Need help understanding how to solve.

Steps Please

Steps Please

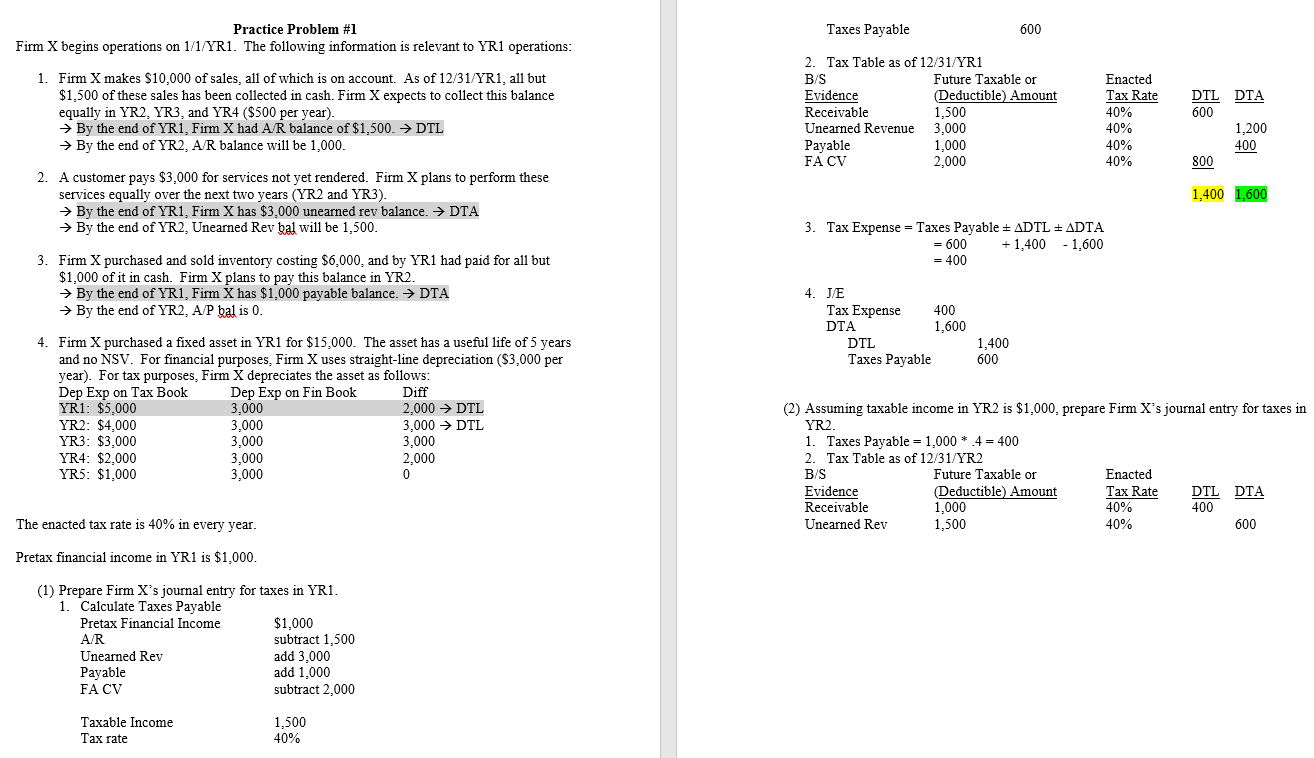

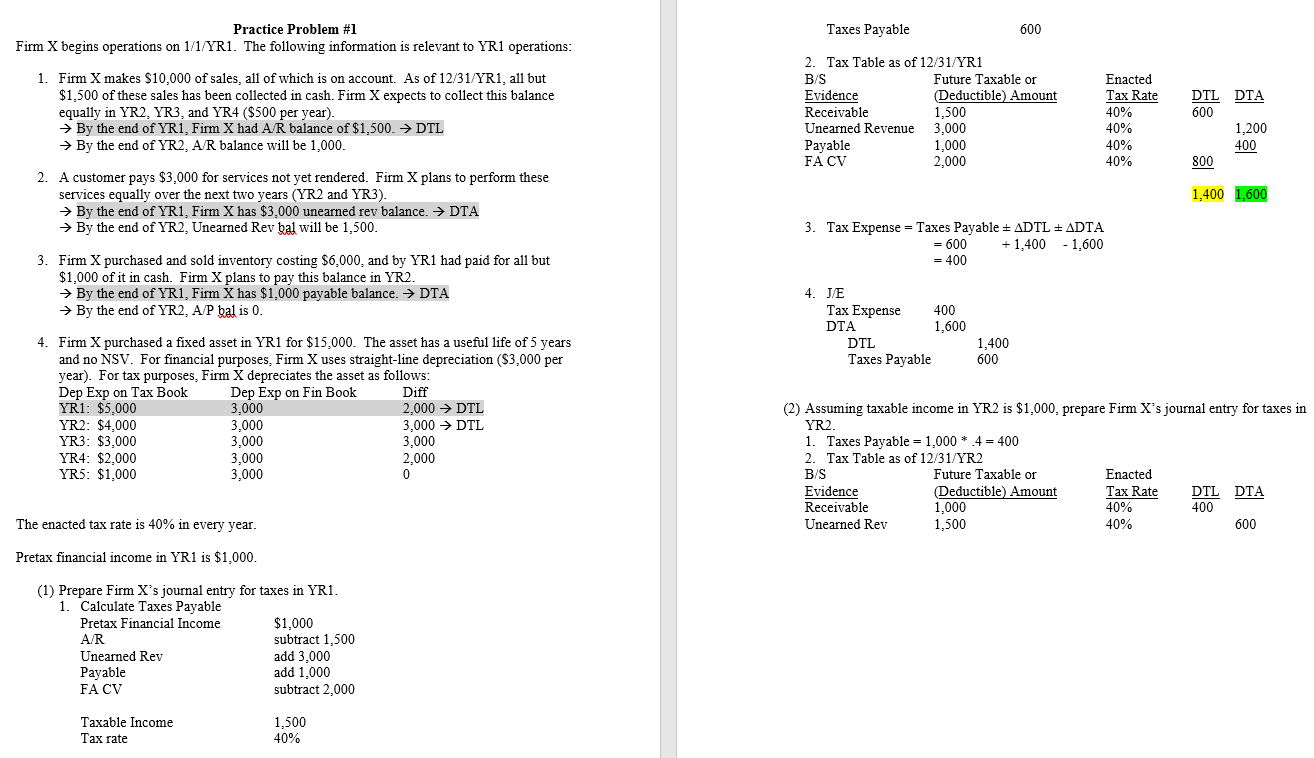

Taxes Payable 600 Practice Problem #1 Firm X begins operations on 1/1/YR1. The following information is relevant to YR1 operations: DTA 1. Firm X makes $10,000 of sales, all of which is on account. As of 12/31/YR1, all but $1,500 of these sales has been collected in cash. Firm X expects to collect this balance equally in YR2, YR3, and YR4 ($500 per year). By the end of YR1, Firm X had A/R balance of $1,500. DTL By the end of YR2, A/R balance will be 1,000. 2. Tax Table as of 12/31/YR1 B/S Future Taxable or Evidence (Deductible) Amount Receivable 1,500 Unearned Revenue 3,000 Payable FA CV 2,000 DTL 600 Enacted Tax Rate 40% 40% 40% 40% 1,200 400 1,000 800 2. A customer pays $3,000 for services not yet rendered. Firm X plans to perform these services equally over the next two years (YR2 and YR3) By the end of YR1, Firm X has $3,000 unearned rev balance. DTA By the end of YR2, Unearned Rev bal will be 1,500. 1,400 1,600 3. Tax Expense = Taxes Payable = ADTL ADTA = 600 + 1,400 - 1,600 = 400 3. Firm X purchased and sold inventory costing $6,000, and by YR1 had paid for all but $1,000 of it in cash. Firm X plans to pay this balance in YR2. By the end of YR1, Firm X has $1,000 payable balance. DTA By the end of YR2, A/P bal is 0. 4. JE Tax Expense 400 DTA 1,600 DTL 1,400 Taxes Payable 600 4. Firm X purchased a fixed asset in YR1 for $15,000. The asset has a useful life of 5 years and no NSV. For financial purposes. Firm X uses straight-line depreciation ($3,000 per year). For tax purposes, Firm X depreciates the asset as follows: Dep Exp on Tax Book Dep Exp on Fin Book Diff YR1: $5.000 2,000 DTL YR2: $4,000 3,000 3,000 DTL YR3: $3,000 3,000 3,000 YR4: $2,000 3,000 2,000 YR5: $1.000 3,000 0 3,000 (2) Assuming taxable income in YR2 is $1,000, prepare Firm X's journal entry for taxes in YR2. 1. Taxes Payable = 1,000 * 4 = 400 2. Tax Table as of 12/31/YR2 B/S Future Taxable or Enacted Evidence (Deductible) Amount Tax Rate DTL DTA Receivable 1,000 40% 400 Unearned Rev 1,500 40% 600 The enacted tax rate is 40% in every year. Pretax financial income in YR1 is $1,000 $1,000 (1) Prepare Firm X's journal entry for taxes in YR1. 