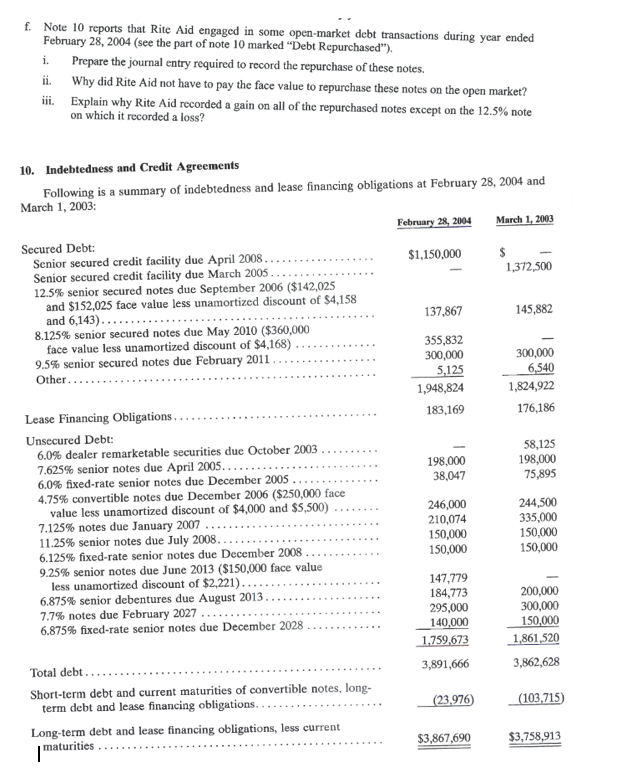

f Note 10 reports that Rite Aid engaged in some open-market debt transactions during year ended February 28, 2004 (see the part of note 10 marked "Debt Repurchased"). i. Prepare the journal entry required to record the repurchase of these notes, ii. Why did Rite Aid not have to pay the face value to repurchase these notes on the open market? iii. Explain why Rite Aid recorded a gain on all of the repurchased notes except on the 12.5% note on which it recorded a loss? 10. Indebtedness and Credit Agreements Following is a summary of indebtedness and lease financing obligations at February 28, 2004 and March 1, 2003: February 28, 2004 March 1, 2003 $1,150,000 S 1,372,500 Secured Debt: Senior secured credit facility due April 2008. .... Senior secured credit facility due March 2005.......... 12.5% senior secured notes due September 2006 ($142,025 and $152,025 face value less unamortized discount of $4,158 and 6,143)......... 8.125% senior secured notes due May 2010 ($360,000 face value less unamortized discount of $4,168) ...... 9.5% senior secured notes due February 2011.. Other.. 137.867 145,882 355,832 300,000 5,125 1,948,824 183,169 300,000 6,540 1,824,922 176,186 198,000 38,047 58,125 198,000 75,895 Lease Financing Obligations..... Unsecured Debt: 6.0% dealer remarketable securities due October 2003......... 7.625% senior notes due April 2005........ 6.0% fixed-rate senior notes due December 2005 4.75% convertible notes due December 2006 ($250,000 face value less unamortized discount of $4,000 and $5,500) 7.125% notes due January 2007 .......... 11.25% senior notes due July 2008....................... 6.125% fixed-rate senior notes due December 2008 ..... 9.25% senior notes due June 2013 ($150,000 face value less unamortized discount of $2,221)..... 6.875% senior debentures due August 2013... 7.7% notes due February 2027 ........... 6.875% fixed-rate senior notes due December 2028 ............. 246,000 210,074 150,000 150,000 244,500 335,000 150,000 150,000 147,779 184.773 295,000 140,000 1.759.673 200,000 300,000 150,000 1,861,520 3,862,628 Total debt.... 3,891,666 Short-term debt and current maturities of convertible notes, long- term debt and lease financing obligations...... (23,976) (103,715) Long-term debt and lease financing obligations, less current maturities .. $3,867,690 $3,758,913 f Note 10 reports that Rite Aid engaged in some open-market debt transactions during year ended February 28, 2004 (see the part of note 10 marked "Debt Repurchased"). i. Prepare the journal entry required to record the repurchase of these notes, ii. Why did Rite Aid not have to pay the face value to repurchase these notes on the open market? iii. Explain why Rite Aid recorded a gain on all of the repurchased notes except on the 12.5% note on which it recorded a loss? 10. Indebtedness and Credit Agreements Following is a summary of indebtedness and lease financing obligations at February 28, 2004 and March 1, 2003: February 28, 2004 March 1, 2003 $1,150,000 S 1,372,500 Secured Debt: Senior secured credit facility due April 2008. .... Senior secured credit facility due March 2005.......... 12.5% senior secured notes due September 2006 ($142,025 and $152,025 face value less unamortized discount of $4,158 and 6,143)......... 8.125% senior secured notes due May 2010 ($360,000 face value less unamortized discount of $4,168) ...... 9.5% senior secured notes due February 2011.. Other.. 137.867 145,882 355,832 300,000 5,125 1,948,824 183,169 300,000 6,540 1,824,922 176,186 198,000 38,047 58,125 198,000 75,895 Lease Financing Obligations..... Unsecured Debt: 6.0% dealer remarketable securities due October 2003......... 7.625% senior notes due April 2005........ 6.0% fixed-rate senior notes due December 2005 4.75% convertible notes due December 2006 ($250,000 face value less unamortized discount of $4,000 and $5,500) 7.125% notes due January 2007 .......... 11.25% senior notes due July 2008....................... 6.125% fixed-rate senior notes due December 2008 ..... 9.25% senior notes due June 2013 ($150,000 face value less unamortized discount of $2,221)..... 6.875% senior debentures due August 2013... 7.7% notes due February 2027 ........... 6.875% fixed-rate senior notes due December 2028 ............. 246,000 210,074 150,000 150,000 244,500 335,000 150,000 150,000 147,779 184.773 295,000 140,000 1.759.673 200,000 300,000 150,000 1,861,520 3,862,628 Total debt.... 3,891,666 Short-term debt and current maturities of convertible notes, long- term debt and lease financing obligations...... (23,976) (103,715) Long-term debt and lease financing obligations, less current maturities .. $3,867,690 $3,758,913