need help solving 3) 4) and 5) using the following info

questions to solve below

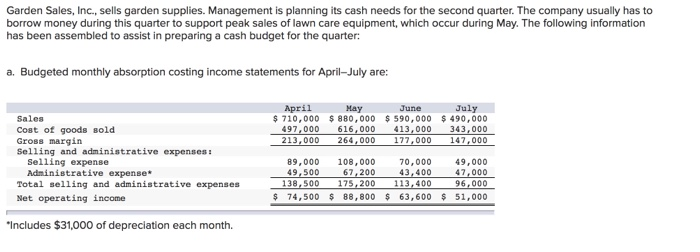

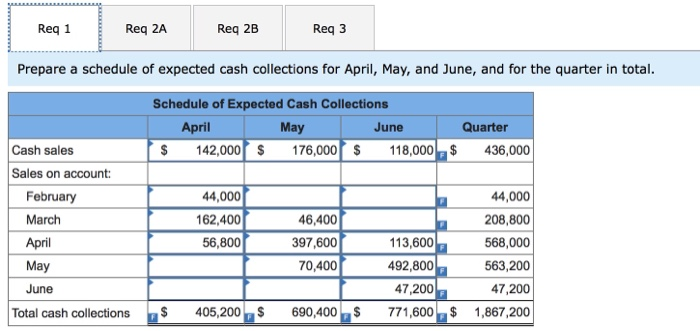

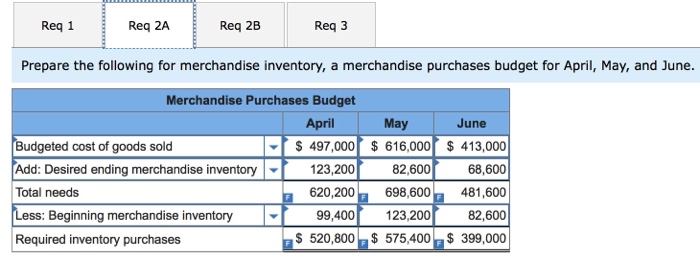

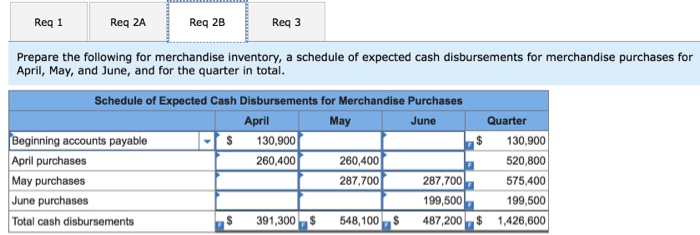

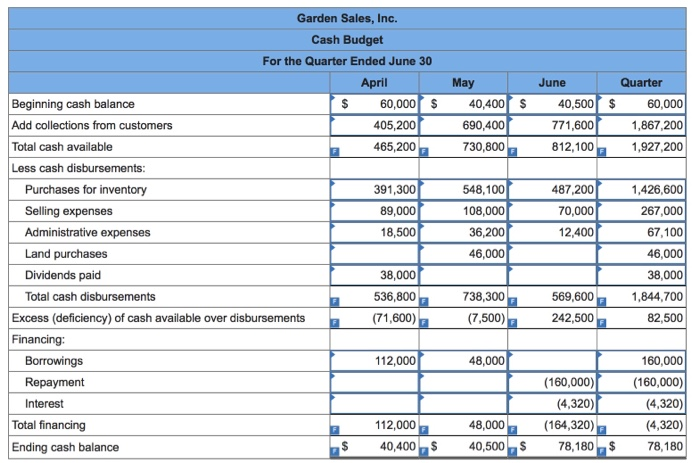

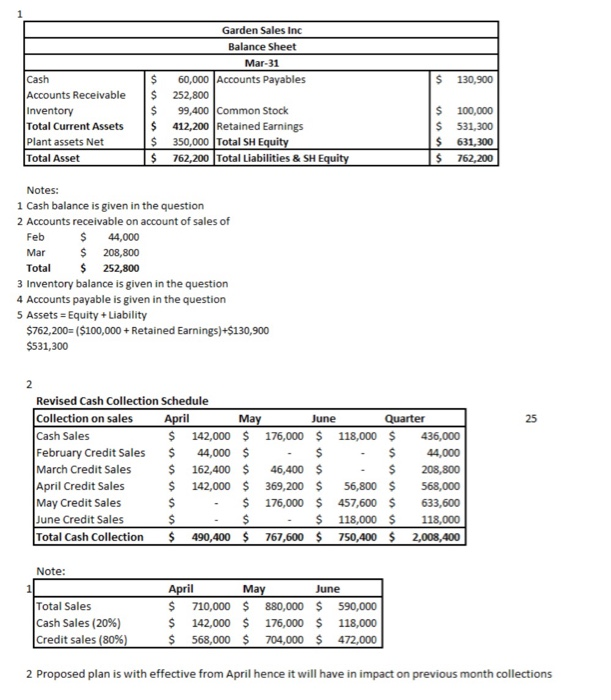

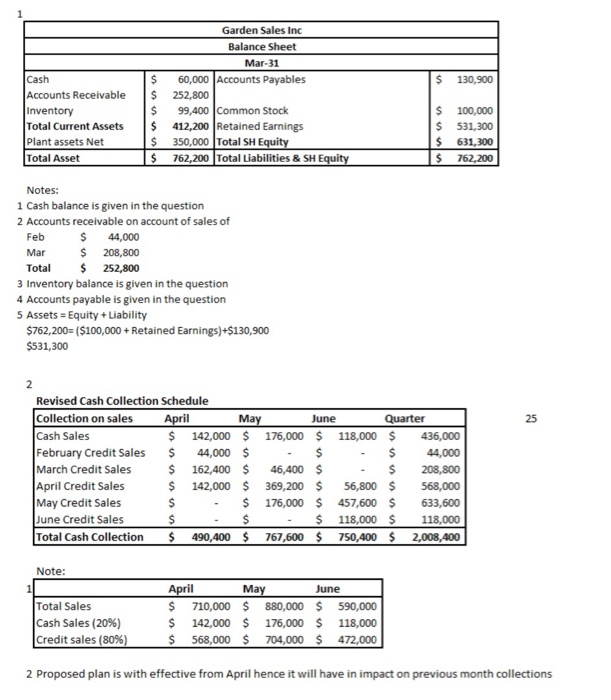

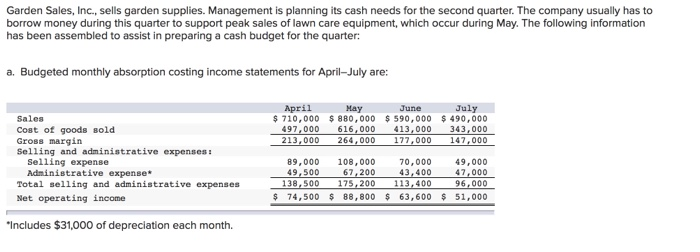

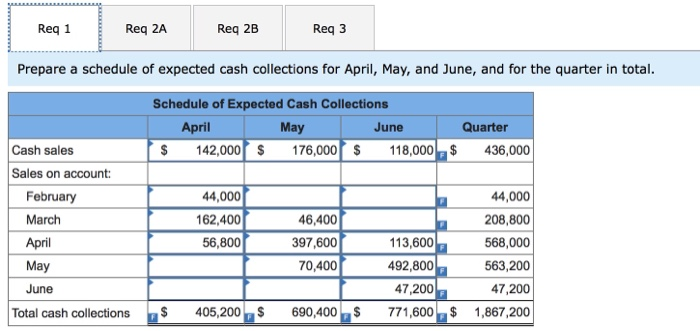

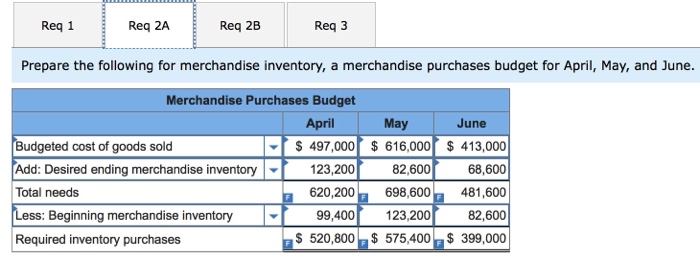

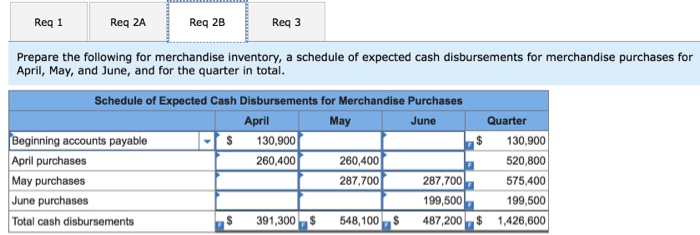

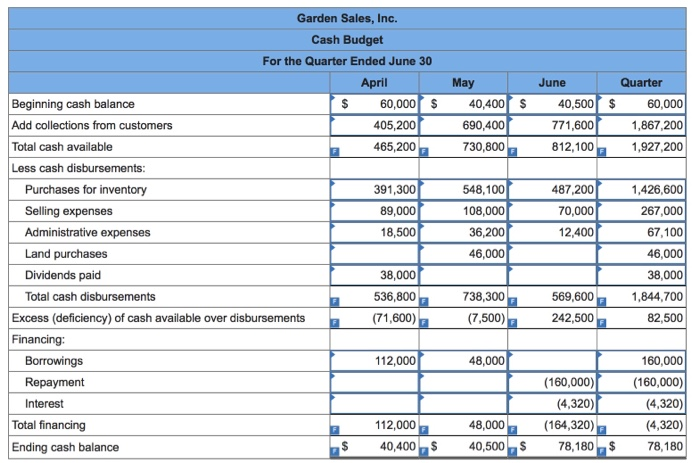

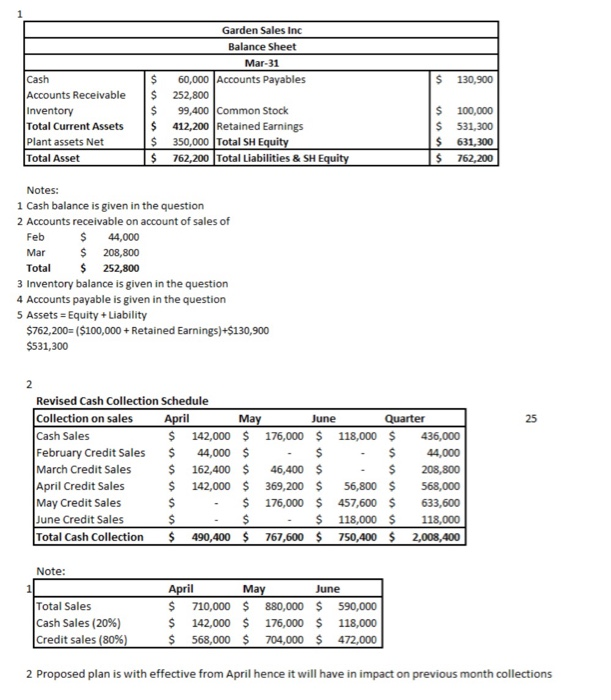

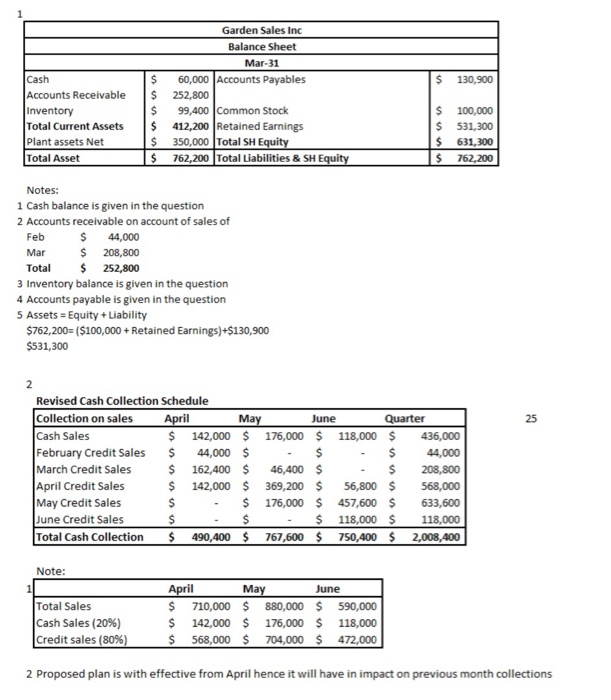

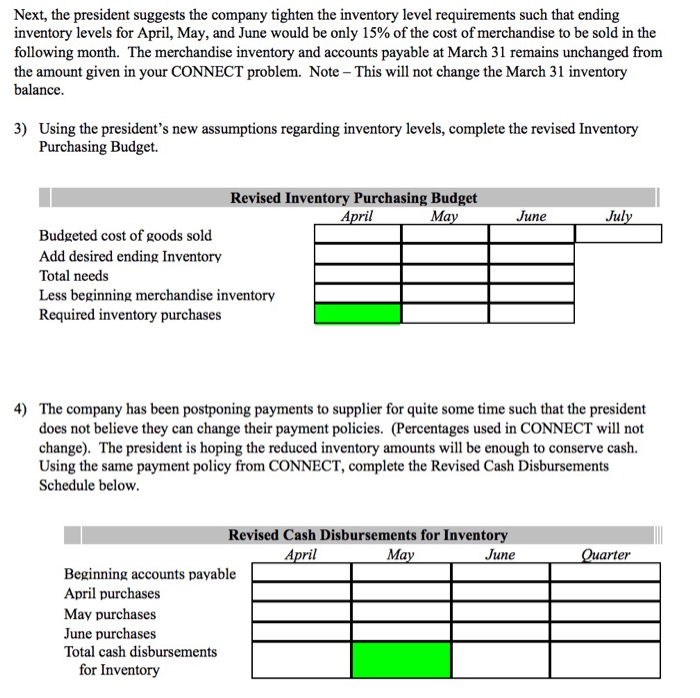

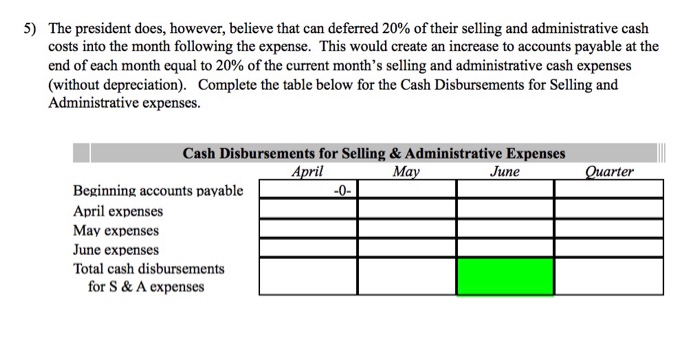

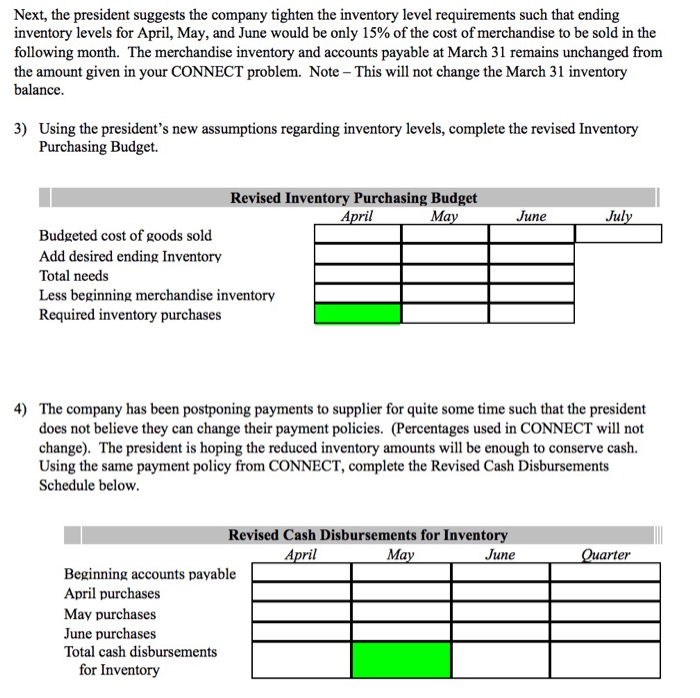

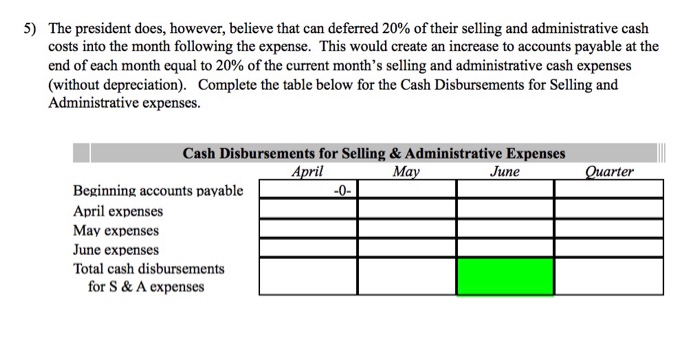

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: a. Budgeted monthly absorption costing income statements for April-July are: April May June July $ 710,000 $ 880,000 $ 590,000 $ 490,000 497,000 616,000 413,000 343,000 213,000 264,000 177,000 147,000 Sales Cost of goods sold Gross margin Selling and administrative expenses : Selling expense Administrative expense* Total selling and administrative expenses Net operating income 89,000 108,000 70,000 49,000 49,500 67,200 43,400 47,000 138,500 175,200 113,400 96,000 $ 74,500 $ 88,800 $ 63,600 $ 51,000 *Includes $31,000 of depreciation each month. Req 1 Req 2A Req 2B Req3 Prepare a schedule of expected cash collections for April, May, and June, and for the quarter in total. Schedule of Expected Cash Collections April May June Quarter $ 142,000 $ 176,000 $ 118,000 $ 436,000 Cash sales Sales on account: February March April May June Total cash collections 44,000 162,400 56,800 46,400 397,600 70,400 44,000 208,800 113,600 568,000 492,800 563,200 47,200 47,200 771,600$ 1,867,200 405,200 $ 690,400$ Req 1 Reg 2A Req 2B Req3 Prepare the following for merchandise inventory, a merchandise purchases budget for April, May, and June. Merchandise Purchases Budget April May June Budgeted cost of goods sold $ 497,000 $ 616,000 $ 413,000 Add: Desired ending merchandise inventory 123,2001 82,600 68,600 Total needs 620,200 698,600 481,600 Less: Beginning merchandise inventory 99,400 123,200 82,600 Required inventory purchases $ 520,800 $ 575,400$ 399,000 Reg 1 Req 2A Req 2B Req3 Prepare the following for merchandise inventory, a schedule of expected cash disbursements for merchandise purchases for April, May, and June, and for the quarter in total. Schedule of Expected Cash Disbursements for Merchandise Purchases April May June Quarter Beginning accounts payable 130,900 130,900 April purchases 260,400 260,400 520,800 May purchases 287,700 287,700 575,400 