1. Calculate Taxes Payable Pretax Financial Income A/R subtract 1,500 Unearned Rev add 3,000 Payable add 1,000 FA CV subtract 2,000 Taxable Income Tax rate 1,500 40% Firm X begins operations on 1/1/YR1. The following information is relevant to YR1 operations: Firm X makes $10,000 of sales, all of which is on account. As of 12/31/YR1, all but $1,500 of these sales has been collected in cash. Firm X expects to collect this balance equally in YR2, YR3, and YR4 ($500 per year). A customer pays $3,000 for services not yet rendered. Firm X plans to perform these services equally over the next two years (YR2 and YR3). Firm X purchased and sold inventory costing $6,000, and by YR1 had paid for all but $1,000 of it in cash. Firm X plans to pay this balance in YR2. Firm X purchased a fixed asset in YR1 for $15,000. The asset has a useful life of 5 years and no NSV. For financial purposes, Firm X uses straight-line depreciation ($3,000 per year). For tax purposes, Firm X depreciates the asset as follows: YR1: $5,000 YR2: $4,000 YR3: $3,000 YR4: $2,000 YRS: $1,000 The enacted tax rate is 40% in every year. Pretax financial income in YR1 is $1,000. (1) Prepare Firm X's journal entry for taxes in YR1. (2) Assuming taxable income in YR2 is $1,000, prepare Firm X's journal entry for taxes in YR2. Taxes Payable 600 Practice Problem #1 Firm X begins operations on 1/1/YR1. The following information is relevant to YR1 operations: DTA 1. Firm X makes $10,000 of sales, all of which is on account. As of 12/31/YR1, all but $1,500 of these sales has been collected in cash. Firm X expects to collect this balance equally in YR2, YR3, and YR4 ($500 per year). By the end of YR1, Firm X had A/R balance of $1,500. DTL By the end of YR2, A/R balance will be 1,000. 2. Tax Table as of 12/31/YR1 B/S Future Taxable or Evidence (Deductible) Amount Receivable 1,500 Unearned Revenue 3,000 Payable FA CV 2,000 DTL 600 Enacted Tax Rate 40% 40% 40% 40% 1,200 400 1,000 800 2. A customer pays $3,000 for services not yet rendered. Firm X plans to perform these services equally over the next two years (YR2 and YR3) By the end of YR1, Firm X has $3,000 unearned rev balance. DTA By the end of YR2, Unearned Rev bal will be 1,500. 1,400 1,600 3. Tax Expense = Taxes Payable = ADTL ADTA = 600 + 1,400 - 1,600 = 400 3. Firm X purchased and sold inventory costing $6,000, and by YR1 had paid for all but $1,000 of it in cash. Firm X plans to pay this balance in YR2. By the end of YR1, Firm X has $1,000 payable balance. DTA By the end of YR2, A/P bal is 0. 