Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help thank youuu so much!! 1. Definitions account classifications: Assets, Liabilities, Capital, Drawing, Revenue and Expense 2. Definition the three financial statements-Income Statement, Balance

need help thank youuu so much!!

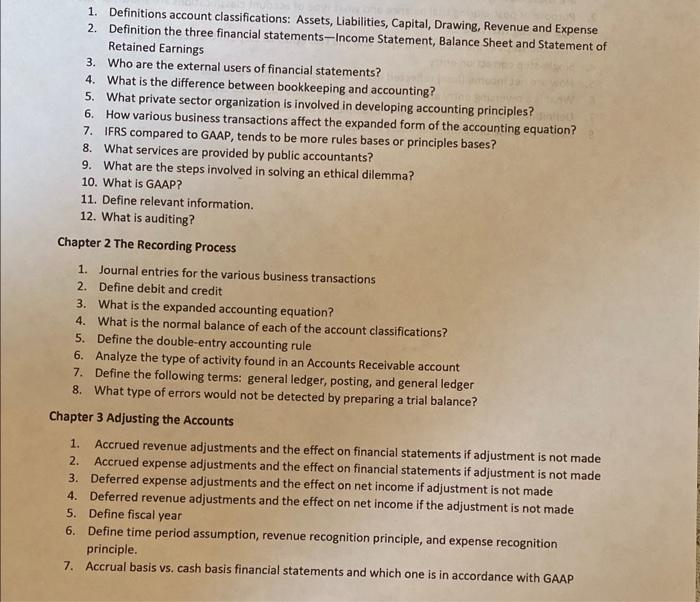

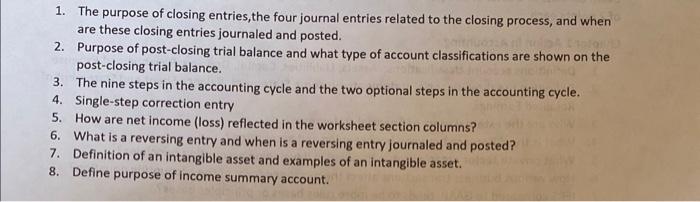

1. Definitions account classifications: Assets, Liabilities, Capital, Drawing, Revenue and Expense 2. Definition the three financial statements-Income Statement, Balance Sheet and Statement of Retained Earnings 3. Who are the external users of financial statements? 4. What is the difference between bookkeeping and accounting? 5. What private sector organization is involved in developing accounting principles? 6. How various business transactions affect the expanded form of the accounting equation? 7. IFRS compared to GAAP, tends to be more rules bases or principles bases? 8. What services are provided by public accountants? 9. What are the steps involved in solving an ethical dilemma? 10. What is GAAP? 11. Define relevant information. 12. What is auditing? Chapter 2 The Recording Process 1. Journal entries for the various business transactions 2. Define debit and credit 3. What is the expanded accounting equation? 4. What is the normal balance of each of the account classifications? 5. Define the double-entry accounting rule 6. Analyze the type of activity found in an Accounts Receivable account 7. Define the following terms: general ledger, posting, and general ledger 8. What type of errors would not be detected by preparing a trial balance? Chapter 3 Adjusting the Accounts 1. Accrued revenue adjustments and the effect on financial statements if adjustment is not made 2. Accrued expense adjustments and the effect on financial statements if adjustment is not made 3. Deferred expense adjustments and the effect on net income if adjustment is not made 4. Deferred revenue adjustments and the effect on net income if the adjustment is not made 5. Define fiscal year 6. Define time period assumption, revenue recognition principle, and expense recognition principle. 7. Accrual basis vs. cash basis financial statements and which one is in accordance with GAAP 1. The purpose of closing entries, the four journal entries related to the closing process, and when are these closing entries journaled and posted. 2. Purpose of post-closing trial balance and what type of account classifications are shown on the post-closing trial balance. 3. The nine steps in the accounting cycle and the two optional steps in the accounting cycle. 4. Single-step correction entry 5. How are net income (loss) reflected in the worksheet section columns? 6. What is a reversing entry and when is a reversing entry journaled and posted? 7. Definition of an intangible asset and examples of an intangible asset. 8. Define purpose of income summary account. 1. Definitions account classifications: Assets, Liabilities, Capital, Drawing, Revenue and Expense 2. Definition the three financial statements-Income Statement, Balance Sheet and Statement of Retained Earnings 3. Who are the external users of financial statements? 4. What is the difference between bookkeeping and accounting? 5. What private sector organization is involved in developing accounting principles? 6. How various business transactions affect the expanded form of the accounting equation? 7. IFRS compared to GAAP, tends to be more rules bases or principles bases? 8. What services are provided by public accountants? 9. What are the steps involved in solving an ethical dilemma? 10. What is GAAP? 11. Define relevant information. 12. What is auditing? Chapter 2 The Recording Process 1. Journal entries for the various business transactions 2. Define debit and credit 3. What is the expanded accounting equation? 4. What is the normal balance of each of the account classifications? 5. Define the double-entry accounting rule 6. Analyze the type of activity found in an Accounts Receivable account 7. Define the following terms: general ledger, posting, and general ledger 8. What type of errors would not be detected by preparing a trial balance? Chapter 3 Adjusting the Accounts 1. Accrued revenue adjustments and the effect on financial statements if adjustment is not made 2. Accrued expense adjustments and the effect on financial statements if adjustment is not made 3. Deferred expense adjustments and the effect on net income if adjustment is not made 4. Deferred revenue adjustments and the effect on net income if the adjustment is not made 5. Define fiscal year 6. Define time period assumption, revenue recognition principle, and expense recognition principle. 7. Accrual basis vs. cash basis financial statements and which one is in accordance with GAAP 1. The purpose of closing entries, the four journal entries related to the closing process, and when are these closing entries journaled and posted. 2. Purpose of post-closing trial balance and what type of account classifications are shown on the post-closing trial balance. 3. The nine steps in the accounting cycle and the two optional steps in the accounting cycle. 4. Single-step correction entry 5. How are net income (loss) reflected in the worksheet section columns? 6. What is a reversing entry and when is a reversing entry journaled and posted? 7. Definition of an intangible asset and examples of an intangible asset. 8. Define purpose of income summary account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started