Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Help The cash conversion cycle is the length of time between the firm's actual cash expenditure to pay for productive resources and its cash

Need Help

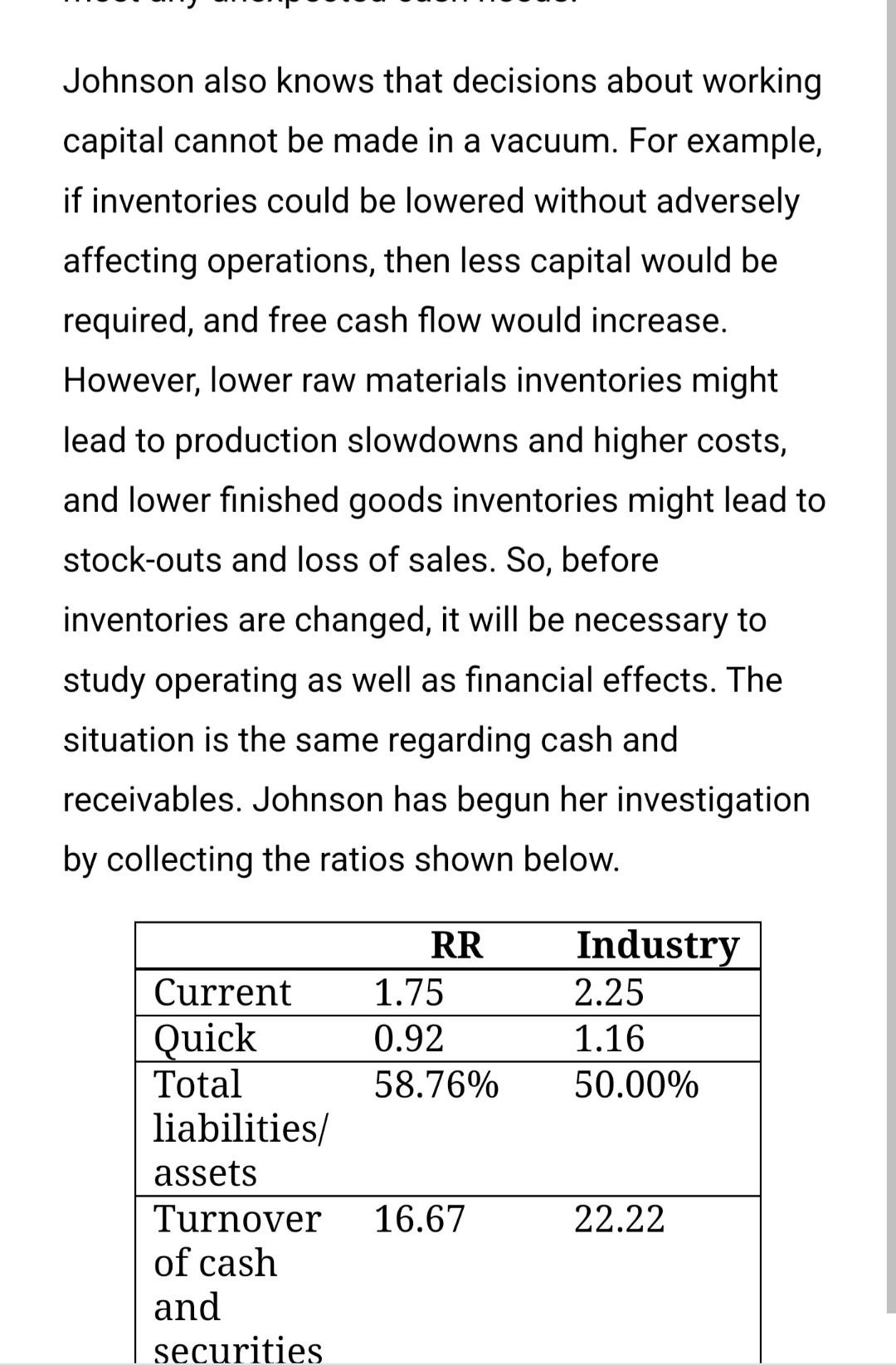

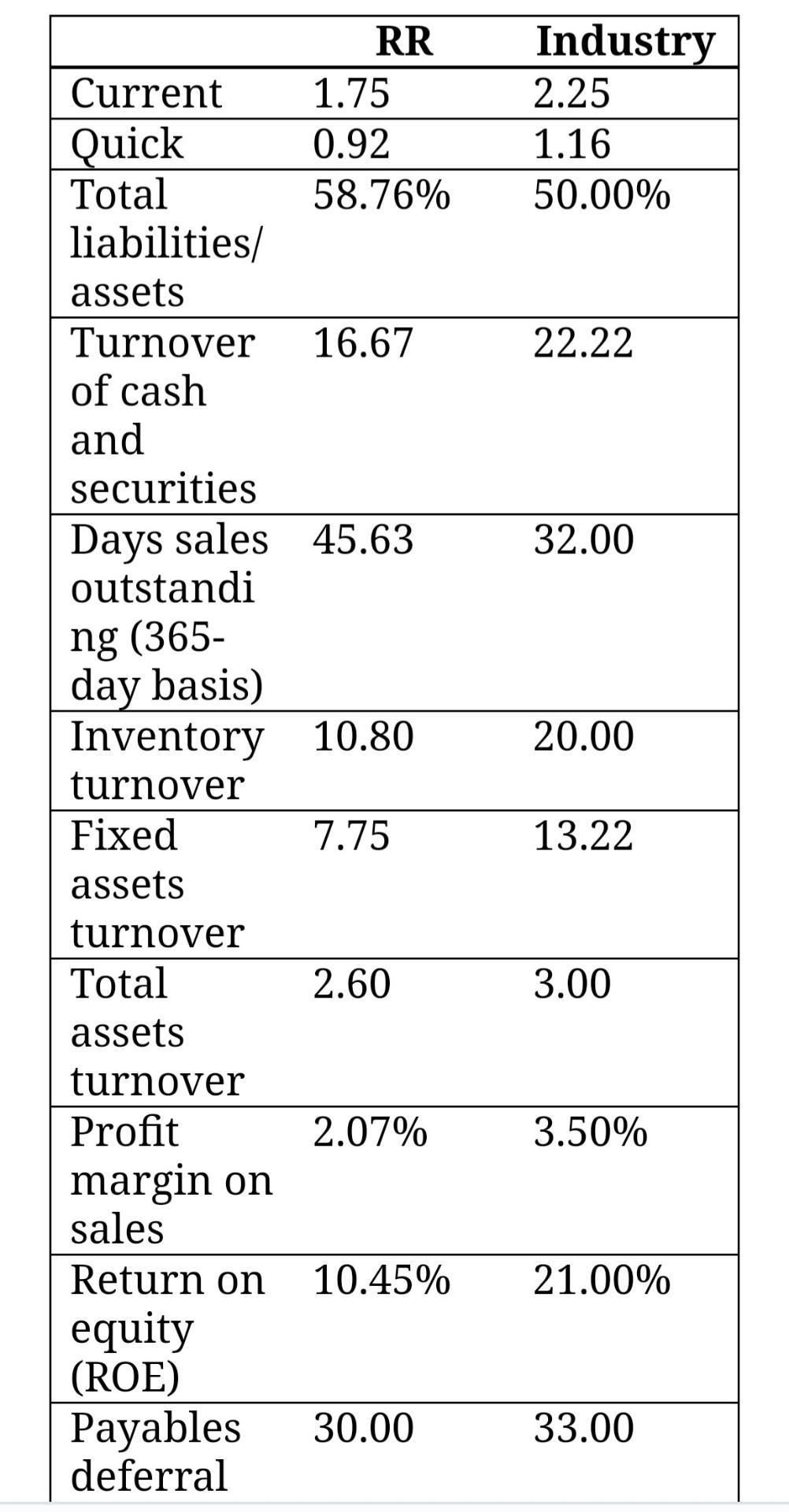

The cash conversion cycle is the length of time between the firm's actual cash expenditure to pay for productive resources and its cash receipts from the sale of products. A cash budget shows the projected cash inflows and outflows over a period of time and is used to predict surpluses and deficits. The primary goal of cash management is to minimize the amount of cash the firm must hold for conducting its normal business activities while at the same time maintaining a sufficient cash reserve to take discounts, pay bills promptly, and meet any unexpected cash needs. Johnson also knows that decisions about working capital cannot be made in a vacuum. For example, if inventories could be lowered without adversely affecting operations, then less capital would be required, and free cash flow would increase. However, lower raw materials inventories might lead to production slowdowns and higher costs, and lower finished goods inventories might lead to Johnson also knows that decisions about working capital cannot be made in a vacuum. For example, if inventories could be lowered without adversely affecting operations, then less capital would be required, and free cash flow would increase. However, lower raw materials inventories might lead to production slowdowns and higher costs, and lower finished goods inventories might lead to stock-outs and loss of sales. So, before inventories are changed, it will be necessary to study operating