June purchases 199,500 199,500 Total cash disbursements 391,300 $ 548,100 $ 487,200 $ 1,426,600 May 40,400 $ 690,400 730,800 June Quarter 40,500 $ 60,000 771,600 1,867,200 812,100 1,927,200 Garden Sales, Inc. Cash Budget For the Quarter Ended June 30 April Beginning cash balance $ 60,000 $ Add collections from customers 405,200 Total cash available 465,200 Less cash disbursements: Purchases for inventory 391,300 Selling expenses 89,000 Administrative expenses 18,500 Land purchases Dividends paid 38,000 Total cash disbursements 536,800 Excess deficiency) of cash available over disbursements (71,600) Financing: Borrowings 112,000 Repayment Interest Total financing 112,000 Ending cash balance $ 40,400$ 548,100 108,000 36,200 46,000 487,200 70,000 12,400 1,426,600 267,000 67,100 46,000 38,000 1,844,700 82,500 738,300 (7,500) 569,600 242,500 48,000 (160,000) (4,320) (164,320) 78,180$ 160,000 (160,000) (4,320) (4,320) 78,180 48,000 40,500$ $ 130,900 Cash Accounts Receivable Inventory Total Current Assets Plant assets Net Total Asset Garden Sales Inc Balance Sheet Mar-31 $ 60,000 Accounts Payables $ 252,800 $ 99,400 Common Stock $ 412,200 Retained Earnings $ 350,000 Total SH Equity $ 762,200 Total Liabilities & SH Equity $ 100,000 531,300 631,300 762,200 $ $ Notes: 1 Cash balance is given in the question 2 Accounts receivable on account of sales of Feb $ 44,000 