need help with all of them. Also, explain the steeps too please that way i understand the proplem .

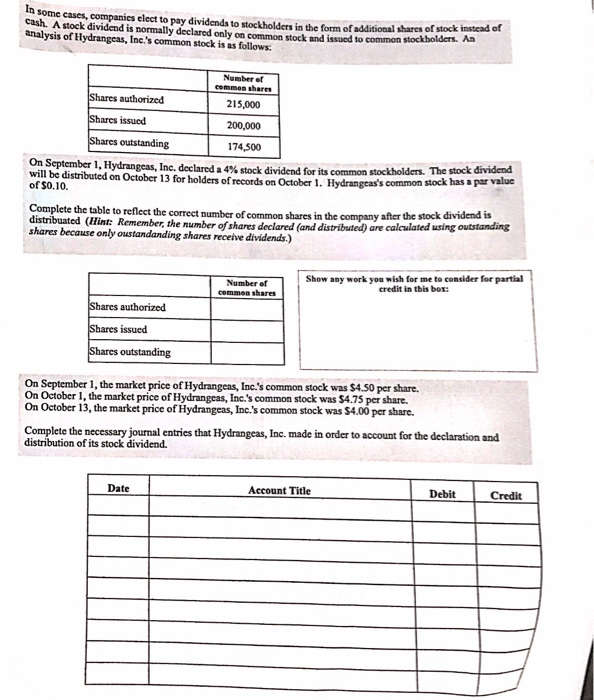

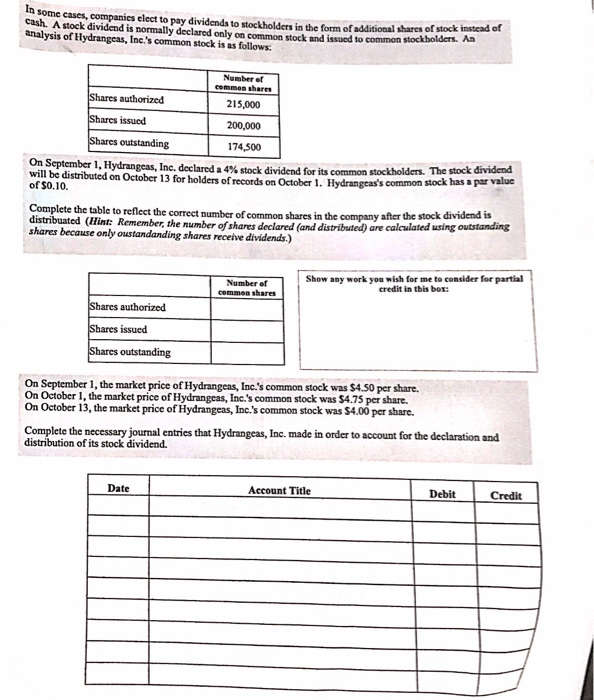

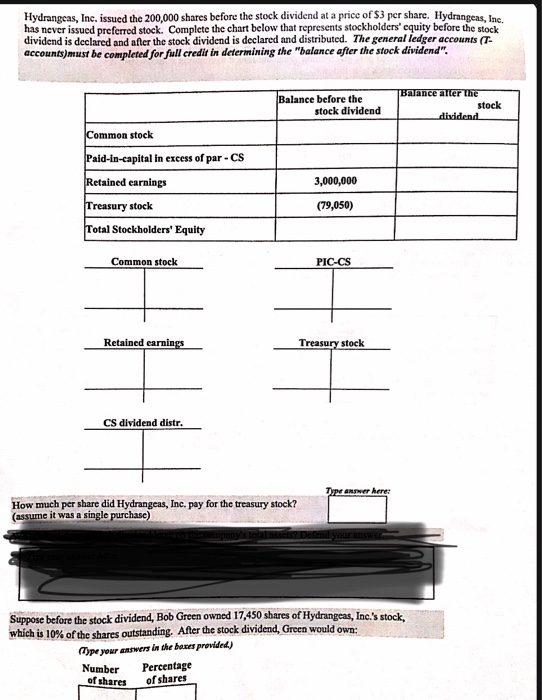

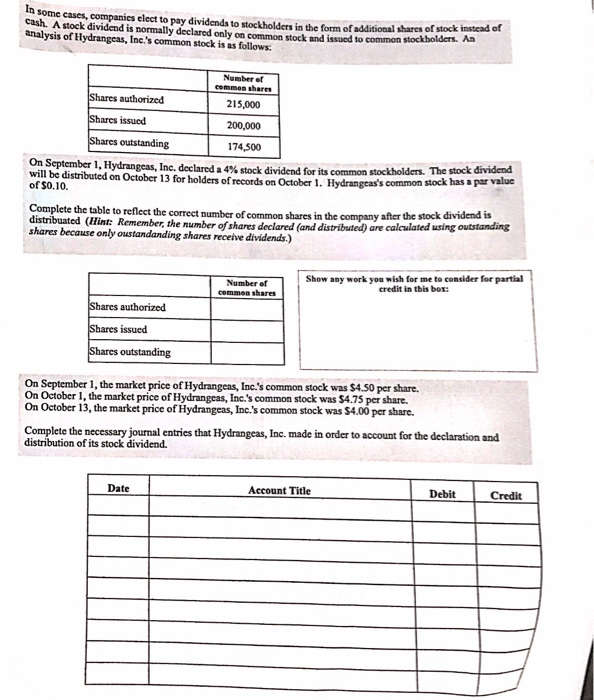

In some cases, companies clect to pay dividends to stockholders in the form of additional shares of stock instead of cash. A stock dividend is normally declared only on common stock and issued to common stockholders. An analysis of Hydrangeas, Inc.'s common stock is as follows: Number of common shares 215,000 Shares authorized Sharcs issued 200,000 174,500 of $0.10. Shares outstanding On September 1, Hydrangeas, Inc. declared a 4% stock dividend for its common stockholders. The stock dividend will be distributed on October 13 for holders of records on October 1. Hydrangeas's common stock has a par value Complete the table to reflect the correct number of common shares in the company after the stock dividend is distributed (Hint: Remember, the number of shares declared (and distributed) are calculated using outstanding shares because only oustandanding shares receive dividends.) Number of common shares Show any work you wish for me to consider for partial credit in this box: Shares authorized Shares issued Shares outstanding On September 1, the market price of Hydrangeas, Inc.'s common stock was 54.50 per share. On October 1, the market price of Hydrangeas, Inc.'s common stock was $4.75 per share. On October 13, the market price of Hydrangeas, Inc.'s common stock was 54.00 per share. Complete the necessary journal entries that Hydrangeas, Inc. made in order to account for the declaration and distribution of its stock dividend. Date Account Title Debit Credit Hydrangeas, Inc. issued the 200,000 shares before the stock dividend at a price of $3 per share. Hydrangeas, Ine. has never issued preferred stock. Complete the chart below that represents stockholders' equity before the stock dividend is declared and after the stock dividend is declared and distributed. The general ledger accounts (T- accounts must be completed for full credit in determining the "balance after the stock dividend". Balance before the stock dividend Balance after the stock dividend Common stock Paid-in-capital in excess of par-CS Retained earnings Treasury stock Total Stockholders' Equity 3,000,000 (19,050) Common stock PIC-CS Retained earnings Treasury stock CS dividend distr. Type aner here: How much per share did Hydrangeas, Inc. pay for the treasury stock? (assume it was a single purchase) Suppose before the stock dividend, Bob Green owned 17,450 shares of Hydrangeas, Inc.'s stock, which is 10% of the shares outstanding. After the stock dividend, Green would own: Type your answers in the boxes provided) Number Percentage of shares of shares