Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with 4-1, 4-7, 5-1, 5-5 & 5-19 only these 5 problems, I can do the rest TY (4-1) Future Value of a Single

need help with 4-1,

4-7, 5-1, 5-5 & 5-19 only these 5 problems, I can do the rest TY

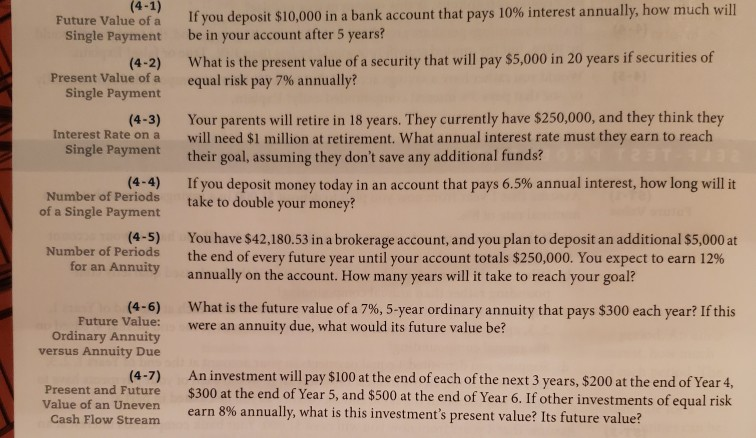

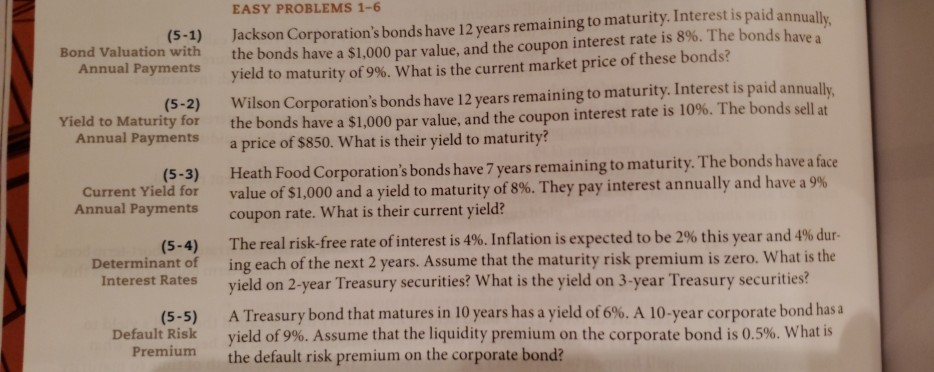

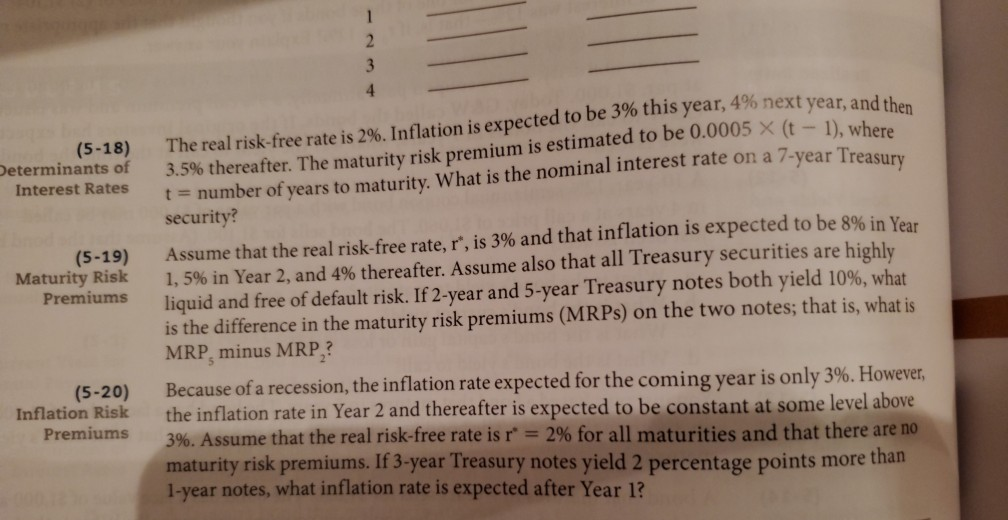

(4-1) Future Value of a Single Payment (4-2) Present Value of a Single Payment If you deposit $10,000 in a bank account that pays 10% interest annually, how much will be in your account after 5 years? What is the present value of a security that will pay $5,000 in 20 years if securities of equal risk pay 7% annually? Interest Rate on a Single Payment Your parents will retire in 18 years. They currently have $250,000, and they think they will need $1 million at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? If you deposit money today in an account that pays 6.5% annual interest, how long will it take to double your money? (4-4) Number of Periods of a Single Payment - (4-5) Number of Periods for an Annuity You have $42,180.53 in a brokerage account, and you plan to deposit an additional $5,000 at the end of every future year until your account totals $250,000. You expect to earn 12% annually on the account. How many years will it take to reach your goal? What is the future value of a 7%, 5-year ordinary annuity that pays $300 each year? If this were an annuity due, what would its future value be? 0 (4-6) Future Value: Ordinary Annuity versus Annuity Due (4-7) Present and Future Value of an Uneven Cash Flow Stream An investment will pay $100 at the end of each of the next 3 years, $200 at the end of Year 4, $300 at the end of Year 5, and $500 at the end of Year 6. If other investments of equal risk earn 8% annually, what is this investment's present value? Its future value? (5-1) Bond Valuation with Annual Payments (5-2) Yield to Maturity for Annual Payments EASY PROBLEMS 1-6 Jackson Corporation's bonds have 12 years remaining to maturity. Interest is paid annually the bonds have a $1,000 par value, and the coupon interest rate is 8%. The bonds have a yield to maturity of 9%. What is the current market price of these bonds? Wilson Corporation's bonds