Question

Need help with finance homework as soon as possible! Consider the following information on a yield curve (where t = 0 is now) Time (in

Need help with finance homework as soon as possible!

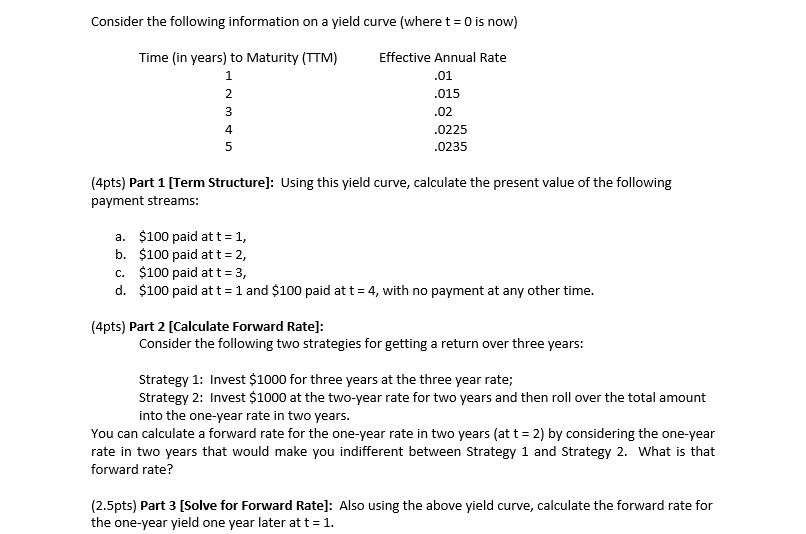

Consider the following information on a yield curve (where t = 0 is now) Time (in years) to Maturity (TTM) Effective Annual Rate 1 .01 2 .015 3 .02 4 .0225 5 .0235

Part 1 [Term Structure]: Using this yield curve, calculate the present value of the following payment streams: a. $100 paid at t = 1, b. $100 paid at t = 2, c. $100 paid at t = 3, d. $100 paid at t = 1 and $100 paid at t = 4, with no payment at any other time.

Part 2 [Calculate Forward Rate]: Consider the following two strategies for getting a return over three years: Strategy 1: Invest $1000 for three years at the three year rate; Strategy 2: Invest $1000 at the two-year rate for two years and then roll over the total amount into the one-year rate in two years. You can calculate a forward rate for the one-year rate in two years (at t = 2) by considering the one-year rate in two years that would make you indifferent between Strategy 1 and Strategy 2. What is that forward rate?

Part 3 [Solve for Forward Rate]: Also using the above yield curve, calculate the forward rate for the one-year yield one year later at t = 1.

Consider the following information on a yield curve (where t 0 is now) Time (in years) to Maturity (TTM) Effective Annual Rate 01 015 02 0225 0235 (4pts) Part 1 [Term Structurel: Using this yield curve, calculate the present value of the following payment streams: a. $100 paid at t 1, b. $100 paid att 32, c. $100 paid at t 3, d. $100 paid at t 1 and 100 paid at t 4, with no payment at any other time (4pts) Part 2 [Calculate Forward Ratel: Consider the following two strategies for getting a return over three years Strategy 1: Invest S1000 for three years at the three year rate; Strategy 2: Invest $1000 at the two-year rate for two years a nd then roll over the total amount into the one-year rate in two years. You can calculate a forward rate for the one-year rate in two years (at t 2) by considering the one-year rate in two years that would make you indifferent between strategy 1 and strategy 2. What is that forward rate? (2.5pts) Part 3 [Solve for Forward Rate]: Also using the above yield curve, calculate the forward rate for the one-year yield one year later at t 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started