Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help solving this probelm pls help. Financial Work. Need help on the following problems. Show how you solve problems (e.g., draw a diagram that

Need help solving this probelm pls help. Financial Work. Need help on the following problems.

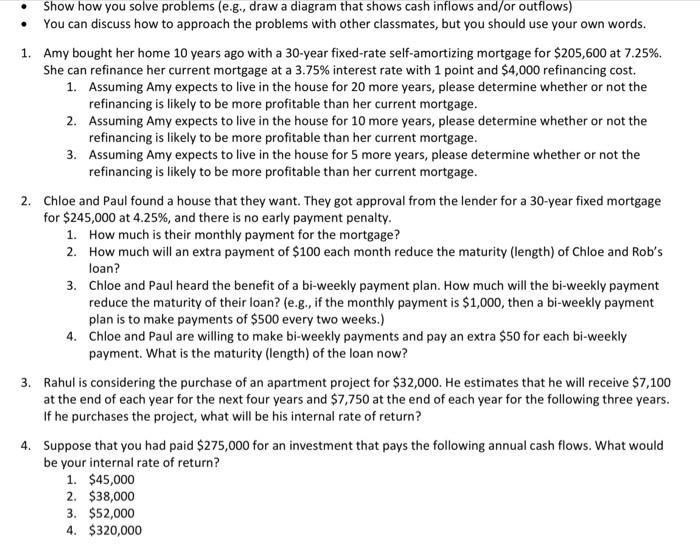

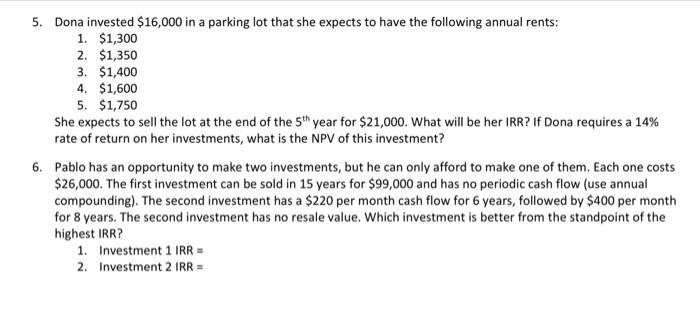

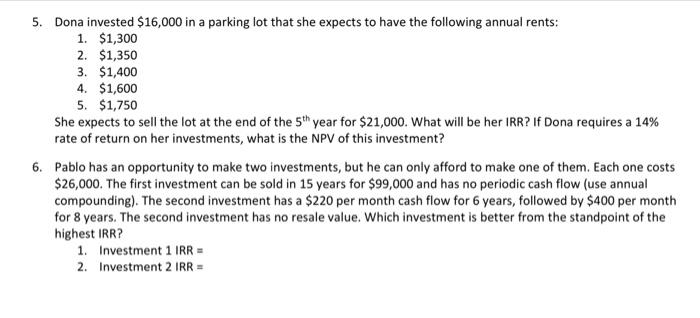

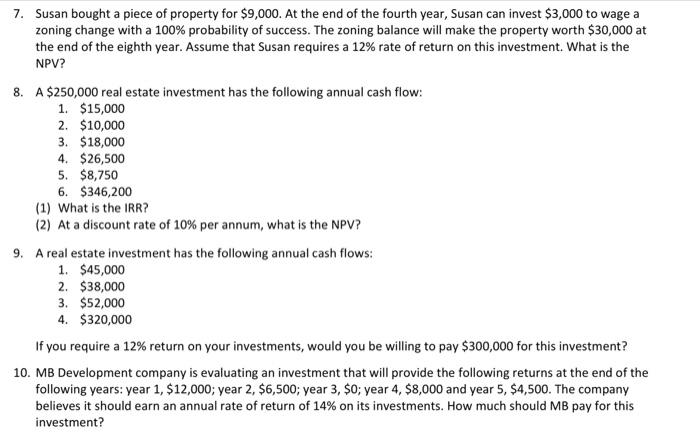

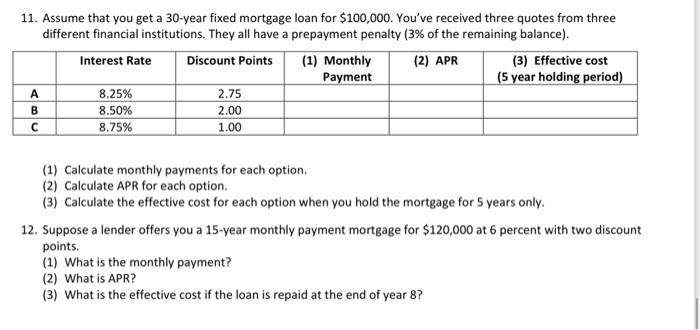

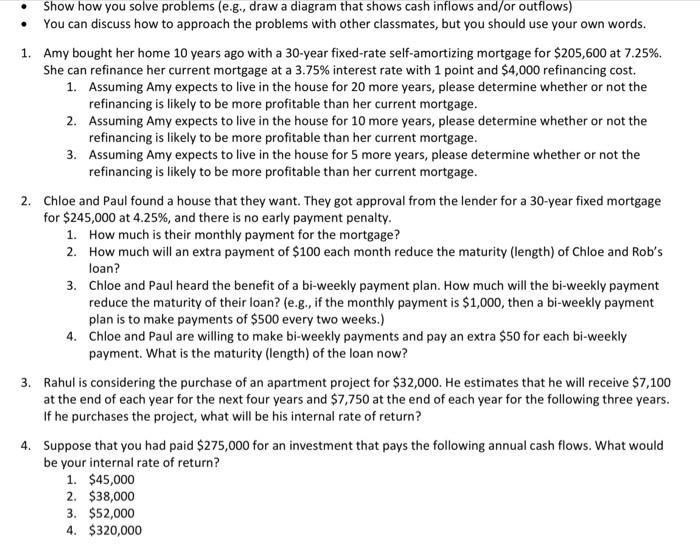

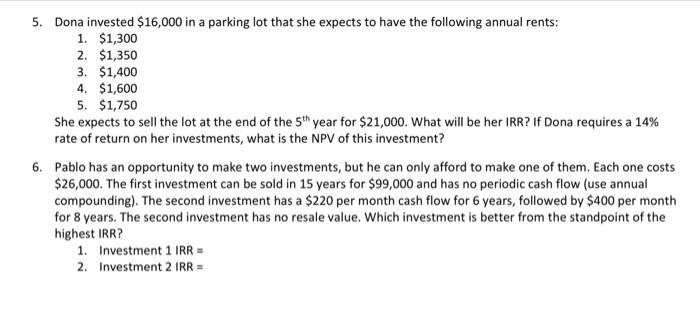

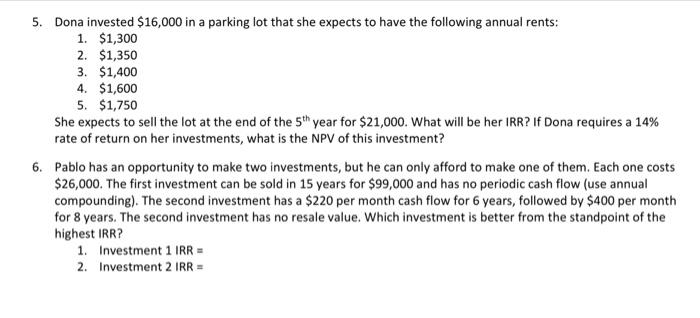

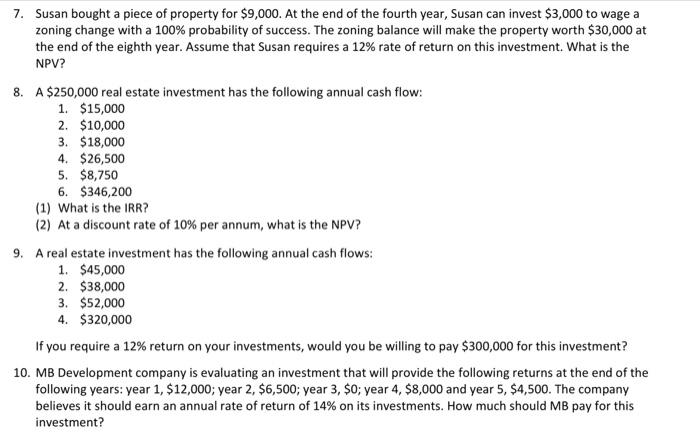

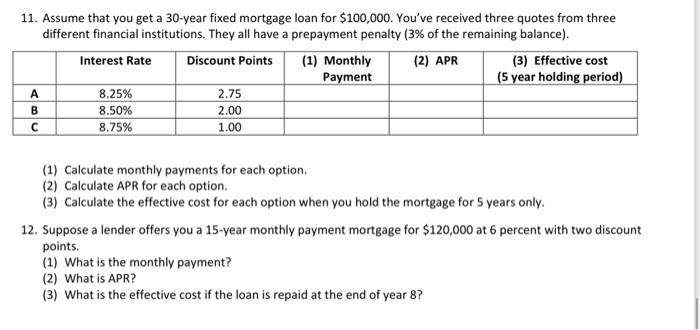

Show how you solve problems (e.g., draw a diagram that shows cash inflows and/or outflows) You can discuss how to approach the problems with other classmates, but you should use your own words. 1. Amy bought her home 10 years ago with a 30-year fixed-rate self-amortizing mortgage for $205,600 at 7.25%. She can refinance her current mortgage at a 3.75% interest rate with 1 point and $4,000 refinancing cost. 1. Assuming Amy expects to live in the house for 20 more years, please determine whether or not the refinancing is likely to be more profitable than her current mortgage. 2. Assuming Amy expects to live in the house for 10 more years, please determine whether or not the refinancing is likely to be more profitable than her current mortgage. 3. Assuming Amy expects to live in the house for 5 more years, please determine whether or not the refinancing is likely to be more profitable than her current mortgage. 2. Chloe and Paul found a house that they want. They got approval from the lender for a 30-year fixed mortgage for $245,000 at 4.25%, and there is no early payment penalty. 1. How much is their monthly payment for the mortgage? 2. How much will an extra payment of $100 each month reduce the maturity (length) of Chloe and Rob's loan? 3. Chloe and Paul heard the benefit of a bi-weekly payment plan. How much will the bi-weekly payment reduce the maturity of their loan? (e.g., if the monthly payment is $1,000, then a bi-weekly payment plan is to make payments of $500 every two weeks.) 