Need help with 1a and 1b.

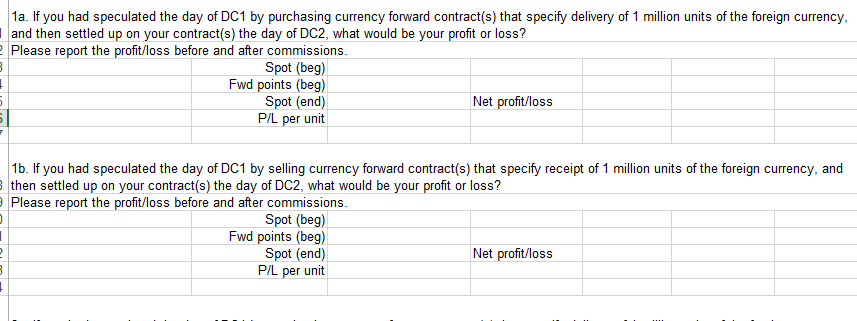

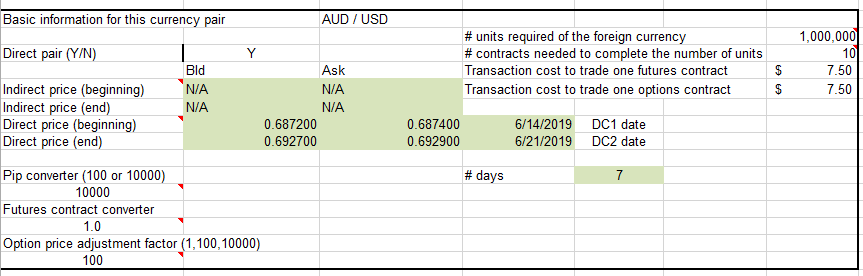

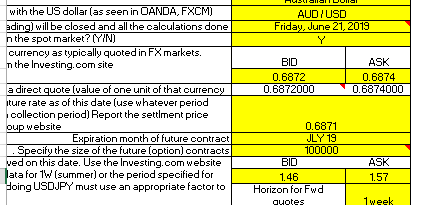

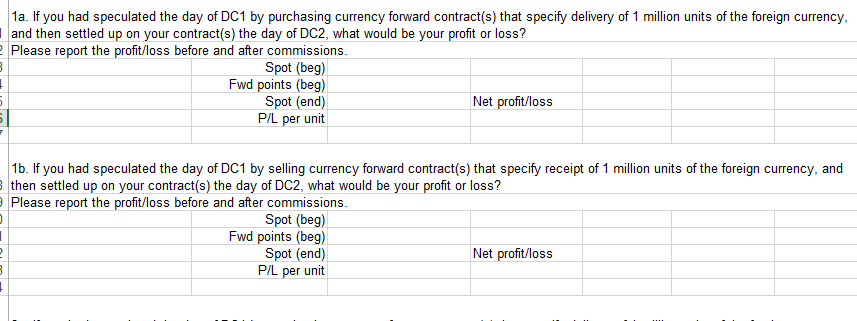

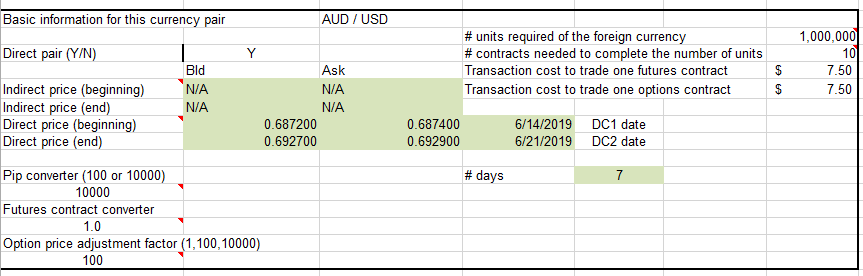

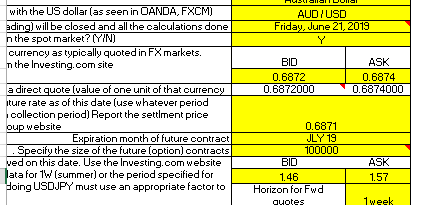

1a. If you had speculated the day of DC1 by purchasing currency forward contract(s) that specify delivery of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions. Spot (beg) Fwd points (beg) Spot (end) P/L per unit Net profit/loss 1b. If you had speculated the day of DC1 by selling currency forward contract(s) that specify receipt of 1 million units of the foreign currency, and |then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Spot (beg) Fwd points (beg) Spot (end) P/L per unit Net profit/loss Basic information for this currency pair AUD/USD 1,000,000 #units required of the foreign currency #contracts needed to complete the number of units Direct pair (Y/N) 10 Y Bld Ask Transaction cost to trade one futures contract 7.50 Indirect price (beginning) Indirect price (end) Direct price (beginning) Direct price (end) N/A Transaction cost to trade one options contract N/A 7.50 N/A N/A 6/14/2019 DC1 date DC2 date 0.687200 0.687400 0.692700 0.692900 6/21/2019 Pip converter (100 or 10000) #days 7 10000 Futures contract converter 1.0 Option price adjustment factor (1,100, 10000) 100 with the US dollar (as seen in OANDA, FXCM) ading will be closed and all the calculations done n the spot market? (YIN) currency as typically quoted in FXmarkets. m the Investing.com site AUDIUSD Friday, June 21, 2019 Y BID ASK 0.6872 0.6872000 0.6874 0.6874000 a direct quote (value of one unit of that currency ture rate as of this date (use whatever period collection period) Report the settlment price oup website 0.6871 JLY 19 100000 BID Expiration month of future contract .Specify the size of the future loption) contracts ved on this date. Use the Investing.com website ata for 1w (summer) or the period specified for Hoing USDJPY must use an appropriate factor to ASK 1.46 1.57 Horizon for Fwd 1week quotes 1a. If you had speculated the day of DC1 by purchasing currency forward contract(s) that specify delivery of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions. Spot (beg) Fwd points (beg) Spot (end) P/L per unit Net profit/loss 1b. If you had speculated the day of DC1 by selling currency forward contract(s) that specify receipt of 1 million units of the foreign currency, and |then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Spot (beg) Fwd points (beg) Spot (end) P/L per unit Net profit/loss Basic information for this currency pair AUD/USD 1,000,000 #units required of the foreign currency #contracts needed to complete the number of units Direct pair (Y/N) 10 Y Bld Ask Transaction cost to trade one futures contract 7.50 Indirect price (beginning) Indirect price (end) Direct price (beginning) Direct price (end) N/A Transaction cost to trade one options contract N/A 7.50 N/A N/A 6/14/2019 DC1 date DC2 date 0.687200 0.687400 0.692700 0.692900 6/21/2019 Pip converter (100 or 10000) #days 7 10000 Futures contract converter 1.0 Option price adjustment factor (1,100, 10000) 100 with the US dollar (as seen in OANDA, FXCM) ading will be closed and all the calculations done n the spot market? (YIN) currency as typically quoted in FXmarkets. m the Investing.com site AUDIUSD Friday, June 21, 2019 Y BID ASK 0.6872 0.6872000 0.6874 0.6874000 a direct quote (value of one unit of that currency ture rate as of this date (use whatever period collection period) Report the settlment price oup website 0.6871 JLY 19 100000 BID Expiration month of future contract .Specify the size of the future loption) contracts ved on this date. Use the Investing.com website ata for 1w (summer) or the period specified for Hoing USDJPY must use an appropriate factor to ASK 1.46 1.57 Horizon for Fwd 1week quotes