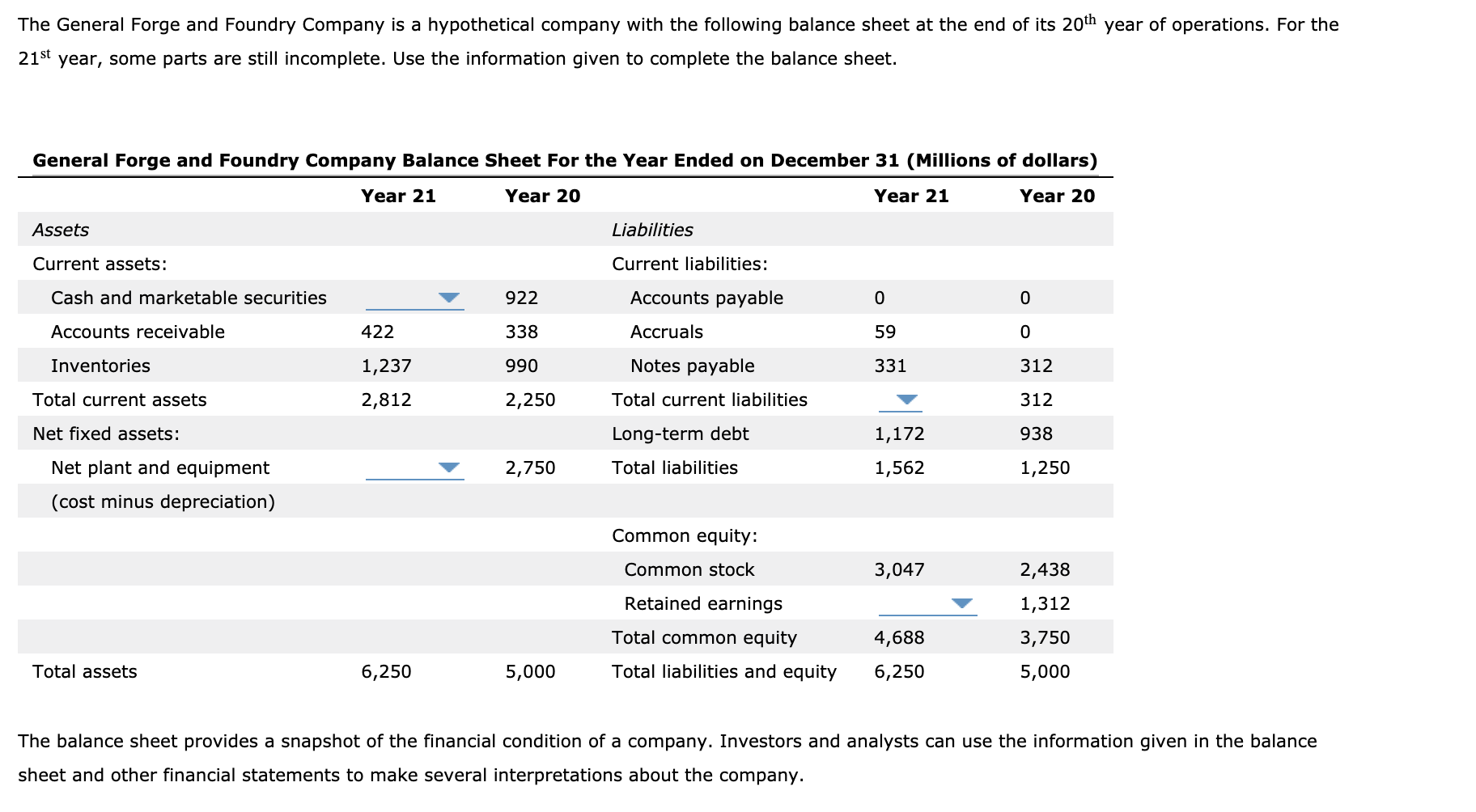

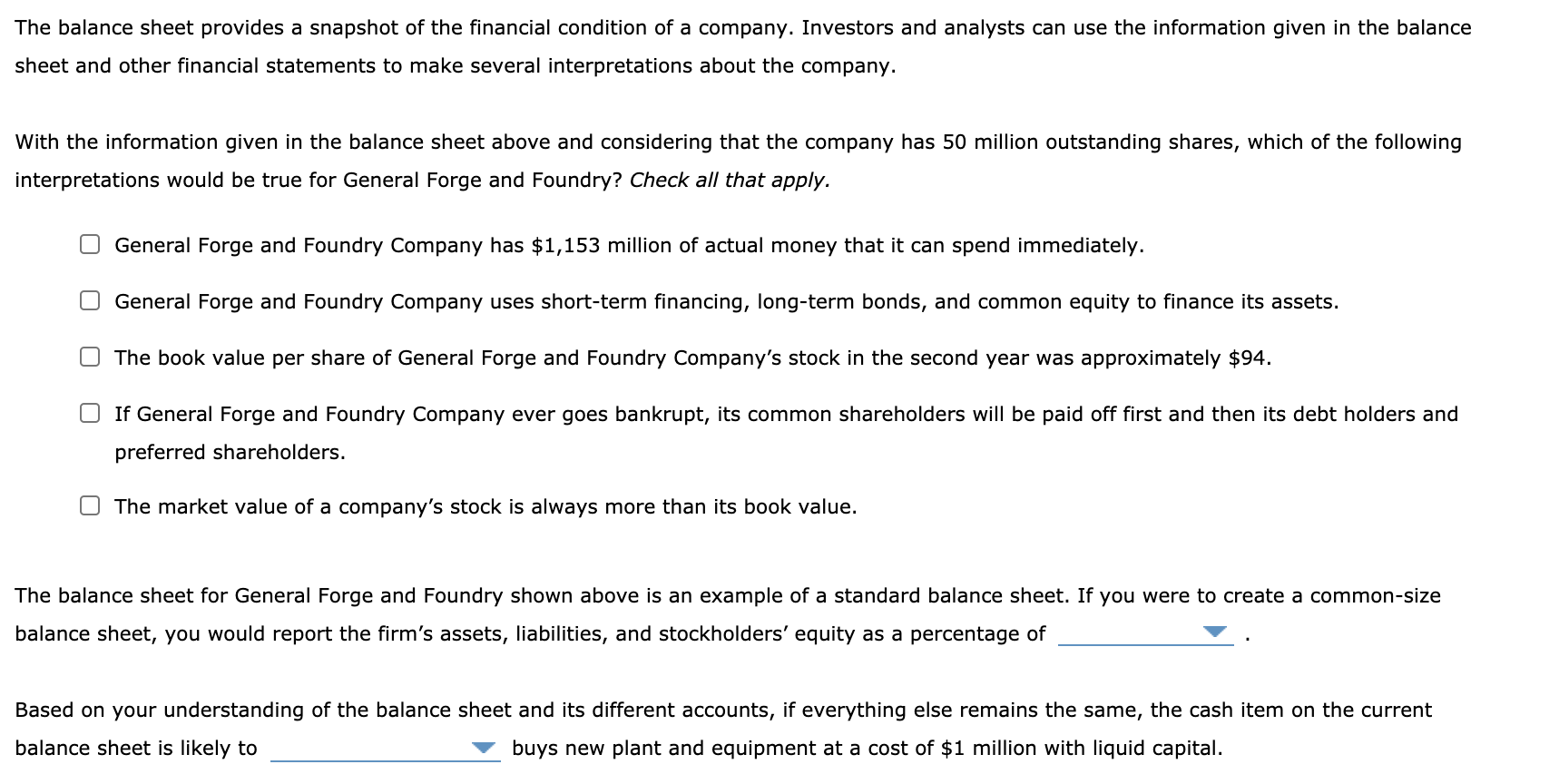

The General Forge and Foundry Company is a hypothetical company with the following balance sheet at the end of its 20th year of operations. For the 21st year, some parts are still incomplete. Use the information given to complete the balance sheet. General Forge and Foundry Company Balance Sheet For the Year Ended on December 31 (Millions of dollars) Year 21 Year 20 Year 21 Year 20 Assets Liabilities Current assets: Current liabilities: Cash and marketable securities 922 Accounts payable 0 0 Accounts receivable 422 338 Accruals 59 0 Inventories 990 Notes payable 331 312 1,237 2,812 Total current assets 2,250 Total current liabilities 312 Net fixed assets: Long-term debt 1,172 938 2,750 Total liabilities 1,562 1,250 Net plant and equipment (cost minus depreciation) Common equity: Common stock 3,047 2,438 Retained earnings Total common equity Total liabilities and equity 1,312 3,750 4,688 Total assets 6,250 5,000 6,250 5,000 The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts can use the information given in the balance sheet and other financial statements to make several interpretations about the company. The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts can use the information given in the balance sheet and other financial statements to make several interpretations about the company. With the information given in the balance sheet above and considering that the company has 50 million outstanding shares, which of the following interpretations would be true for General Forge and Foundry? Check all that apply. General Forge and Foundry Company has $1,153 million of actual money that it can spend immediately. General Forge and Foundry Company uses short-term financing, long-term bonds, and common equity to finance its assets. The book value per share of General Forge and Foundry Company's stock in the second year was approximately $94. If General Forge and Foundry Company ever goes bankrupt, its common shareholders will be paid off first and then its debt holders and preferred shareholders. The market value of a company's stock is always more than its book value. The balance sheet for General Forge and Foundry shown above is an example of a standard balance sheet. If you were to create a common-size balance sheet, you would report the firm's assets, liabilities, and stockholders' equity as a percentage of Based on your understanding of the balance sheet and its different accounts, if everything else remains the same, the cash item on the current balance sheet is likely to buys new plant and equipment at a cost of $1 million with liquid capital