need help with #4 and #5 please thank you

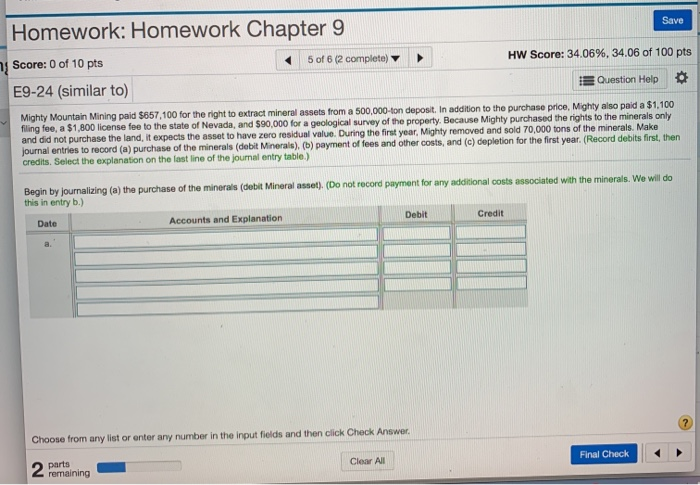

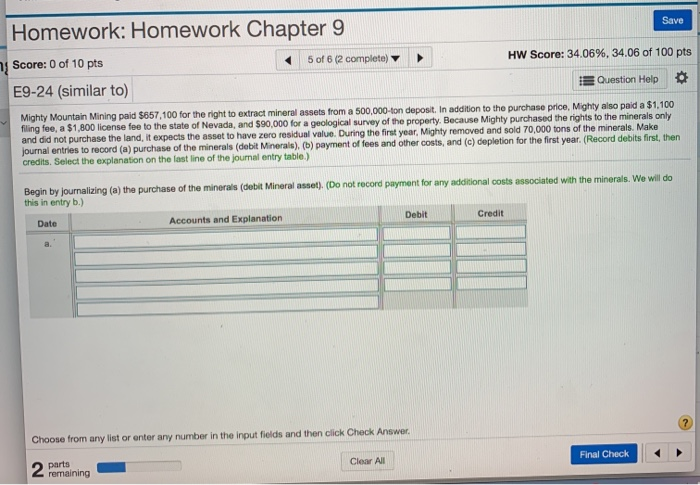

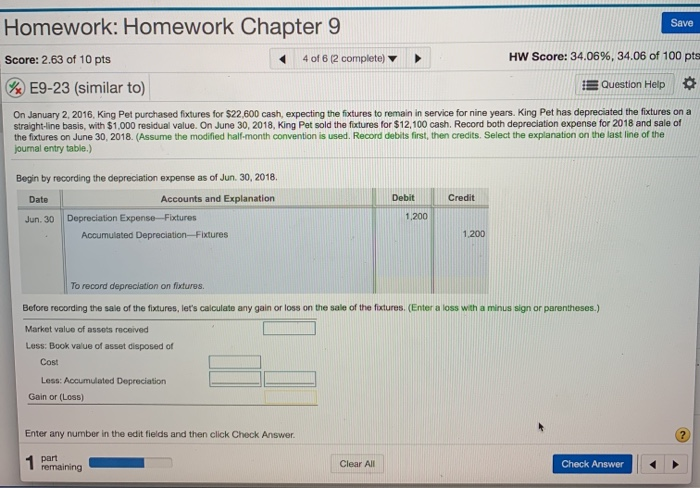

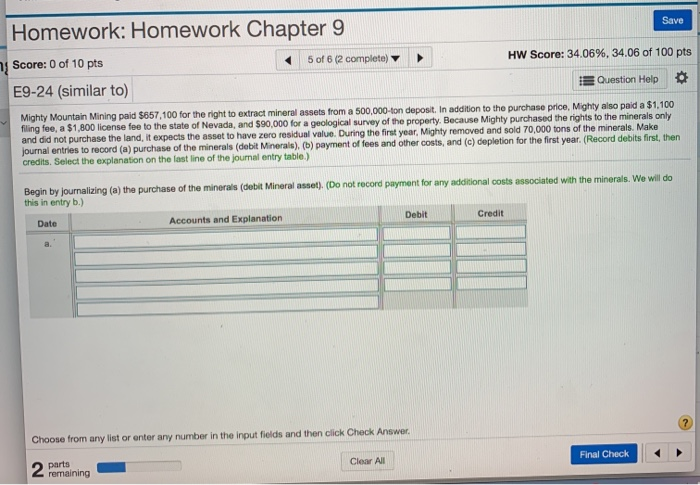

Save Homework: Homework Chapter 9 Score: 0 of 10 pts 5 of 6 (2 complete) E9-24 (similar to) HW Score: 34.06%. 34.06 of 100 pts Question Help Mighty Mountain Mining paid $657,100 for the right to extract mineral assets from a 500,000 ton deposit. In addition to the purchase price, Mighty also paid a $1,100 filing fee, a $1,800 license fee to the state of Nevada, and $90,000 for a geological survey of the property. Because Mighty purchased the rights to the minerals only and did not purchase the land, it expects the asset to have zero residual value. During the first year, Mighty removed and sold 70,000 tons of the minerals. Make journal entries to record (a) purchase of the minerals (debit Minerals). (b) payment of fees and other costs, and (c) depletion for the first year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing (a) the purchase of the minerals (debit Mineral asset), (Do not record payment for any additional costs associated with the minerals. We will do this in entry b.) Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then click Check Answer Final Check parts Clear All Final Check 2 remaining Save Homework: Homework Chapter 9 Score: 2.63 of 10 pts 4 of 6 (2 complete) %E9-23 (similar to) HW Score: 34.06%, 34.06 of 100 pts E Question Help On January 2, 2016, King Pet purchased fixtures for $22.600 cash, expecting the fixtures to remain in service for nine years. King Pet has depreciated the foxtures on a straight-line basis, with $1,000 residual value. On June 30, 2018, King Pet sold the fixtures for $12,100 cash. Record both depreciation expense for 2018 and sale of the factures on June 30, 2018. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Debit Credit Begin by recording the depreciation expense as of Jun 30, 2018 Date Accounts and Explanation Jun. 30 Depreciation Expense --Fixtures Accumulated Depreciation --Fixtures 1,200 1.200 To record depreciation on fixtures. Before recording the sale of the fixtures, let's calculate any gain or loss on the sale of the fixtures, (Enter a loss with a minus sign or parentheses.) Market value of assets received Loss: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss) Enter any number in the edit fields and then click Check Answer. 1 part I remaining Clear All Check