Answered step by step

Verified Expert Solution

Question

1 Approved Answer

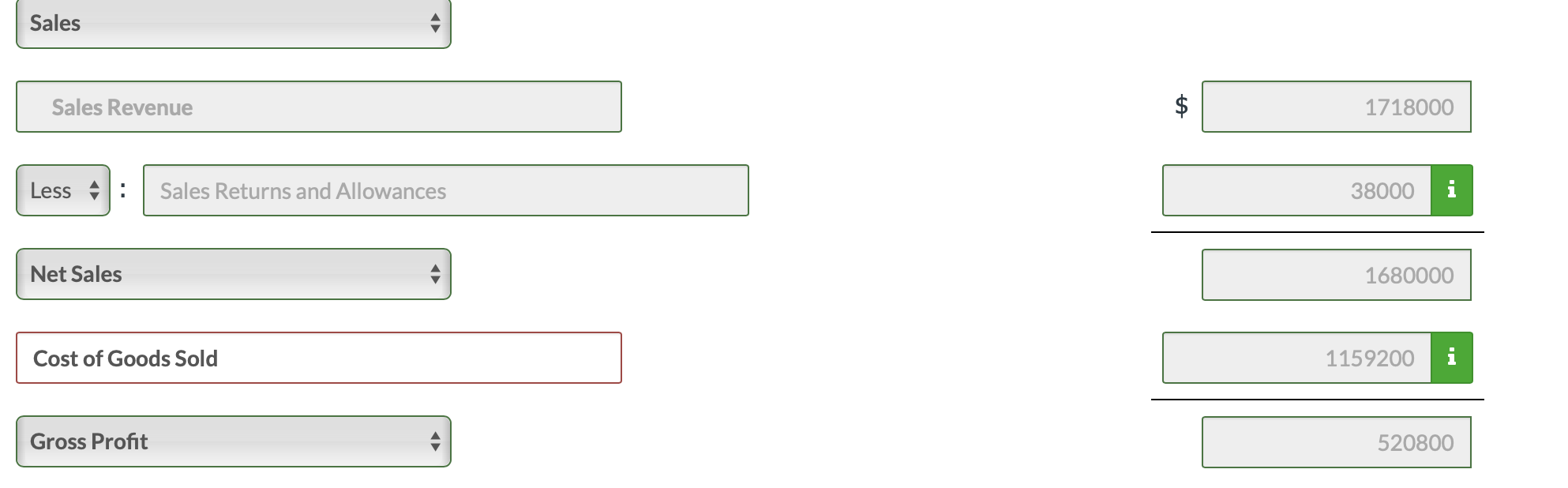

Need help with calculating the revised net income, profit margin and gross profit rate current net income - 67200 Sales 1718000 Sales Revenue i Less

Need help with calculating the revised net income, profit margin and gross profit rate

Need help with calculating the revised net income, profit margin and gross profit rate

current net income - 67200

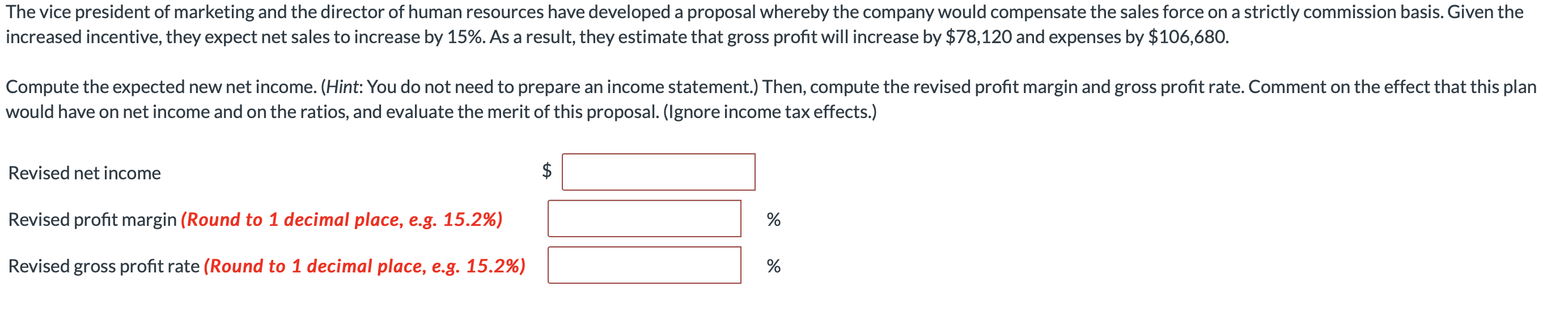

Sales 1718000 Sales Revenue i Less Sales Returns and Allowances 38000 Net Sales 1680000 i Cost of Goods Sold 115 200 Gross Profit 520800 The vice president of marketing and the director of human resources have developed a proposal whereby the company would compensate the sales force on a strictly commission basis. Given the increased incentive, they expect net sales to increase by 15%. As a result, they estimate that gross profit will increase by $78,120 and expenses by $106,680 Compute the expected new net income. (Hint: You do not need to prepare an income statement.) Then, compute the revised profit margin and gross profit rate. Comment on the effect that this plan would have on net income and on the ratios, and evaluate the merit of this proposal. (lgnore income tax effects.) Revised net income Revised profit margin (Round to 1 decimal place, e.g. 15.2%) Revised gross profit rate (Round to 1 decimal place, e.g. 15.2%) tAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started