Answered step by step

Verified Expert Solution

Question

1 Approved Answer

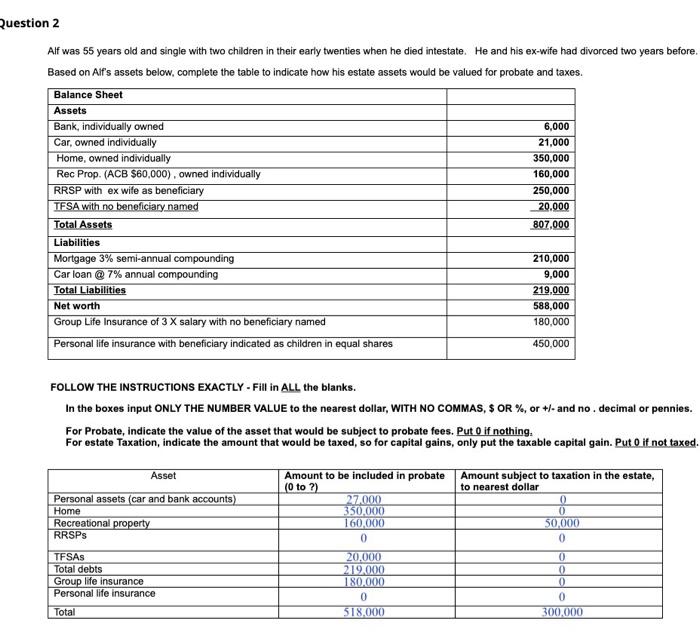

Need help understanding why Amount subject to taxation total is 300,000 and why recreational property is subject to to 50,000 taxation. Help is much appreciated!

Need help understanding why Amount subject to taxation total is 300,000 and why recreational property is subject to to 50,000 taxation.

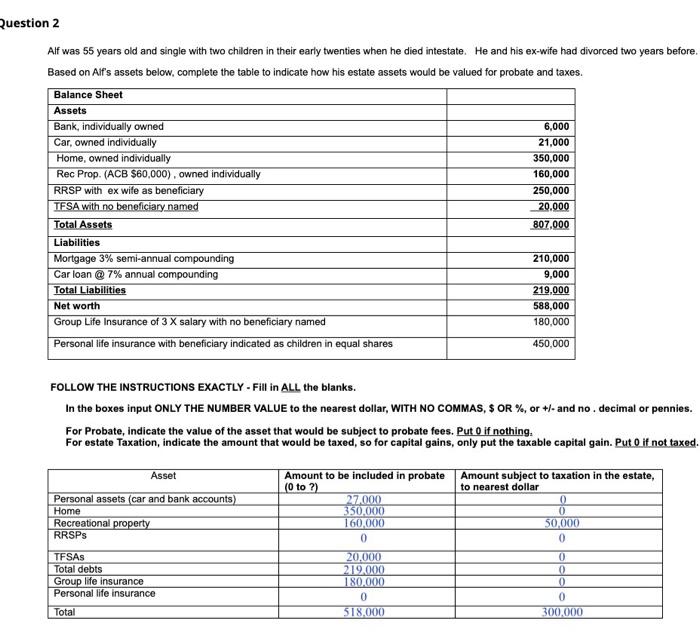

Alf was 55 years old and single with two children in their early twenties when he died intestate. He and his ex-wife had divorced two years before. Based on Alf's assets below, complete the table to indicate how his estate assets would be valued for probate and taxes. FOLLOW THE INSTRUCTIONS EXACTLY - Fill in ALL the blanks. In the boxes input ONLY THE NUMBER VALUE to the nearest dollar, WITH NO COMMAS, $ OR %, or +/ and no. decimal or pennies. For Probate, indicate the value of the asset that would be subject to probate fees. Put 0 if nothing. For estate Taxation, indicate the amount that would be taxed, so for capital gains, only put the taxable capital gain. Put 0 if not taxed Help is much appreciated! Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started