Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help on this Thanks 11. Suppose a bond's price is expected to fall by 3% if its yield to maturity (YTM) increases by 100

Need help on this

Thanks

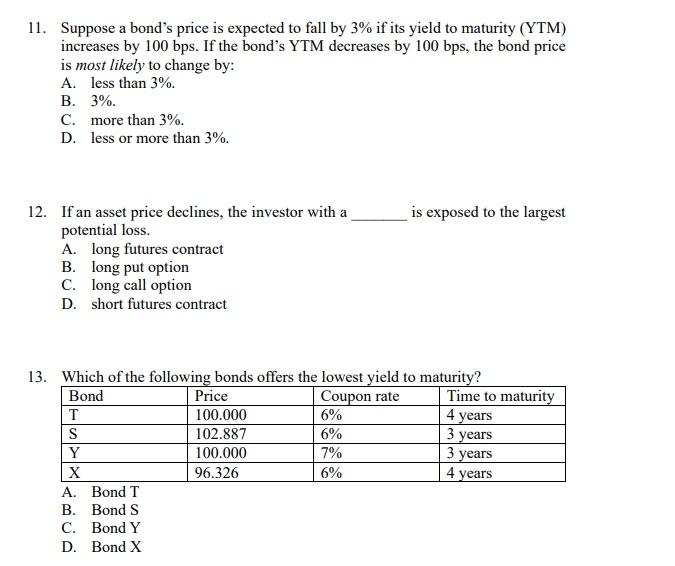

11. Suppose a bond's price is expected to fall by 3% if its yield to maturity (YTM) increases by 100 bps. If the bond's YTM decreases by 100 bps, the bond price is most likely to change by: A. less than 3%. B. 3%. C. more than 3%. D. less or more than 3%. is exposed to the largest 12. If an asset price declines, the investor with a potential loss. A. long futures contract B. long put option C. long call option D. short futures contract 13. Which of the following bonds offers the lowest yield to maturity? Bond Price Coupon rate Time to maturity T 100.000 6% 4 years S 102.887 6% 3 years Y 100.000 7% 3 years X 96.326 6% 4 years A. Bond T B. Bond S C. Bond Y D. Bond XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started