as well as financial effects. The situation is the same regarding cash and receivables. Johnson has begun her investigation \begin{tabular}{|lll|} \hline & \multicolumn{1}{|c}{ RR } & Industry \\ \hline Current & 1.75 & 2.25 \\ \hline Quick & 0.92 & 1.16 \\ \hline Totalliabilities/assets & 58.76% & 50.00% \\ \hline Turnoverofcashandsecurities & 16.67 & 22.22 \\ \hline Dayssalesoutstanding(365-daybasis) & 45.63 & 32.00 \\ \hline Inventoryturnover & 10.80 & 20.00 \\ \hline Fixedassetsturnover & 7.75 & 13.22 \\ \hline Totalassetsturnover & 2.60 & 3.00 \\ \hline Profitmarginonsales & 2.07% & 3.50% \\ \hline Returnonequity(ROE) & 10.45% & 21.00% \\ \hline Payablesdeferral & 30.00 & 33.00 \\ \hline \end{tabular} 1. Johnson plans to use the preceding, ratios as the starting point for discussions with RR's operating team. Based on the data, does RR seem to be following a relaxed, moderate, or restricted current asset usage policy. 2. How can one distinguish between a relaxec but rational working capital policy and a 1. Johnson plans to use the preceding, ratios as the starting point for discussions with RR's operating team. Based on the data, does RR seem to be following a relaxed, moderate, or restricted current asset usage policy. 2. How can one distinguish between a relaxed but rational working capital policy and a situation in which a firm simply has excessive current assets because it is inefficient? Does RR's working capital policy seem appropriate? 3. Calculate the firm's cash conversion cycle given annual sales are $660,000 and cost of goods representing 80% of sales. Assume a 365-day year 4. Is there any reason to think that RR may be holding too much inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started