need help with all of the parts

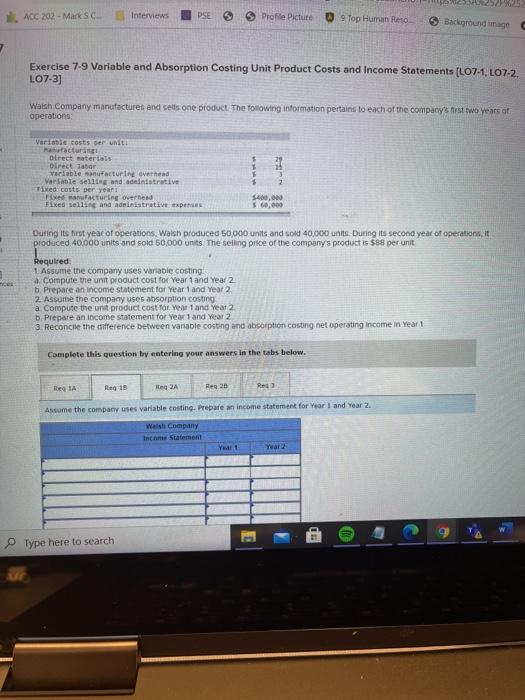

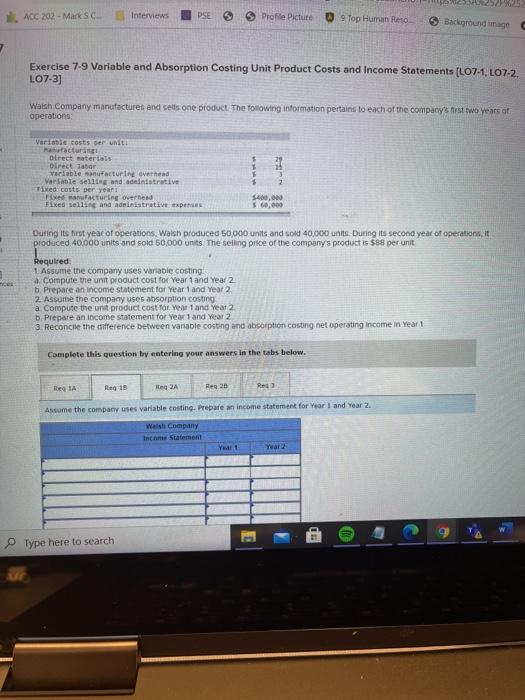

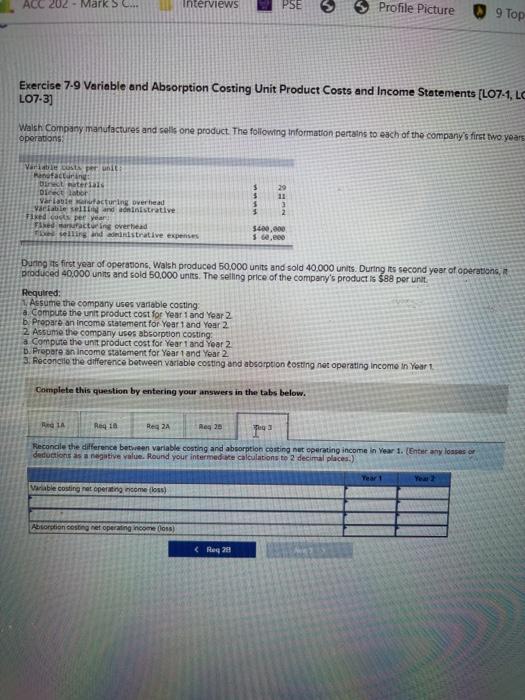

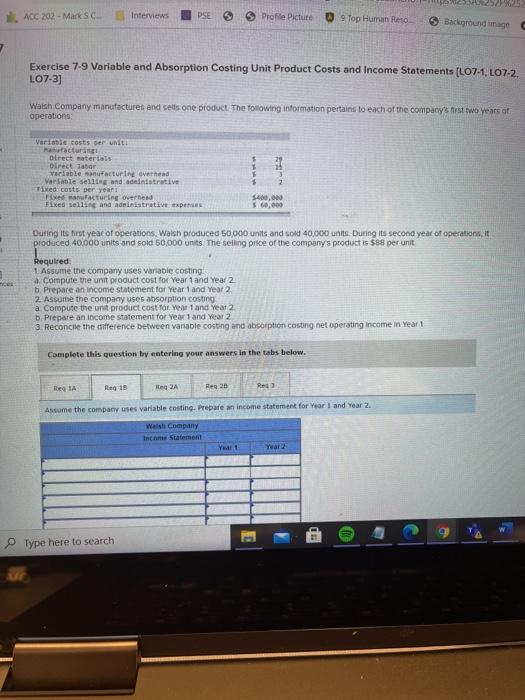

ACC 202 - Mark SC Interviews PSE Profile Picture 09 Top Human Reso 3 Bedround image Exercise 7-9 Variable and Absorption Costing Unit Product Costs and Income Statements (L07-1, L07-2. LO7-3] Walsh Company manufactures and sets one product. The following information pertains to each of the company's first two years at operations Variable costs per unit acturing Direct materials Director variable infacturing overhead Verable set and dinistrative Tixed costs per year Fixes facturing overhead Fixed selling and administrative expenses 5400,000 560.000 During its first year of operations. Walsh produced 50,000 units and sold 40,000 units. During its second year of operations, it produced 40.000 units and sold 50,000 units. The selling price of the company's product is $88 per unit Required: 1. Assume the company uses variable costing a compute the unit product cost for Year 1 and Year 2 b. Prepare an income statement for Year 1 and Year 2 2. Assume the company uses absorption costing a Compute the unit product cost for Year 1 and Year 2 6. Prepare an income statement for Year 1 and Year 2 3. Reconcile the difference between variable costing and absorption costing net operating income in Year Complete this question by entering your answers in the tabs below. R 1A R18 Reg 2A Res 20 Assume the company uses variable costing. Prepare an income statement for Year 1 and Year 2 Welsh Company Income Statement Yeart Year 2 Type here to search ACC 202 - Marks Interviews PSE Profile Picture 9 Top Exercise 7-9 Variable and Absorption Costing Unit Product Costs and Income Statements (L07-1, LC LO7-3) Walsh Company manufactures and sells one product. The following information pertains to each of the company's first two years oporations 29 Varit per te Manufacturing Bateria Director Vrlable facturing over head vacible selling and analstrative Fixed cos per year Feracturing overhead Telling and addestrative expenses $400.000 550.000 During its first year of operations, Walsh produced 50,000 units and sold 40.000 units. During its second year of operations, produced 40.000 units and sold 50,000 units. The selling price of the company's product is $88 per unit. Required: Assume the company uses variable costing a. Compute the unit product cost for Year 1 and Year 2 b. Propare an income statement for Year 1 and Year 2 2. Assume the company uses absorption costing: a Compute the unit product cost for Year 1 and Year 2 D. Prepare an income statement for Year 1 and Year 2 3. Reconcile the difference between Variable costing and absorption costing net operating incomo in Year 1 Complete this question by entering your answers in the tabs below. LA Re16 Reg 2 Reg 20 Tega Reconcile the difference between variable costing and absorption costing net operating income in Year 1. (Enter any losses or deductions as a negative value. Round your intermediate calculations to 2 decimal places.) Year 1 Variable costing net operating con (los) Abortion song net operating income (s)