Mar $ 208,800 Total $ 252,800 3 Inventory balance is given in the question 4 Accounts payable is given in the question 5 Assets = Equity + Liability $762,200=($100,000 + Retained Earnings)+$130,900 $531,300 25 2 Revised Cash Collection Schedule Collection on sales April May June Quarter Cash Sales $ 142,000 $ 176,000 $ 118,000 $ 436,000 February Credit Sales $ 44,000 $ $ $ 44,000 March Credit Sales $ 162,400 $ 46,400 $ $ 208,800 April Credit Sales $ 142,000 $ 369,200 $ 56,800 $ 568,000 May Credit Sales $ $ 176,000 $ 457,600 $ 633,600 June Credit Sales $ $ $ 118,000 $ 118,000 Total Cash Collection $ 490,400 $ 767,600 $ 750,400 $ 2,008,400 Note: Total Sales Cash Sales (20%) Credit sales (80%) April May June $ 710,000 $ 880,000 $ 590,000 $ 142,000 $ 176,000 $ 118,000 $ 568,000 $ 704,000 $ 472,000 2 Proposed plan is with effective from April hence it will have in impact on previous month collections $ 130,900 Cash Accounts Receivable Inventory Total Current Assets Plant assets Net Total Asset Garden Sales Inc Balance Sheet Mar-31 $ 60,000 Accounts Payables $ 252,800 $ 99,400 Common Stock $ 412,200 Retained Earnings $ 350,000 Total SH Equity $ 762,200 Total Liabilities & SH Equity $ 100,000 531,300 631,300 762,200 $ $ Notes: 1 Cash balance is given in the question 2 Accounts receivable on account of sales of Feb $ 44,000 Mar $ 208,800 Total $ 252,800 3 Inventory