Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help on income statement . Rose and Budd, Inc. is a closely held corporation that owns a small roadside motel in a rural area.

need help on income statement

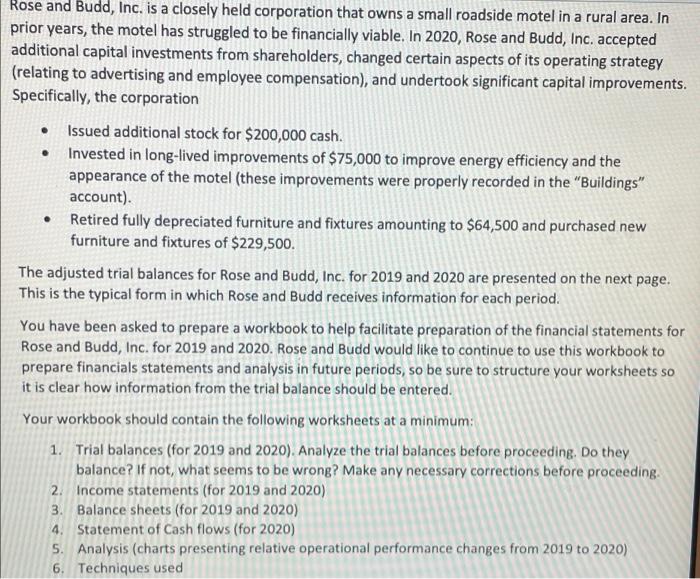

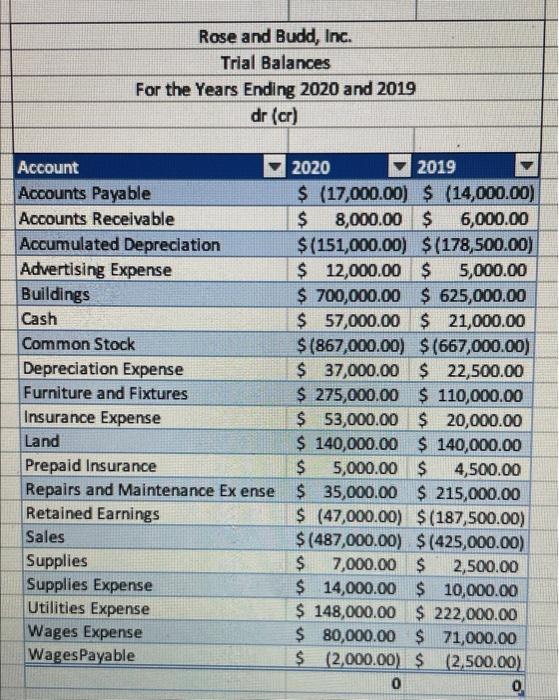

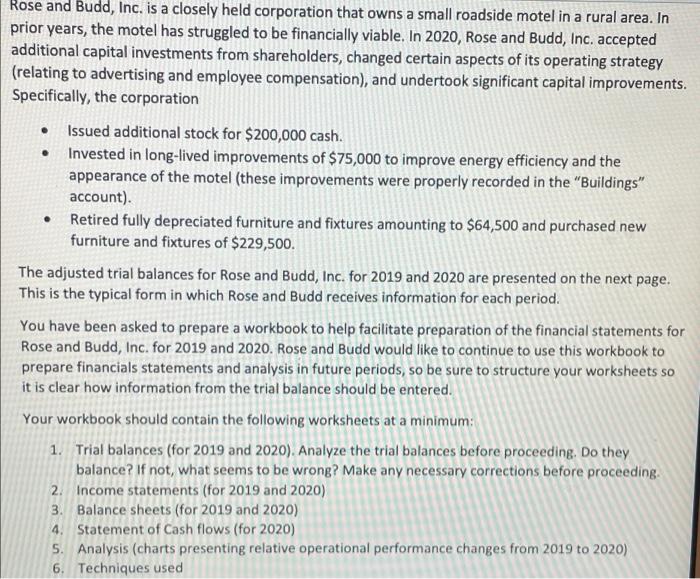

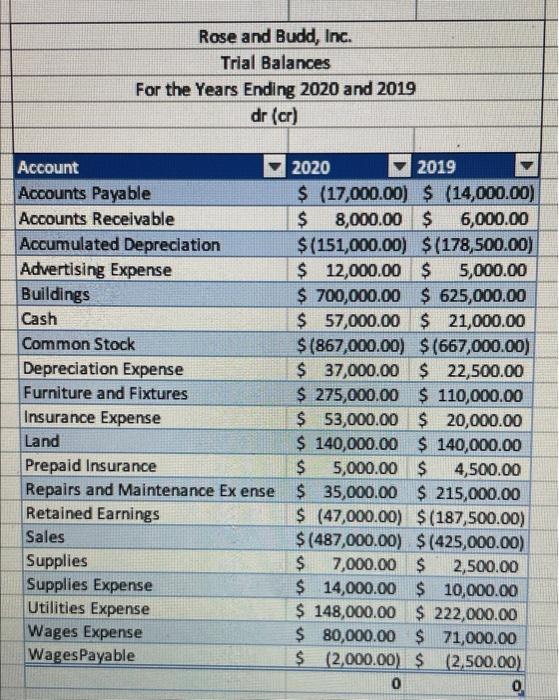

. Rose and Budd, Inc. is a closely held corporation that owns a small roadside motel in a rural area. In prior years, the motel has struggled to be financially viable. In 2020, Rose and Budd, Inc. accepted additional capital investments from shareholders, changed certain aspects of its operating strategy (relating to advertising and employee compensation), and undertook significant capital improvements. Specifically, the corporation Issued additional stock for $200,000 cash. Invested in long-lived improvements of $75,000 to improve energy efficiency and the appearance of the motel (these improvements were properly recorded in the "Buildings" account). Retired fully depreciated furniture and fixtures amounting to $64,500 and purchased new furniture and fixtures of $229,500. The adjusted trial balances for Rose and Budd, Inc. for 2019 and 2020 are presented on the next page. This is the typical form in which Rose and Budd receives information for each period. You have been asked to prepare a workbook to help facilitate preparation of the financial statements for Rose and Budd, Inc. for 2019 and 2020. Rose and Budd would like to continue to use this workbook to prepare financials statements and analysis