Answered step by step

Verified Expert Solution

Question

1 Approved Answer

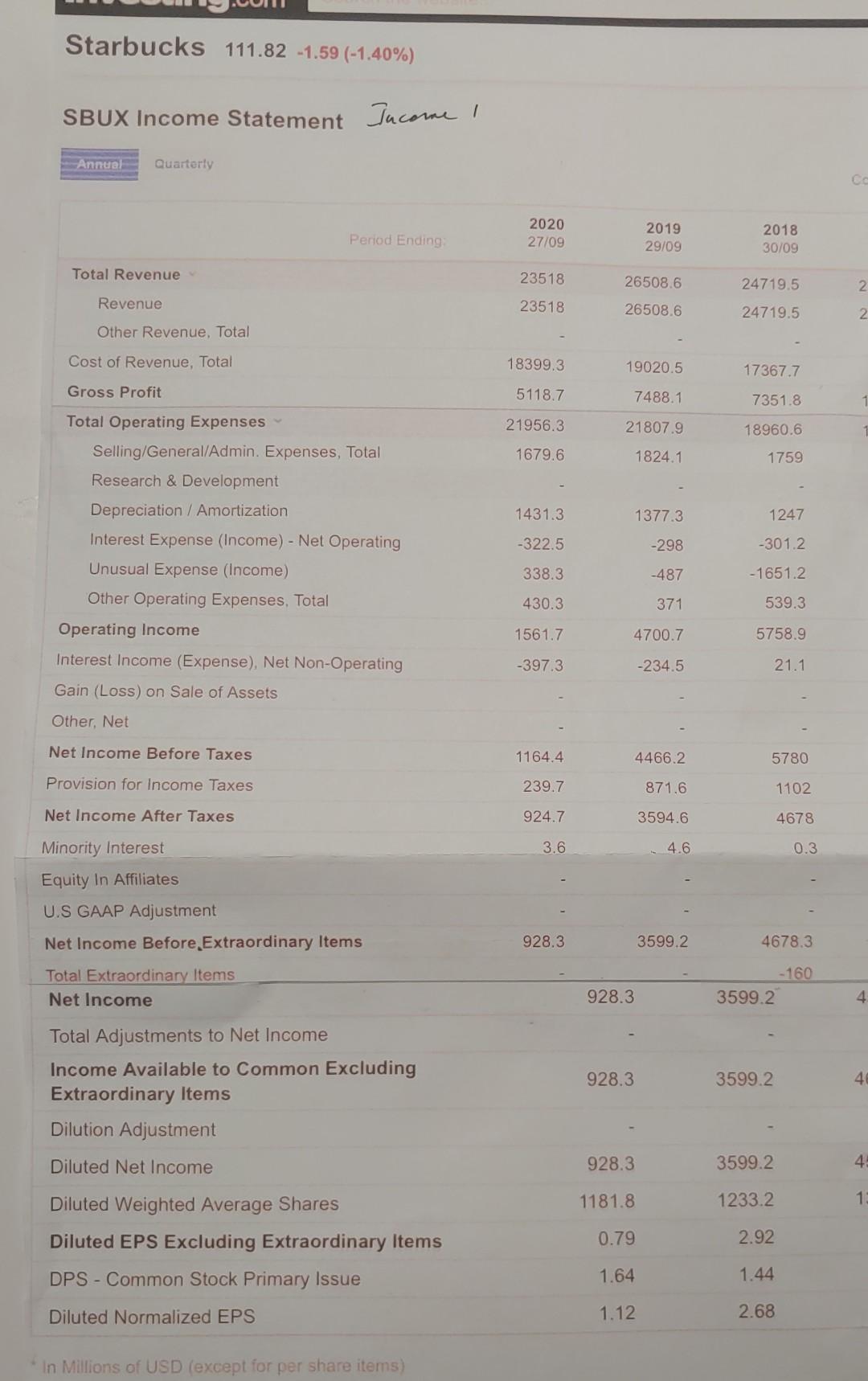

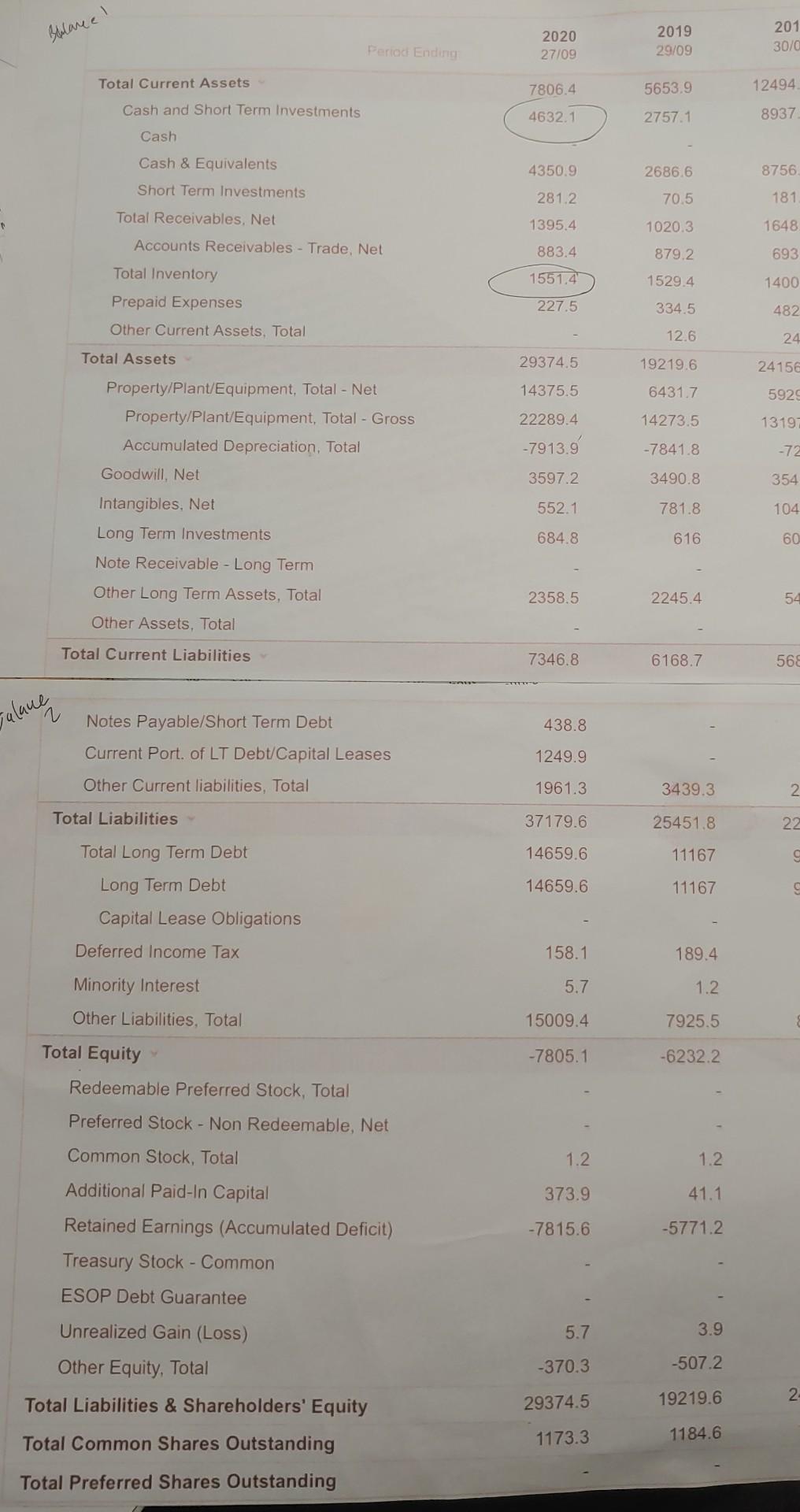

need help trying to figure out free cash flow for the attached income statement and balance sheet Starbucks 111.82 -1.59 (-1.40%) SBUX Income Statement Jucome

need help trying to figure out free cash flow for the attached income statement and balance sheet

