Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with a,b,c,d what more information could possivly be needed. its all right there from the book that is all the information the book

need help with a,b,c,d

what more information could possivly be needed. its all right there from the book

that is all the information the book gives

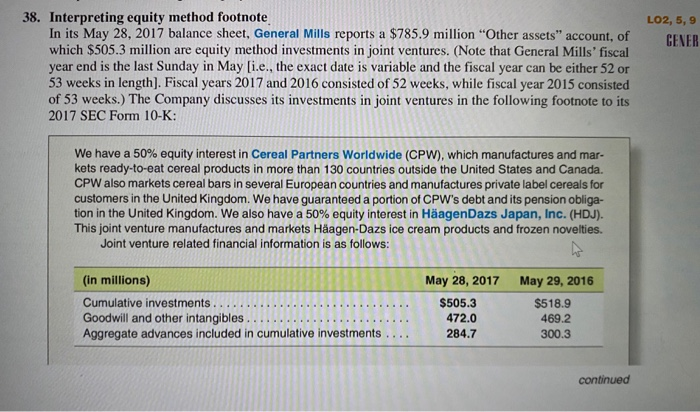

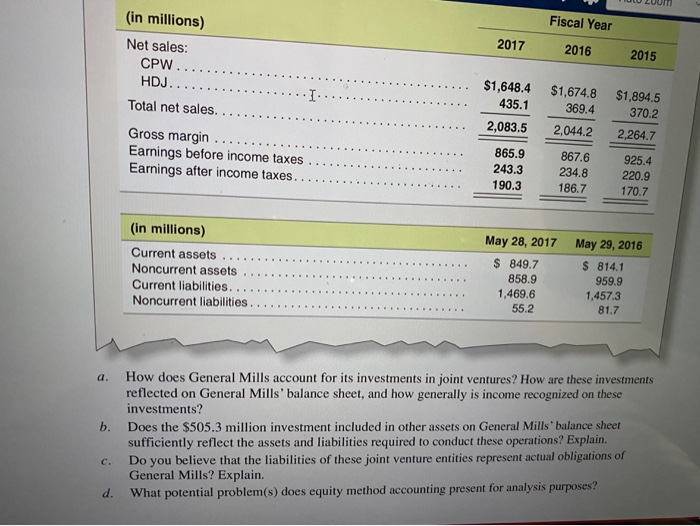

LO2, 5, 9 CENER 38. Interpreting equity method footnote In its May 28, 2017 balance sheet, General Mills reports a $785.9 million "Other assets" account, of which $505.3 million are equity method investments in joint ventures. (Note that General Mills' fiscal year end is the last Sunday in May [i.e., the exact date is variable and the fiscal year can be either 52 or 53 weeks in length). Fiscal years 2017 and 2016 consisted of 52 weeks, while fiscal year 2015 consisted of 53 weeks.) The Company discusses its investments in joint ventures in the following footnote to its 2017 SEC Form 10-K: We have a 50% equity interest in Cereal Partners Worldwide (CPW), which manufactures and mar- kets ready-to-eat cereal products in more than 130 countries outside the United States and Canada. CPW also markets cereal bars in several European countries and manufactures private label cereals for customers in the United Kingdom. We have guaranteed a portion of CPW's debt and its pension obliga- tion in the United Kingdom. We also have a 50% equity interest in Hagen Dazs Japan, Inc. (HD). This joint venture manufactures and markets Hagen-Dazs ice cream products and frozen novelties. Joint venture related financial information is as follows: (in millions) Cumulative investments. Goodwill and other intangibles Aggregate advances included in cumulative investments May 28, 2017 $505.3 472.0 284.7 May 29, 2016 $518.9 469.2 300.3 . continued Fiscal Year 2017 2016 2015 (in millions) Net sales: CPW HDJ.. Total net sales... Gross margin Earnings before income taxes Earnings after income taxes. $1,648.4 435.1 $1,674.8 369.4 $1,894.5 370.2 2,083.5 2,044.2 2,264.7 865.9 243.3 190.3 867.6 234.8 186.7 925.4 220.9 170.7 (in millions) Current assets Noncurrent assets Current liabilities. . Noncurrent liabilities May 28, 2017 $ 849.7 858.9 1,469.6 55.2 May 29, 2016 $ 814.1 959.9 1,457.3 81.7 a. b. How does General Mills account for its investments in joint ventures? How are these investments reflected on General Mills' balance sheet, and how generally is income recognized on these investments? Does the $505.3 million investment included in other assets on General Mills' balance sheet sufficiently reflect the assets and liabilities required to conduct these operations? Explain. Do you believe that the liabilities of these joint venture entities represent actual obligations of General Mills? Explain. What potential problem(s) does equity method accounting present for analysis purposes? c. d. LO2, 5, 9 CENER 38. Interpreting equity method footnote In its May 28, 2017 balance sheet, General Mills reports a $785.9 million "Other assets" account, of which $505.3 million are equity method investments in joint ventures. (Note that General Mills' fiscal year end is the last Sunday in May [i.e., the exact date is variable and the fiscal year can be either 52 or 53 weeks in length). Fiscal years 2017 and 2016 consisted of 52 weeks, while fiscal year 2015 consisted of 53 weeks.) The Company discusses its investments in joint ventures in the following footnote to its 2017 SEC Form 10-K: We have a 50% equity interest in Cereal Partners Worldwide (CPW), which manufactures and mar- kets ready-to-eat cereal products in more than 130 countries outside the United States and Canada. CPW also markets cereal bars in several European countries and manufactures private label cereals for customers in the United Kingdom. We have guaranteed a portion of CPW's debt and its pension obliga- tion in the United Kingdom. We also have a 50% equity interest in Hagen Dazs Japan, Inc. (HD). This joint venture manufactures and markets Hagen-Dazs ice cream products and frozen novelties. Joint venture related financial information is as follows: (in millions) Cumulative investments. Goodwill and other intangibles Aggregate advances included in cumulative investments May 28, 2017 $505.3 472.0 284.7 May 29, 2016 $518.9 469.2 300.3 . continued Fiscal Year 2017 2016 2015 (in millions) Net sales: CPW HDJ.. Total net sales... Gross margin Earnings before income taxes Earnings after income taxes. $1,648.4 435.1 $1,674.8 369.4 $1,894.5 370.2 2,083.5 2,044.2 2,264.7 865.9 243.3 190.3 867.6 234.8 186.7 925.4 220.9 170.7 (in millions) Current assets Noncurrent assets Current liabilities. . Noncurrent liabilities May 28, 2017 $ 849.7 858.9 1,469.6 55.2 May 29, 2016 $ 814.1 959.9 1,457.3 81.7 a. b. How does General Mills account for its investments in joint ventures? How are these investments reflected on General Mills' balance sheet, and how generally is income recognized on these investments? Does the $505.3 million investment included in other assets on General Mills' balance sheet sufficiently reflect the assets and liabilities required to conduct these operations? Explain. Do you believe that the liabilities of these joint venture entities represent actual obligations of General Mills? Explain. What potential problem(s) does equity method accounting present for analysis purposes? c. d Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started