have 12 years remaining to maturity. Interest is paid annually. the bonds have a $1,000 par value, and the coupon interest rate is 10%. The bonds sell at a price of $850. What is their yield to maturity? Heath Food Corporation's bonds have 7 years remaining to maturity. The bonds have a face value of $1,000 and a yield to maturity of 8%. They pay interest annually and have a 9% coupon rate. What is their current yield? (5-3) Current Yield for Annual Payments (5-4) Determinant of Interest Rates The real risk-free rate of interest is 4%. Inflation is expected to be 2% this year and 4% dur- ing each of the next 2 years. Assume that the maturity risk premium is zero. What is the yield on 2-year Treasury securities? What is the yield on 3-year Treasury securities? A Treasury bond that matures in 10 years has a yield of 6%. A 10-year corporate bond has a yield of 9%. Assume that the liquidity premium on the corporate bond is 0.5%. What is the default risk premium on the corporate bond? (5-5) Default Risk (5-18) Determinants of Interest Rates The real risk-free rate is 2%. Inflation is expected to be 3% this year, 4% next year, and 3.3% thereafter. The maturity risk premium is estimated to be 0.0005 % (t-1) 3.5% thereafter. The maturity t = number of years to maturity. What is the nominal interest rate on a 7-year Treasury security? Assume that the real risk-free rate, r", is 3% and that inflation is expected to be 8% in Year 1,5% in Year 2, and 4% thereafter. Assume also that all Treasury securities are highly liquid and free of default risk. If 2-year and 5-year Treasury notes both yield 10%, what is the difference in the maturity risk premiums (MRPs) on the two notes; that is, what is MRP, minus MRP,? (5-19) tunity Risk Premiums (5-20) Inflation Risk Premiums Because of a recession, the inflation rate expected for the coming year is only 3%. However, the inflation rate in Year 2 and thereafter is expected to be constant at some level above 3%. Assume that the real risk-free rate is r* = 2% for all maturities and that there are no maturity risk premiums. If 3-year Treasury notes yield 2 percentage points more than 1-year notes, what inflation rate is expected after Year 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started