Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help plz with accounting for these 8 questions pls Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for prepaid cell phones for

need help plz with accounting for these 8 questions pls

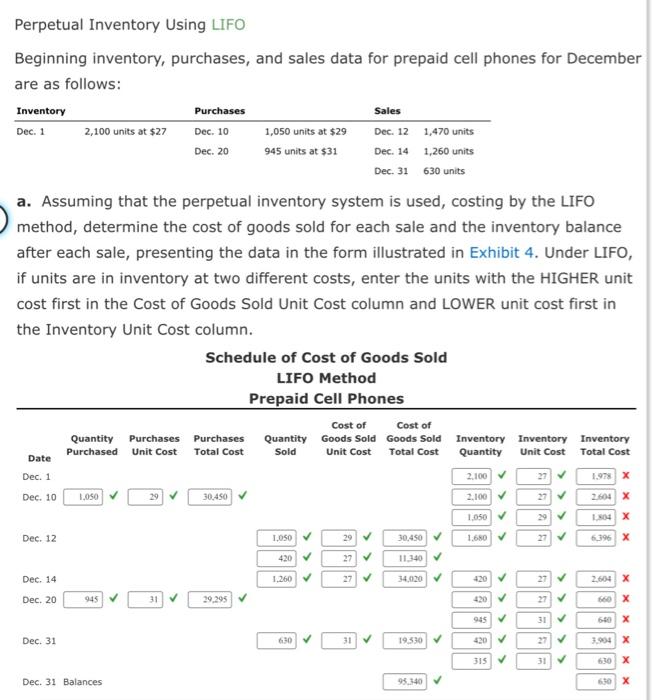

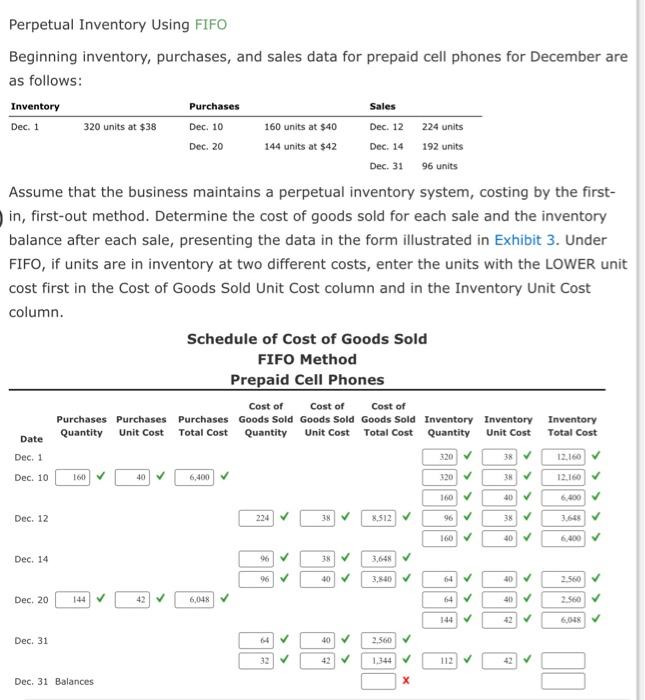

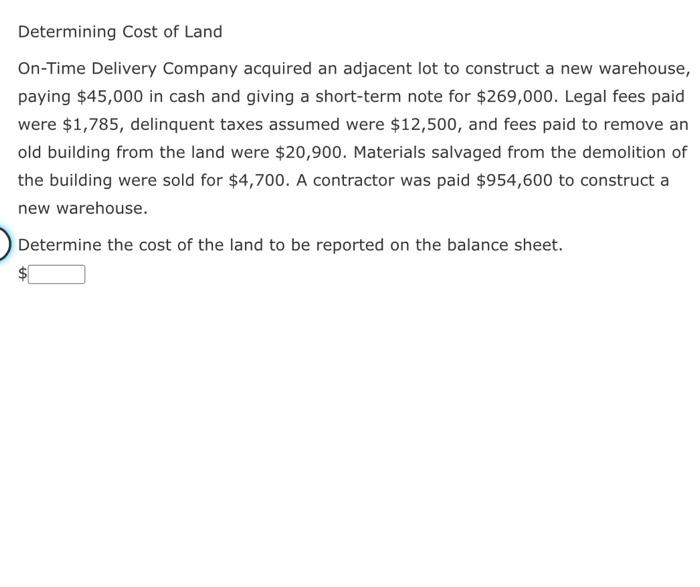

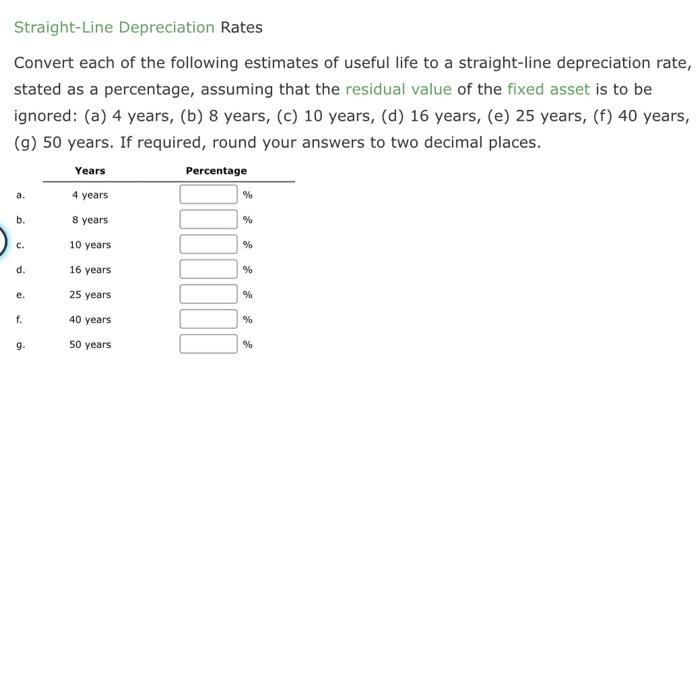

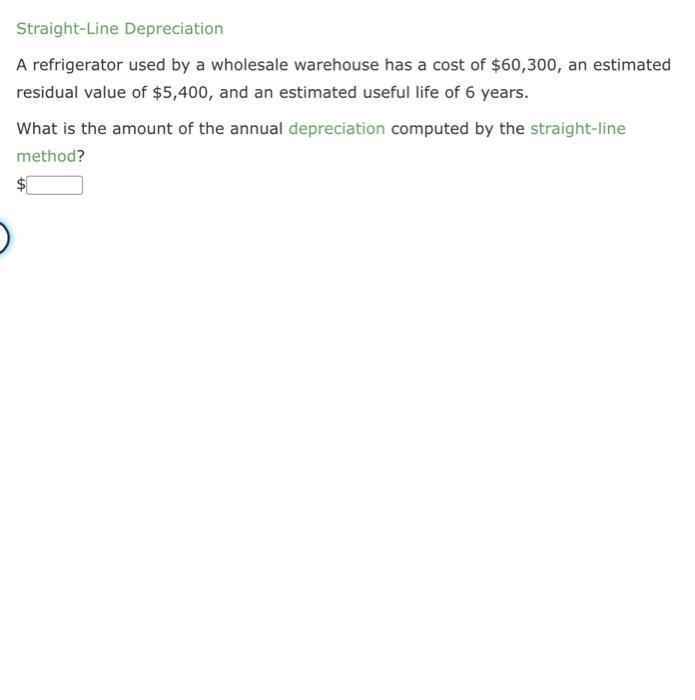

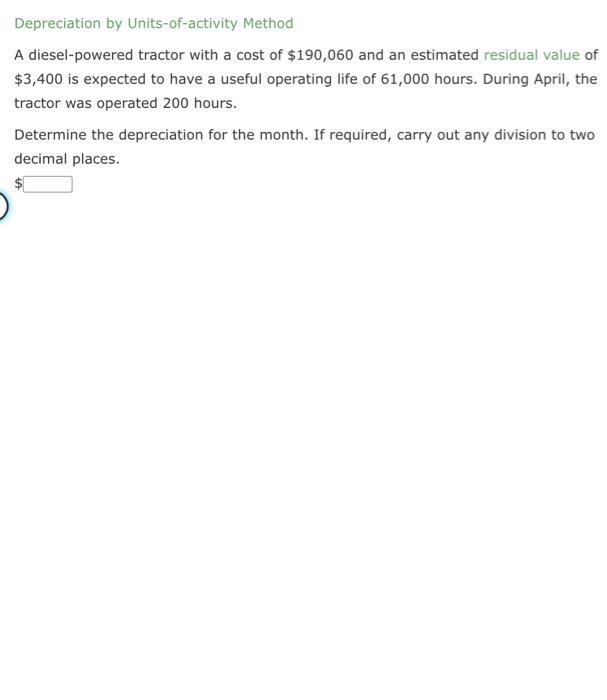

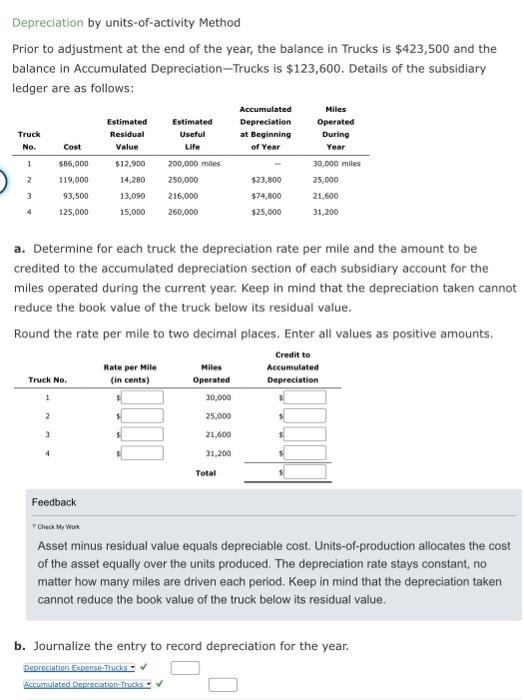

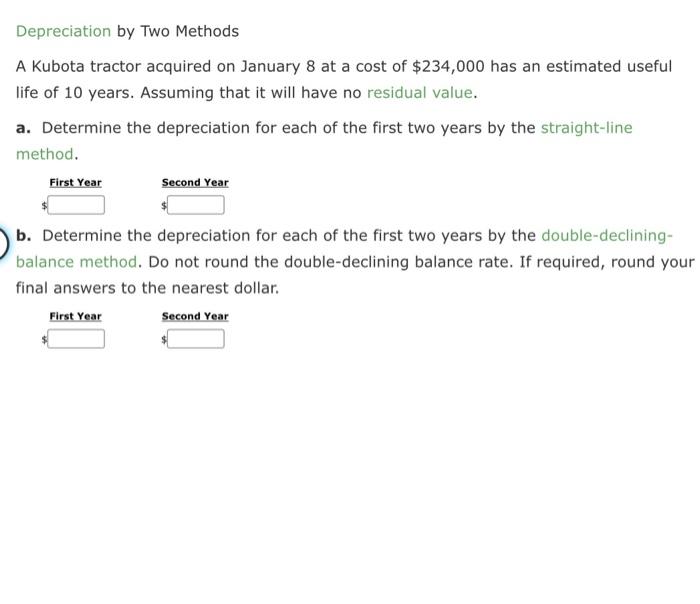

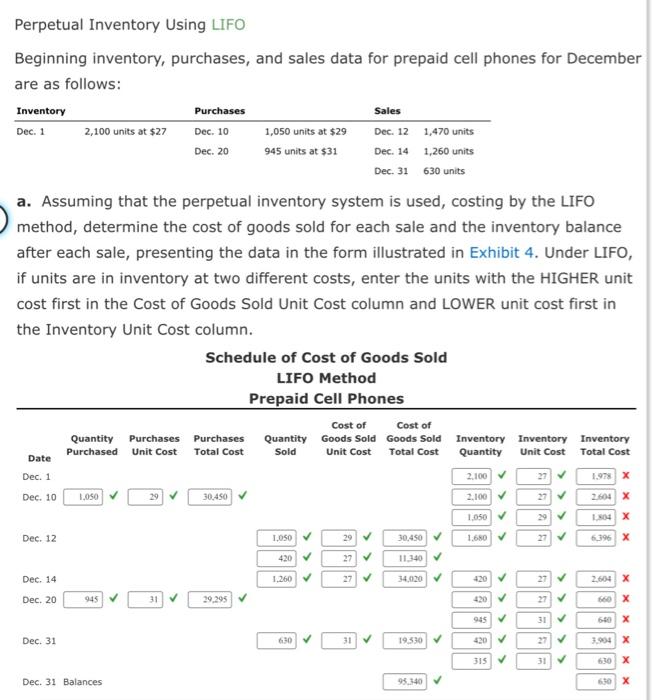

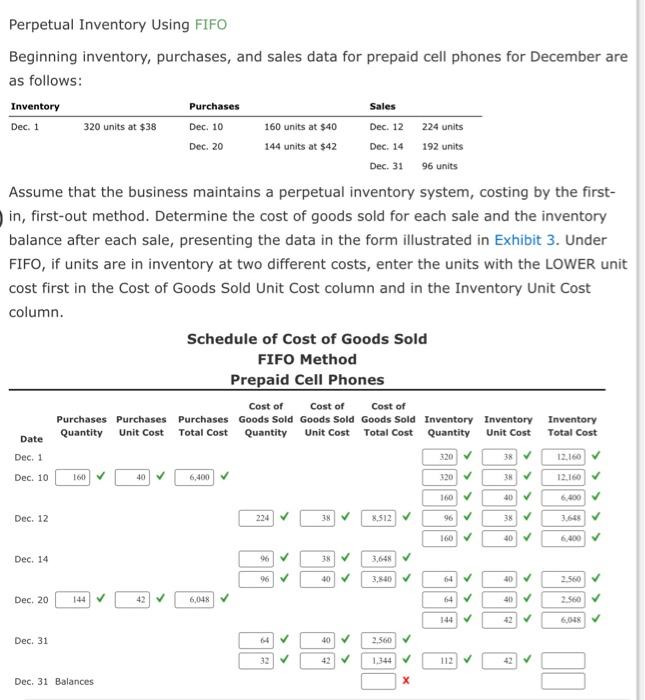

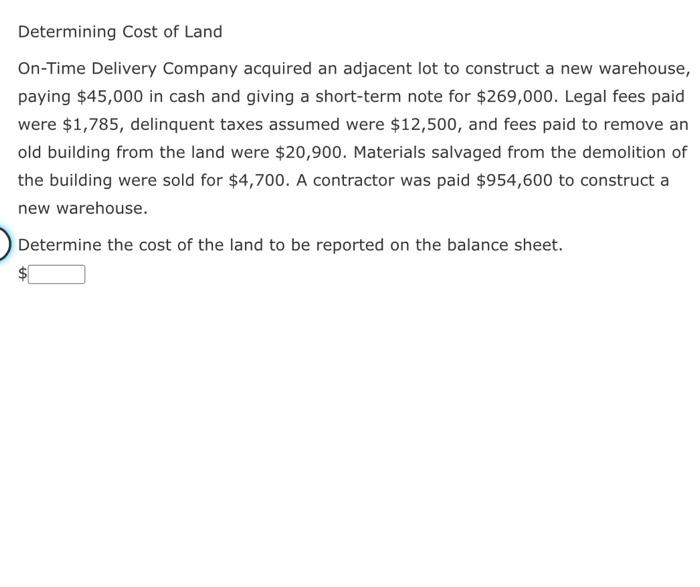

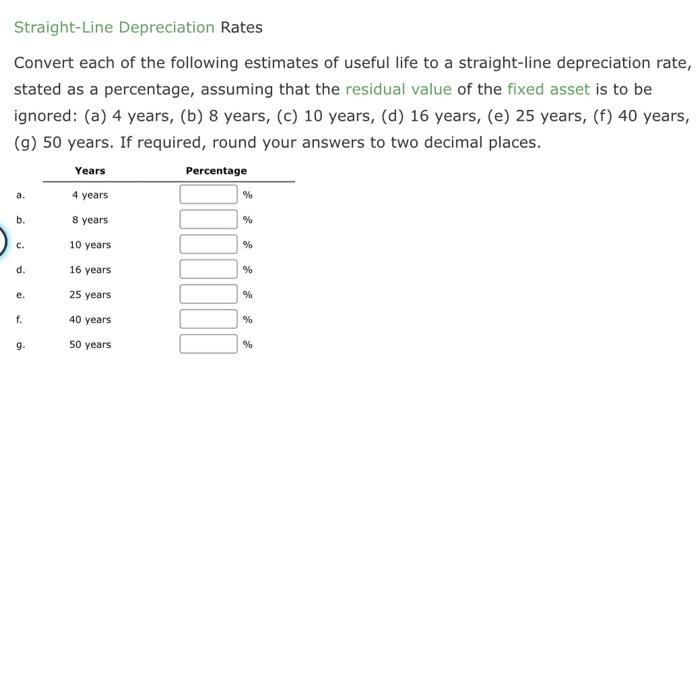