4. Chloe and Paul are willing to make bi-weekly payments and pay an extra $50 for each bi-weekly payment. What is the maturity (length) of the loan now? 3. Rahul is considering the purchase of an apartment project for $32,000. He estimates that he will receive $7,100 at the end of each year for the next four years and $7,750 at the end of each year for the following three years. If he purchases the project, what will be his internal rate of return? 4. Suppose that you had paid $275,000 for an investment that pays the following annual cash flows. What would be your internal rate of return? 1. $45,000 2. $38,000 3. $52,000 4. $320,000 5. Dona invested $16,000 in a parking lot that she expects to have the following annual rents: 1. $1,300 2. $1,350 3. $1,400 4. $1,600 5. $1,750 She expects to sell the lot at the end of the 5th year for $21,000. What will be her IRR? If Dona requires a 14% rate of return on her investments, what is the NPV of this investment? 6. Pablo has an opportunity to make two investments, but he can only afford to make one of them. Each one costs $26,000. The first investment can be sold in 15 years for $99,000 and has no periodic cash flow (use annual compounding). The second investment has a $220 per month cash flow for 6 years, followed by $400 per month for 8 years. The second investment has no resale value. Which investment is better from the standpoint of the highest IRR? 1. Investment 1 IRR 2. Investment 2 IRR = 5. Dona invested $16,000 in a parking lot that she expects to have the following annual rents: 1. $1,300 2. $1,350 3. $1,400 4. $1,600 5. $1,750 She expects to sell the lot at the end of the 5th year for $21,000. What will be her IRR? If Dona requires a 14% rate of return on her investments, what is the NPV of this investment? 