Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help please asap allocates indirect costs to jobs based on a predetermined indirect cost allocation rate computed as a percentage of direct labour costs

need help please asap

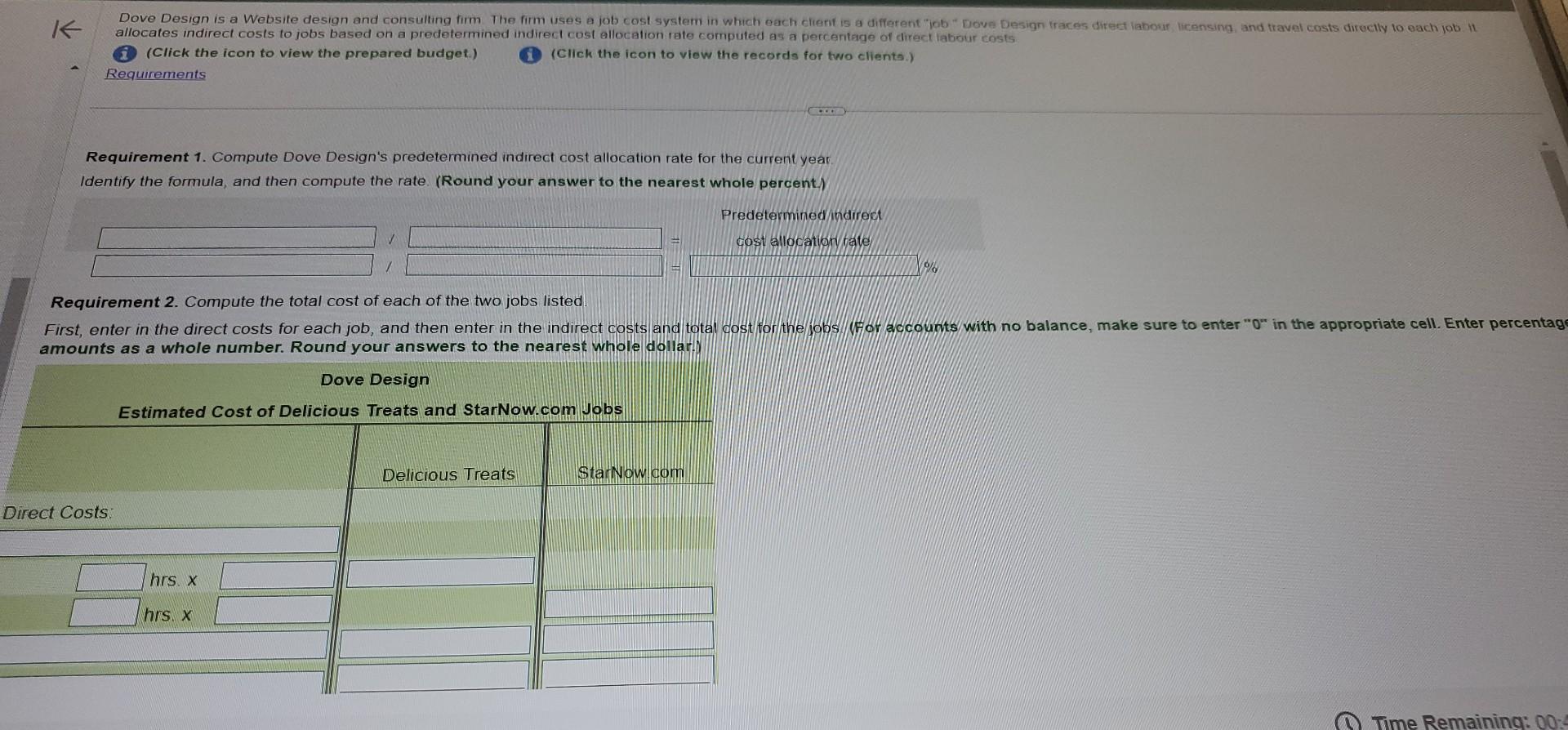

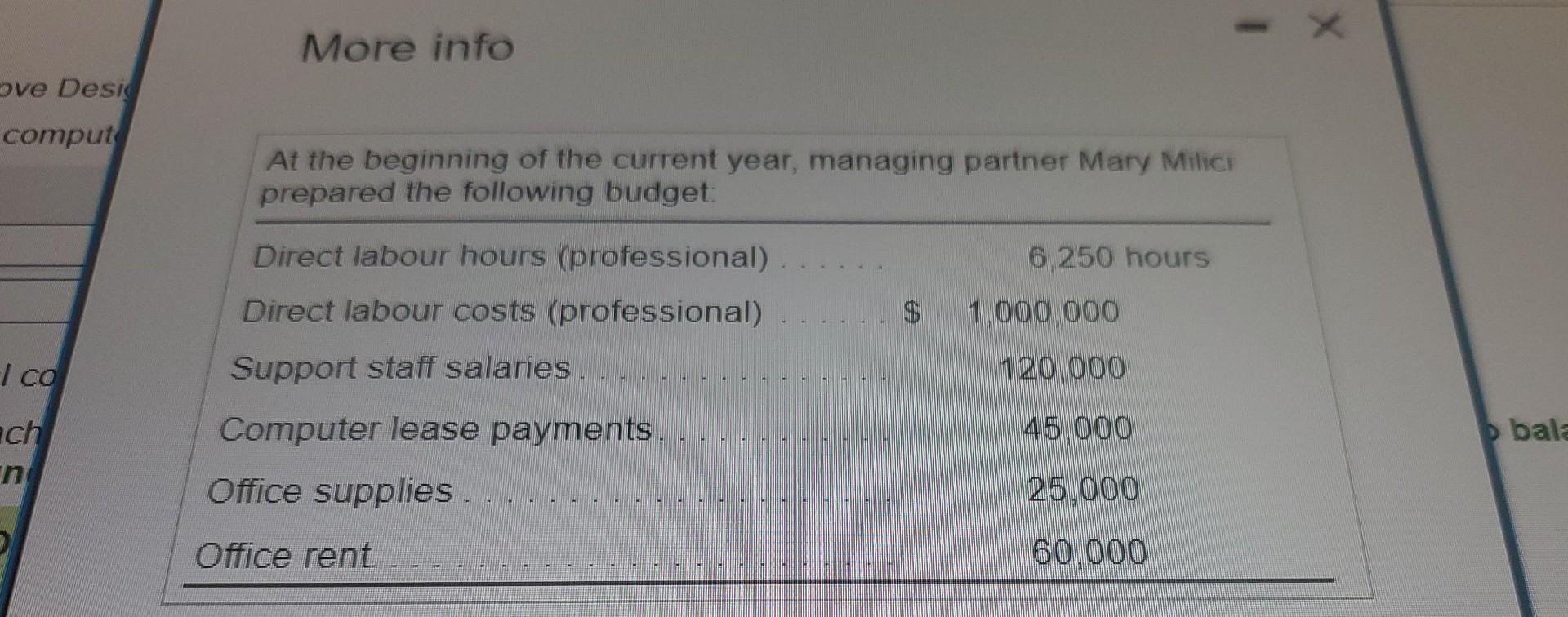

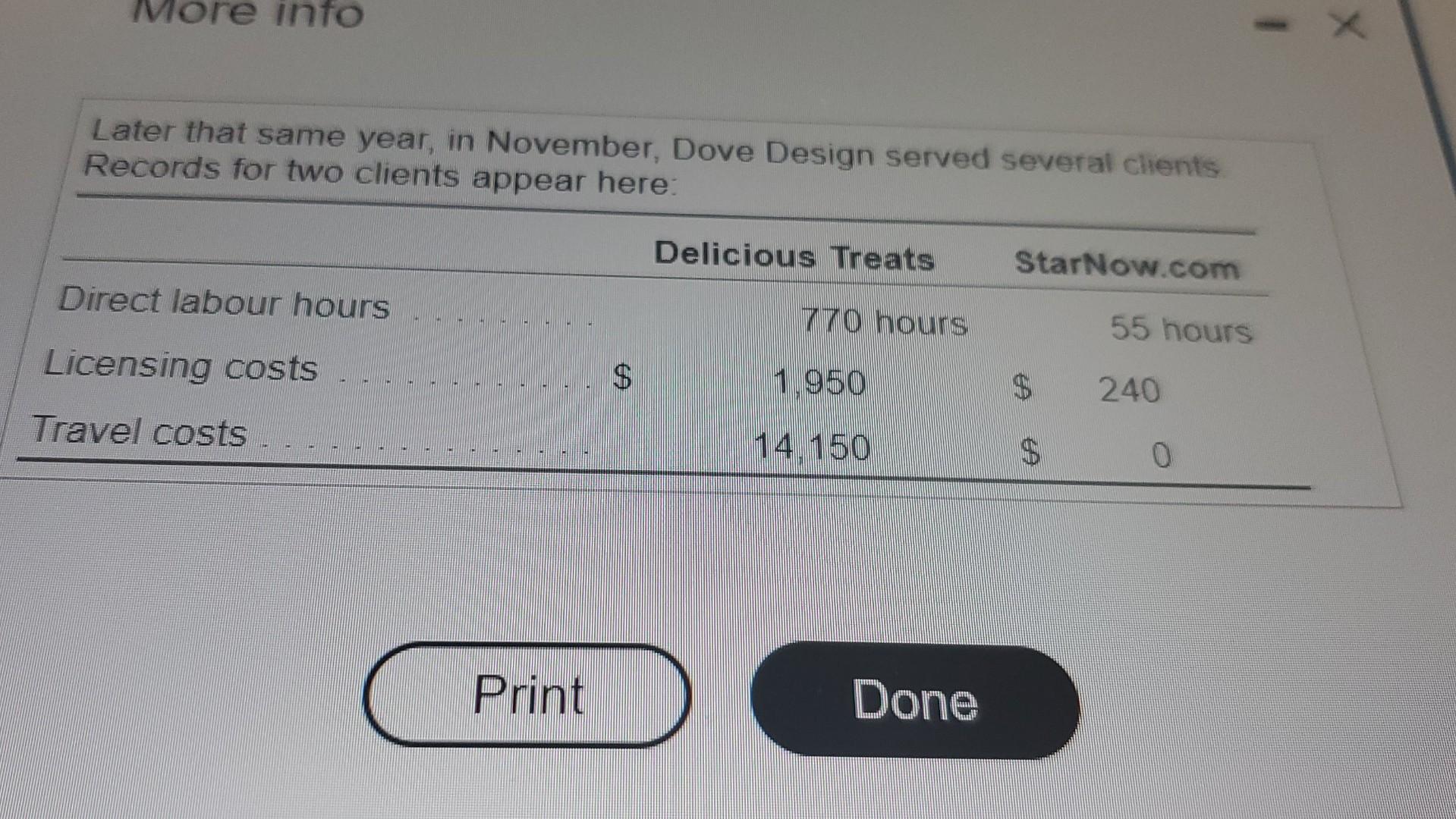

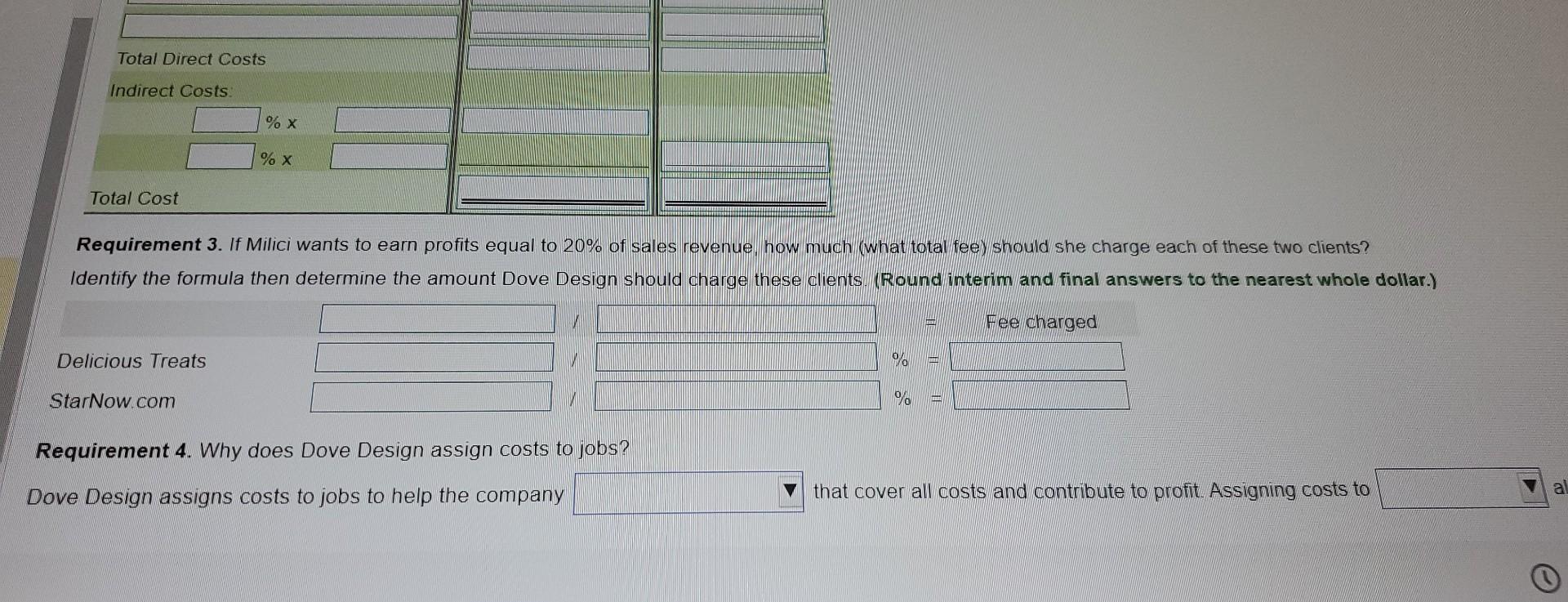

allocates indirect costs to jobs based on a predetermined indirect cost allocation rate computed as a percentage of direct labour costs (i) (Click the icon to view the prepared budget.) (Click the icon to view the records for two clients.) 16 (click the Requirement 1. Compute Dove Design's predetermined indirect cost allocation rate for the current year. Identify the formula, and then compute the rate. (Round your answer to the nearest whole percent.) Predetermined nudirect Requirement 2. Compute the total cost of each of the two jobs listed. cost allocation tafe. mounts as a whole number. Round your answers to the nearest whole dollar. More info At the beginning of the current year, managing partner Mary Milici prepared the following budget: Later that same year, in November, Dove Design served several clients Records for two clients appear here: Requirement 3. If Milici wants to earn profits equal to 20% of sales revenue. how much (what total fee) should she charge each of these two clients? Identify the formula then determine the amount Dove Design should charge these clients. (Round interim and final answers to the nearest whole dollar.) 4 =Feecharged== Requirement 4. Why does Dove Design assign costs to jobs? Dove Design assigns costs to jobs to help the compan that cover all costs and contribute to profit. Assigning costs toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started