Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with calculating business investments Scenario As the owner of a vinyl fencing company. you are making plans for two large purchases in the

need help with calculating business investments

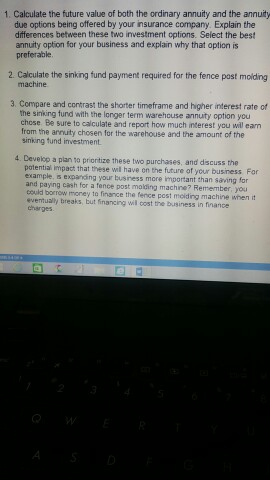

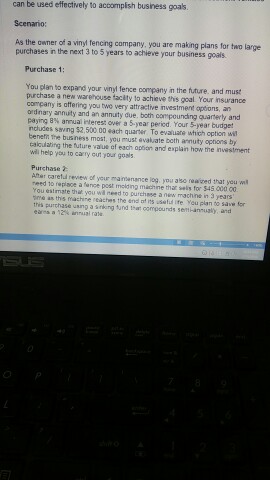

Scenario As the owner of a vinyl fencing company. you are making plans for two large purchases in the next 3 to 5 years to achieve your business goals. ar Purchase 1: You plan to expand your vinyl fence company in the future, and must purchase a new warehouse facility to achieve this goal. Your insurance company is offering you two very attractive investment options, an ordinary annuity and an annuity due, both compounding quarterly and paying 8% annual interest over a 5-year period Your 5-year budget includes saving $2,500.00 each quarter. To evaluate which option will om beneft the business most. you must ev benefit the business most. you must evaluate both annuity options by calculating the future value of each option and explan how the investment will help you to carry out your goals Purchase 2: After careful review of your maintenance log. you also realized that you wil need to replace a fence pos: molding machine that sells for $45,000.00. You estimate that you wil need to purchase a new machine in 3 years time as this machine reaches the end of its useful ife. You plan to save for this purchase using a sinking fund that compounds semi-annually, and earns a 12% annual rate. s5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started