6. Pablo has an opportunity to make two investments, but he can only afford to make one of them. Each one costs $26,000. The first investment can be sold in 15 years for $99,000 and has no periodic cash flow (use annual compounding). The second investment has a $220 per month cash flow for 6 years, followed by $400 per month for 8 years. The second investment has no resale value. Which investment is better from the standpoint of the highest IRR? 1. Investment 1 IRR 2. Investment 2 IRR = 7. Susan bought a piece of property for $9,000. At the end of the fourth year, Susan can invest $3,000 to wage a zoning change with a 100% probability of success. The zoning balance will make the property worth $30,000 at the end of the eighth year. Assume that Susan requires a 12% rate of return on this investment. What is the NPV? 8. A $250,000 real estate investment has the following annual cash flow: 1. $15,000 2. $10,000 3. $18,000 4. $26,500 5. $8,750 6. $346,200 (1) What is the IRR? (2) At a discount rate of 10% per annum, what is the NPV? 9. A real estate investment has the following annual cash flows: 1. $45,000 2. $38,000 3. $52,000 4. $320,000 If you require a 12% return on your investments, would you be willing to pay $300,000 for this investment? 10. MB Development company is evaluating an investment that will provide the following returns at the end of the following years: year 1, $12,000; year 2, $6,500; year 3, $0; year 4, $8,000 and year 5, $4,500. The company believes it should earn an annual rate of return of 14% on its investments. How much should MB pay for this investment? 11. Assume that you get a 30-year fixed mortgage loan for $100,000. You've received three quotes from three different financial institutions. They all have a prepayment penalty (3% of the remaining balance). Interest Rate Discount Points (1) Monthly (2) APR (3) Effective cost Payment (5 year holding period) 8.25% 2.75 8.50% 8.75% 1.00 > A 2.00 B (1) Calculate monthly payments for each option. (2) Calculate APR for each option. (3) Calculate the effective cost for each option when you hold the mortgage for 5 years only. 12. Suppose a lender offers you a 15-year monthly payment mortgage for $120,000 at 6 percent with two discount points. (1) What is the monthly payment? (2) What is APR? (3) What is the effective cost if the loan is repaid at the end of year 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started