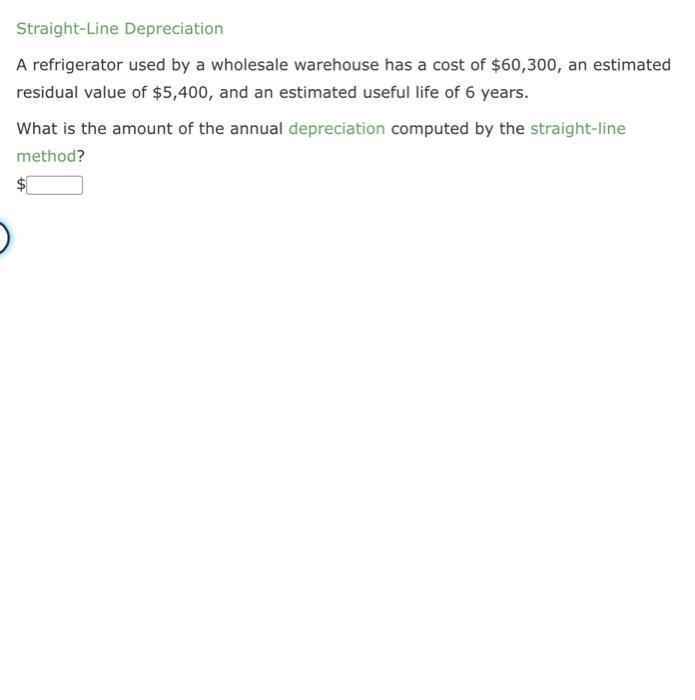

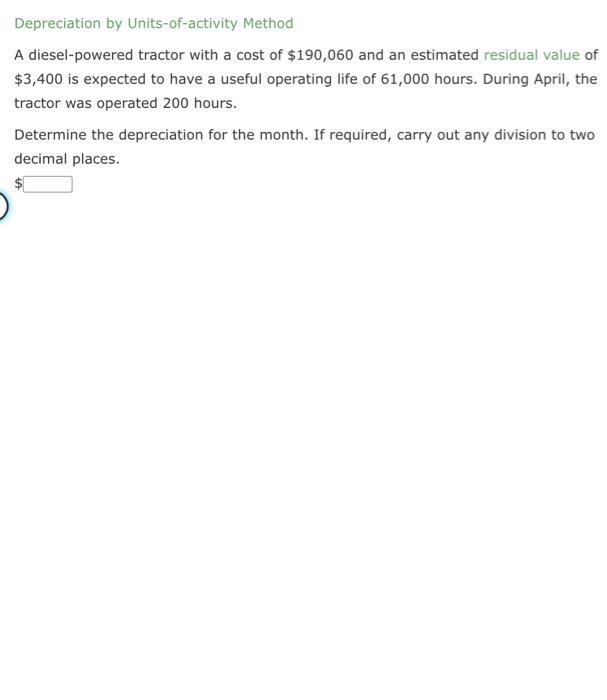

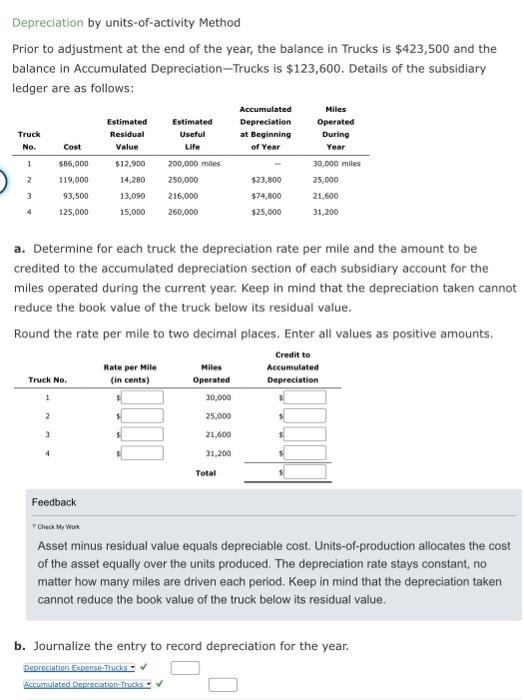

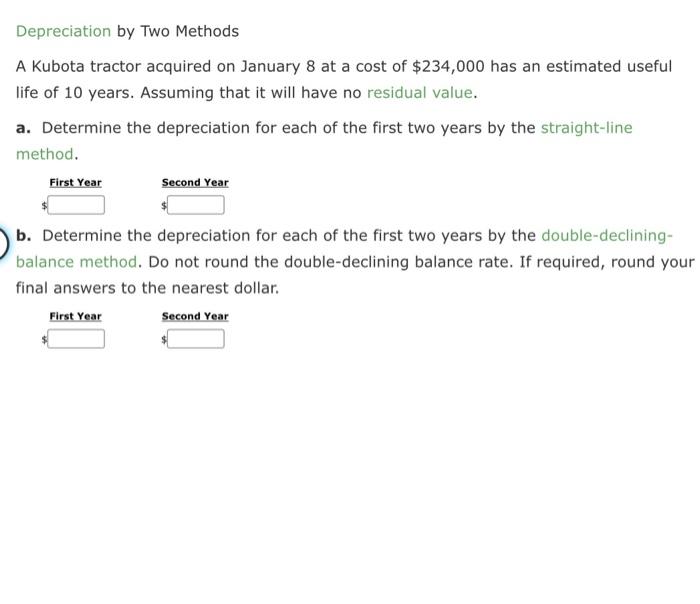

Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for prepaid cell phones for December are as follows: a. Assuming that the perpetual inventory system is used, costing by the LIFO method, determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales data for prepaid cell phones for December are as follows: Assume that the business maintains a perpetual inventory system, costing by the firstin, first-out method. Determine the cost of goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column. Determining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new