balance is given in the question 4 Accounts payable is given in the question 5 Assets = Equity + Liability $762,200=($100,000 + Retained Earnings)+$130,900 $531,300 25 2 Revised Cash Collection Schedule Collection on sales April May June Quarter Cash Sales $ 142,000 $ 176,000 $ 118,000 $ 436,000 February Credit Sales $ 44,000 $ $ $ 44,000 March Credit Sales $ 162,400 $ 46,400 $ $ 208,800 April Credit Sales $ 142,000 $ 369,200 $ 56,800 $ 568,000 May Credit Sales $ $ 176,000 $ 457,600 $ 633,600 June Credit Sales $ $ $ 118,000 $ 118,000 Total Cash Collection $ 490,400 $ 767,600 $ 750,400 $ 2,008,400 Note: Total Sales Cash Sales (20%) Credit sales (80%) April May June $ 710,000 $ 880,000 $ 590,000 $ 142,000 $ 176,000 $ 118,000 $ 568,000 $ 704,000 $ 472,000 2 Proposed plan is with effective from April hence it will have in impact on previous month collections Next, the president suggests the company tighten the inventory level requirements such that ending inventory levels for April, May, and June would be only 15% of the cost of merchandise to be sold in the following month. The merchandise inventory and accounts payable at March 31 remains unchanged from the amount given in your CONNECT problem. Note - This will not change the March 31 inventory balance. 3) Using the president's new assumptions regarding inventory levels, complete the revised Inventory Purchasing Budget June July Revised Inventory Purchasing Budget April May Budgeted cost of goods sold Add desired ending Inventory Total needs Less beginning merchandise inventory Required inventory purchases 4) The company has been postponing payments to supplier for quite some time such that the president does not believe they can change their payment policies. (Percentages used in CONNECT will not change). The president is hoping the reduced inventory amounts will be enough to conserve cash. Using the same payment policy from CONNECT, complete the Revised Cash Disbursements Schedule below. Quarter Revised Cash Disbursements for Inventory April May June Beginning accounts payable April purchases May purchases June purchases Total cash disbursements for Inventory 5) The president does, however, believe that can deferred 20% of their selling and administrative cash costs into the month following the expense. This would create an increase to accounts payable at the end of each month equal to 20% of the current month's selling and administrative cash expenses (without depreciation). Complete the table below for the Cash Disbursements for Selling and Administrative expenses. Quarter Cash Disbursements for Selling & Administrative Expenses April May June Beginning accounts payable -0- April expenses May expenses June expenses Total cash disbursements for S & A expenses