Starbucks 111.82 -1.59 (-1.40%) SBUX Income Statement Jucome ! Annual Quarterly Period Ending 2020 27/09 2019 29/09 2018 30/09 Total Revenue 23518 26508.6 24719.5 2 Revenue 23518 26508.6 24719.5 2. Other Revenue. Total Cost of Revenue, Total 18399.3 19020.5 17367.7 Gross Profit 5118.7 7488.1 7351.8 21956.3 21807.9 18960.6 1679.6 1824.1 1759 1431.3 1377.3 1247 -322.5 -298 -301.2 Total Operating Expenses Selling/General/Admin. Expenses, Total Research & Development Depreciation / Amortization Interest Expense (Income) - Net Operating Unusual Expense (Income) Other Operating Expenses. Total Operating Income Interest Income (Expense), Net Non-Operating Gain (Loss) on Sale of Assets Other, Net 338.3 -487 -1651.2 430.3 371 539.3 1561.7 4700.7 5758.9 -397.3 -234.5 21.1 Net Income Before Taxes 1164.4 4466.2 5780 Provision for Income Taxes 239.7 871.6 1102 Net Income After Taxes 924.7 3594.6 4678 3.6 4.6 0.3 Minority Interest Equity In Affiliates U.S GAAP Adjustment Net Income Before Extraordinary Items 928.3 3599.2 4678.3 Total Extraordinary Items Net Income - 160 3599.2 928.3 4 Total Adjustments to Net Income Income Available to Common Excluding Extraordinary Items Dilution Adjustment 928.3 3599.2 4 Diluted Net Income 928.3 3599.2 4. 1181.8 1233.2 1 Diluted Weighted Average Shares Diluted EPS Excluding Extraordinary Items DPS - Common Stock Primary Issue 0.79 2.92 1.64 1.44 Diluted Normalized EPS 1.12 2.68 In Millions of USD (except for per share items) Beelance! 2020 27/09 2019 29/09 201 30/0 Period Ending Total Current Assets 7806.4 5653.9 12494 Cash and Short Term Investments 4632.1 2757.1 8937 Cash Cash & Equivalents Short Term Investments 4350.9 2686.6 8756 281.2 70.5 181 Total Receivables, Net 1395.4 1020.3 1648 Accounts Receivables - Trade, Net 883.4 879.2. 693 Total Inventory 1551.4 1529.4 1400 Prepaid Expenses 227.5 334.5 482 Other Current Assets, Total 12.6 24 Total Assets 29374.5 19219.6 24156 14375.5 6431.7 5929 22289.4 14273.5 13191 Property/Plant/Equipment, Total - Net Property/Plant/Equipment, Total - Gross Accumulated Depreciation. Total Goodwill, Net -7913.9 -7841.8 -72 3597.2 3490.8 354 552.1 781.8 104 684.8 616 60 Intangibles, Net Long Term Investments Note Receivable - Long Term Other Long Term Assets, Total Other Assets, Total 2358.5 2245.4 54 Total Current Liabilities 7346.8 6168.7 56 valame Notes Payable/Short Term Debt 438.8 Current Port of LT Debt/Capital Leases 1249.9 Other Current liabilities, Total 1961.3 3439.3 2 Total Liabilities 37179.6 25451.8 22 Total Long Term Debt 14659.6 11167 g Long Term Debt 14659.6 11167 Capital Lease Obligations Deferred Income Tax 158.1 189.4 Minority Interest 5.7 1.2 Other Liabilities. Total 15009.4 7925.5 Total Equity -7805.1 -6232.2 Redeemable Preferred Stock, Total Preferred Stock - Non Redeemable, Net Common Stock, Total 1.2 1.2 373.9 41.1 -7815.6 -5771.2 - Additional Paid-In Capital Retained Earnings (Accumulated Deficit) Treasury Stock - Common ESOP Debt Guarantee Unrealized Gain (Loss) Other Equity, Total Total Liabilities & Shareholders' Equity Total Common Shares Outstanding 5.7 3.9 -370.3 -507.2 2 29374.5 19219.6 1173.3 1184.6 Total Preferred Shares Outstanding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started