warehouse, paying $45,000 in cash and giving a short-term note for $269,000. Legal fees paid were $1,785, delinquent taxes assumed were $12,500, and fees paid to remove an old building from the land were $20,900. Materials salvaged from the demolition of the building were sold for $4,700. A contractor was paid $954,600 to construct a new warehouse. Determine the cost of the land to be reported on the balance sheet. Straight-Line Depreciation Rates Convert each of the following estimates of useful life to a straight-line depreciation rate, stated as a percentage, assuming that the residual value of the fixed asset is to be ignored: (a) 4 years, (b) 8 years, (c) 10 years, (d) 16 years, (e) 25 years, (f) 40 years, (g) 50 years. If required, round your answers to two decimal places. Straight-Line Depreciation A refrigerator used by a wholesale warehouse has a cost of $60,300, an estimated residual value of $5,400, and an estimated useful life of 6 years. What is the amount of the annual depreciation computed by the straight-line method? Depreciation by Units-of-activity Method A diesel-powered tractor with a cost of $190,060 and an estimated residual value of $3,400 is expected to have a useful operating life of 61,000 hours. During April, the tractor was operated 200 hours. Determine the depreciation for the month. If required, carry out any division to two decimal places. Depreciation by units-of-activity Method Prior to adjustment at the end of the year, the balance in Trucks is $423,500 and the balance in Accumulated Depreciation-Trucks is $123,600. Details of the subsidiary ledger are as follows: a. Determine for each truck the depreciation rate per mile and the amount to be credited to the accumulated depreciation section of each subsidiary account for the miles operated during the current year. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. Round the rate per mile to two decimal places. Enter all values as positive amounts. Feedback FCheck. My Wok. Asset minus residual value equals depreciable cost. Units-of-production allocates the cost of the asset equally over the units produced. The depreciation rate stays constant, no matter how many miles are driven each period. Keep in mind that the depreciation taken cannot reduce the book value of the truck below its residual value. b. Journalize the entry to record depreciation for the year. Depreciation by Two Methods A Kubota tractor acquired on January 8 at a cost of $234,000 has an estimated useful life of 10 years. Assuming that it will have no residual value. a. Determine the depreciation for each of the first two years by the straight-line method. b. Determine the depreciation for each of the first two years by the double-decliningbalance method. Do not round the double-declining balance rate. If required, round your final answers to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started