in future periods, so be sure to structure your worksheets so it is clear how information from the trial balance should be entered. Your workbook should contain the following worksheets at a minimum: 1. Trial balances (for 2019 and 2020). Analyze the trial balances before proceeding. Do they balance? If not, what seems to be wrong? Make any necessary corrections before proceeding. Income statements (for 2019 and 2020) 3. Balance sheets (for 2019 and 2020) 4. Statement of Cash flows (for 2020) 5. Analysis (charts presenting relative operational performance changes from 2019 to 2020) 6. Techniques used 2. Rose and Budd, Inc. Trial Balances For the Years Ending 2020 and 2019 dr (ar) Account Accounts Payable Accounts Receivable Accumulated Depreciation Advertising Expense Buildings Cash Common Stock Depreciation Expense Furniture and Fixtures Insurance Expense Land Prepaid Insurance Repairs and Maintenance Ex ense Retained Earnings Sales Supplies Supplies Expense Utilities Expense Wages Expense WagesPayable 2020 2019 $ (17,000,00) $ (14,000.00) $ 8,000.00 $ 6,000.00 $(151,000.00) $ (178,500.00) $ 12,000.00 $ 5,000.00 $ 700,000.00 $ 625,000.00 $ 57,000.00 $ 21,000.00 $(867,000.00) $ (667,000.00) $ 37,000.00 $ 22,500.00 $ 275,000.00 $ 110,000.00 $ 53,000.00 $ 20,000.00 $ 140,000.00 $ 140,000.00 $ 5,000.00 $ 4,500.00 $ 35,000.00 $ 215,000.00 $ (47,000.00) $ (187,500.00) $(487,000.00) $ (425,000.00) $ 7,000.00 $ 2,500.00 $ 14,000.00 $ 10,000.00 $ 148,000.00 $ 222,000.00 $ 80,000.00 $ 71,000.00 $ (2,000.00) $ (2,500.00) 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started