4. JE Tax Expense 400 DTA 1,600 DTL 1,400 Taxes Payable 600 4. Firm X purchased a fixed asset in YR1 for $15,000. The asset has a useful life of 5 years and no NSV. For financial purposes. Firm X uses straight-line depreciation ($3,000 per year). For tax purposes, Firm X depreciates the asset as follows: Dep Exp on Tax Book Dep Exp on Fin Book Diff YR1: $5.000 2,000 DTL YR2: $4,000 3,000 3,000 DTL YR3: $3,000 3,000 3,000 YR4: $2,000 3,000 2,000 YR5: $1.000 3,000 0 3,000 (2) Assuming taxable income in YR2 is $1,000, prepare Firm X's journal entry for taxes in YR2. 1. Taxes Payable = 1,000 * 4 = 400 2. Tax Table as of 12/31/YR2 B/S Future Taxable or Enacted Evidence (Deductible) Amount Tax Rate DTL DTA Receivable 1,000 40% 400 Unearned Rev 1,500 40% 600 The enacted tax rate is 40% in every year. Pretax financial income in YR1 is $1,000 $1,000 (1) Prepare Firm X's journal entry for taxes in YR1. 1. Calculate Taxes Payable Pretax Financial Income A/R subtract 1,500 Unearned Rev add 3,000 Payable add 1,000 FA CV subtract 2,000 Taxable Income Tax rate 1,500 40% Firm X begins operations on 1/1/YR1. The following information is relevant to YR1 operations: Firm X makes $10,000 of sales, all of which is on account. As of 12/31/YR1, all but $1,500 of these sales has been collected in cash. Firm X expects to collect this balance equally in YR2, YR3, and YR4 ($500 per year). A customer pays $3,000 for services not yet rendered. Firm X plans to perform these services equally over the next two years (YR2 and YR3). Firm X purchased and sold inventory costing $6,000, and by YR1 had paid for all but $1,000 of it in cash. Firm X plans to pay this balance in YR2. Firm X purchased a fixed asset in YR1 for $15,000. The asset has a useful life of 5 years and no NSV. For financial purposes, Firm X uses straight-line depreciation ($3,000 per year). For tax purposes, Firm X depreciates the asset as follows: YR1: $5,000 YR2: $4,000 YR3: $3,000 YR4: $2,000 YRS: $1,000 The enacted tax rate is 40% in every year. Pretax financial income in YR1 is $1,000. (1) Prepare Firm X's journal entry for taxes in YR1. (2) Assuming taxable income in YR2 is $1,000, prepare Firm X's journal entry for taxes in YR2

Steps Please

Steps Please