need help with all the ones with X!

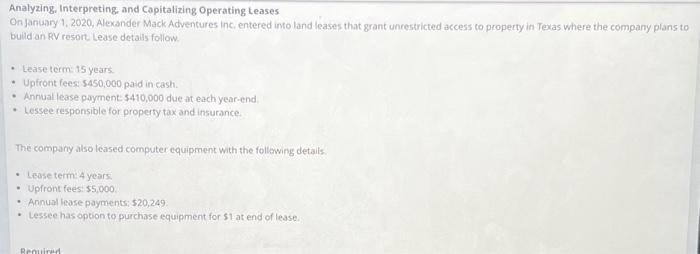

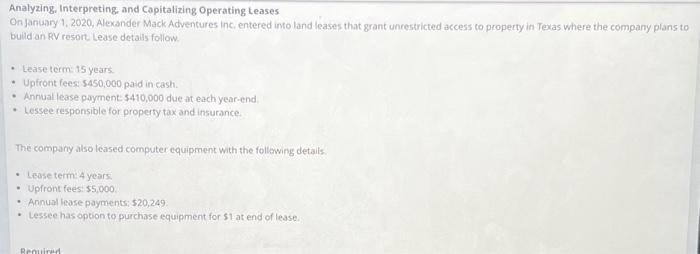

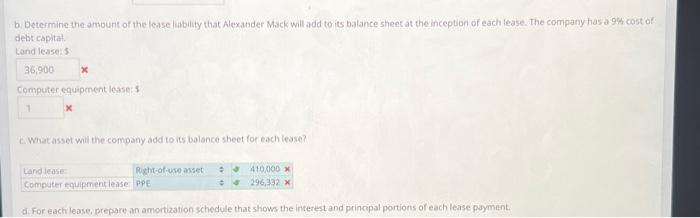

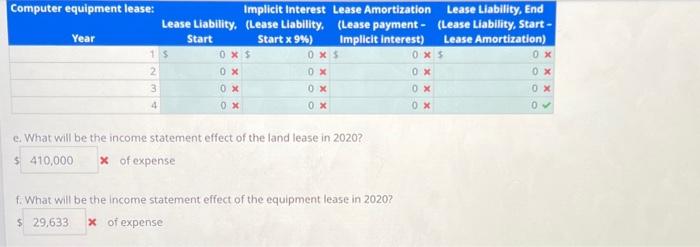

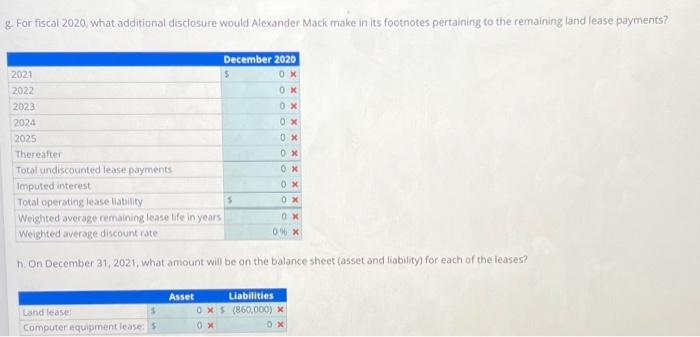

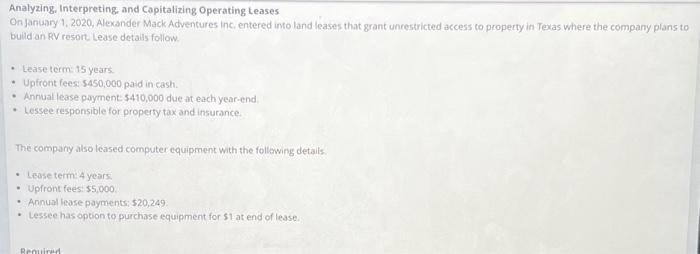

Analyzing, Interpreting, and Copitalizing Operating Leases On Jartuiny 1,2020, Alexander Mack.Adventures inc, entered into land leases that grant unrestricted access co property in Texas where the company plans to buld an RV resort lease detals follow. - Lease term: 15 years. - Upfront fees: 5450,000 paid in cash. - Annuar lease payment $410,000 due at each year-end. - Lessee responsible for property tax and insurance. The compary also leased computer equipment with the follewing details. - inate terth 4 years - Upfront feesi $5,000. - Annual liease payments; 520,249 - Lessec has option to purchase equipment for 51 at end of lease. b. Determine the amount of the lease liability that Alexander Mack will add to its balance sheet at the inception of each lease. The company has a 94 cost of debt canitat Land leasens Computer equipenent lease: 1 x c. What asset will the company add to its balance sheet for each lease? d. For each lease, prepare an amortization schedule that shows the interest and principal portions of each lease payment. d. For each lease, prepare an amortization schedule that shows the interest and principal portions of each lease payment. Note: Adjust the final year for any rounding differences. c. What will be the income statement effect of the land lease in 2020 ? x of expense f. What will be the income statement effect of the equipment lease in 2020? s of expense For fiscal 2020, what additional disclosure would Alexander Mack make in its footnotes pertaining to the remaining land lease payments? h. On December 31,2021 , what amount will be on the balance sheet (asset and liability) for each of the leases? Analyzing, Interpreting, and Copitalizing Operating Leases On Jartuiny 1,2020, Alexander Mack.Adventures inc, entered into land leases that grant unrestricted access co property in Texas where the company plans to buld an RV resort lease detals follow. - Lease term: 15 years. - Upfront fees: 5450,000 paid in cash. - Annuar lease payment $410,000 due at each year-end. - Lessee responsible for property tax and insurance. The compary also leased computer equipment with the follewing details. - inate terth 4 years - Upfront feesi $5,000. - Annual liease payments; 520,249 - Lessec has option to purchase equipment for 51 at end of lease. b. Determine the amount of the lease liability that Alexander Mack will add to its balance sheet at the inception of each lease. The company has a 94 cost of debt canitat Land leasens Computer equipenent lease: 1 x c. What asset will the company add to its balance sheet for each lease? d. For each lease, prepare an amortization schedule that shows the interest and principal portions of each lease payment. d. For each lease, prepare an amortization schedule that shows the interest and principal portions of each lease payment. Note: Adjust the final year for any rounding differences. c. What will be the income statement effect of the land lease in 2020 ? x of expense f. What will be the income statement effect of the equipment lease in 2020? s of expense For fiscal 2020, what additional disclosure would Alexander Mack make in its footnotes pertaining to the remaining land lease payments? h. On December 31,2021 , what amount will be on the balance sheet (asset and liability) for each of the leases