Answered step by step

Verified Expert Solution

Question

1 Approved Answer

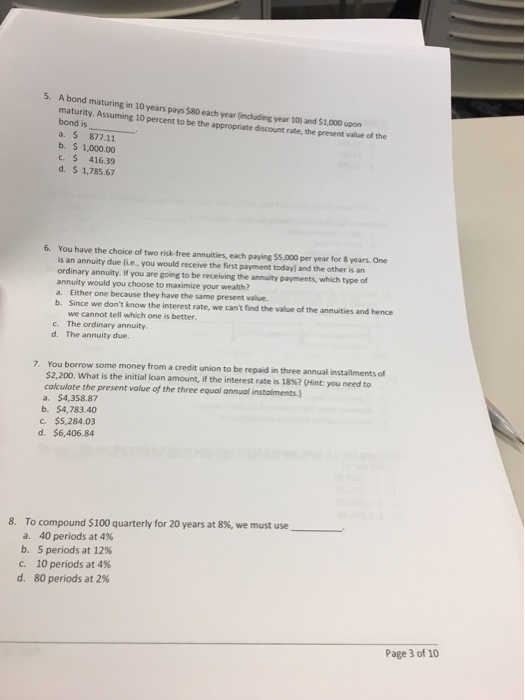

Need help on principles of finance take home test A bond maturing in 10 years pays $80 each year (including year 10) and $ 1,000

Need help on principles of finance take home test

A bond maturing in 10 years pays $80 each year (including year 10) and $ 1,000 upon maturity. Assuming 10 percent to be the appropriate discount rate, the present value of the bond is $ 877.11 $1,000.00 $416.39 $1, 785.67 You have the choice of two risk-free annuities, each paying $5 000 per year for 8 years One is an annuity due (i.e. you would receive the first payment today) and the other it an Ordinary annuity If you are going to be receiving the annuity payments, which type of annuity would you choose to maximize your wealth? Either one became they have the tame prevent value. Since we don't know the interest rate, we can't find the value of the annuities and hence we cannot tell which one is better The ordinary annuity The annuity due You borrow some money from a credit union to be repaid in three annual installments of $2, 200. What is the initial loan amount, if the interest rate is 18%? $4.358.87 $4, 783 40 $5, 284.03 $6, 406.84 To compound $100 quarterly (or 20 years at 8%, we must use 40 periods at 4% 5 periods at 12% 10 periods at 4% 80 periods at 2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started