Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with journals,t accounts and adjusted and un adjusted thank you for you your support the rest my business with $55,000 cash, $15,000 of

need help with journals,t accounts and adjusted and un adjusted

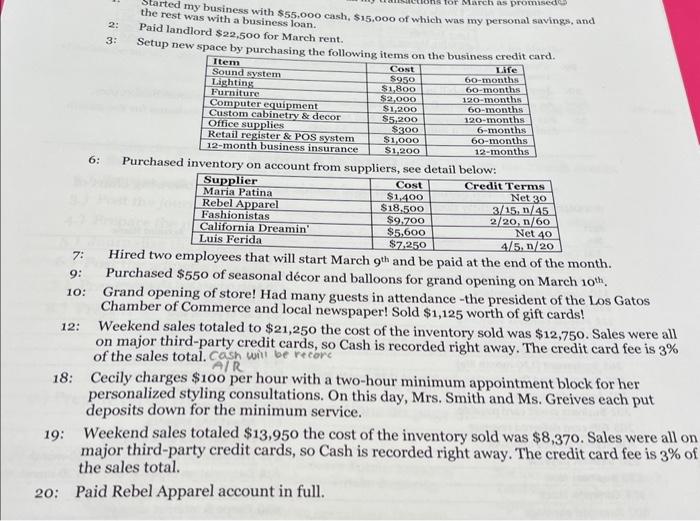

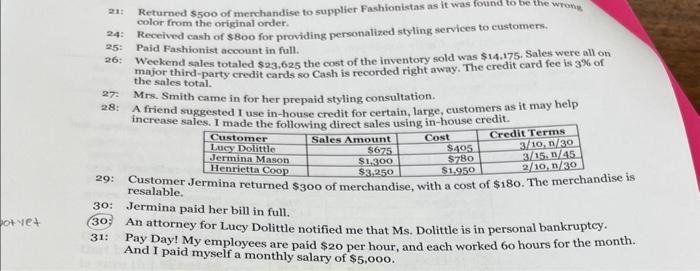

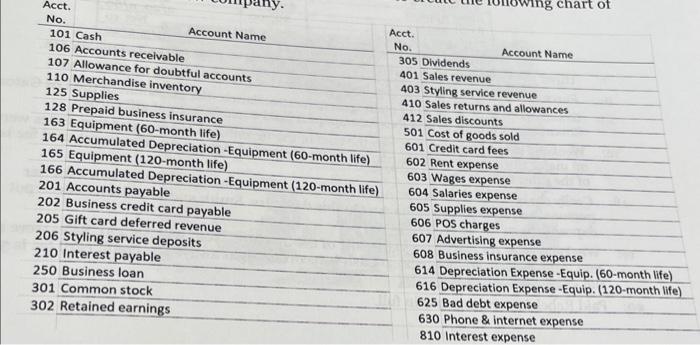

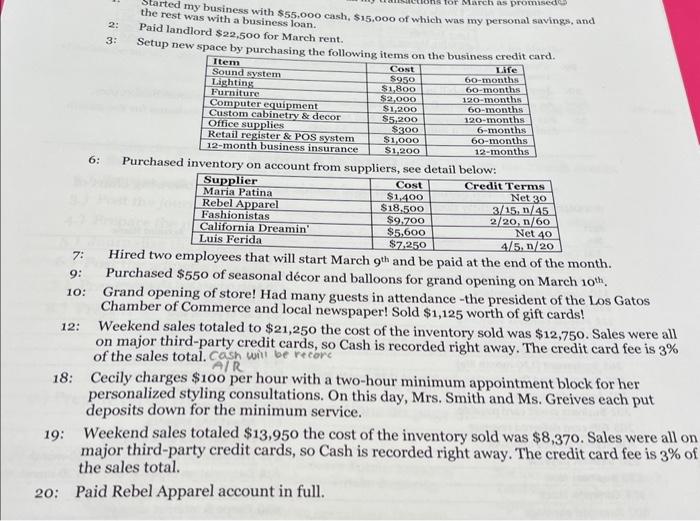

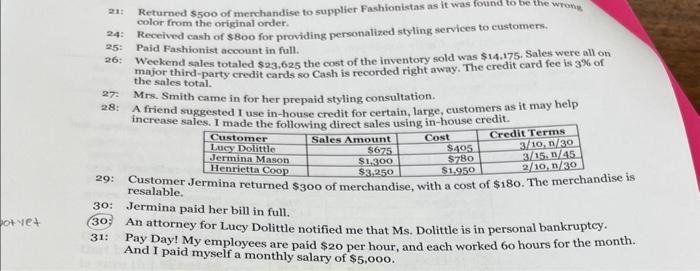

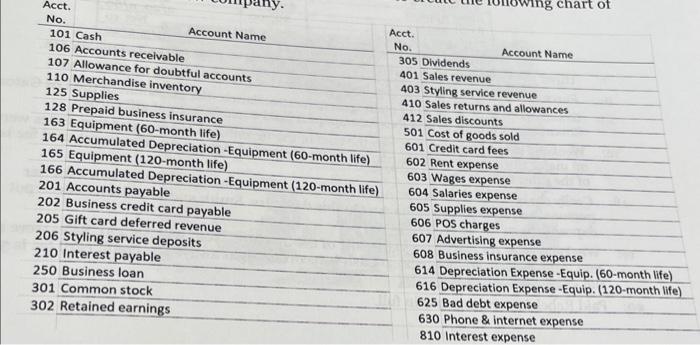

the rest my business with $55,000 cash, $15,000 of which was my personal savings, and 2: Paid landlord $22,500 for March rent. 3: Setup new space by purchasing the followine iteme tho hwai.narn watat ...rd. 6: Purchased inventory on account from suppliers, see detail below: 7: Hired two employees that will start March 9th and be paid at the end of the month. 9: Purchased $550 of seasonal dcor and balloons for grand opening on March 10th. 10: Grand opening of store! Had many guests in attendance - the president of the Los Gatos Chamber of Commerce and local newspaper! Sold $1,125 worth of gift cards! 12: Weekend sales totaled to $21,250 the cost of the inventory sold was $12,750. Sales were all on major third-party credit cards, so Cash is recorded right away. The credit card fee is 3% of the sales total. cash wit be recorc 18: Cecily charges \$1oo per hour with a two-hour minimum appointment block for her personalized styling consultations. On this day, Mrs. Smith and Ms. Greives each put deposits down for the minimum service. 19: Weekend sales totaled $13,950 the cost of the inventory sold was $8,370. Sales were all on major third-party credit cards, so Cash is recorded right away. The credit card fee is 3% of the sales total. 20: Paid Rebel Apparel account in full. 21: Returned s500 of merchandise to supplier Fashionistas as it was found to be the wrong color from the original order. 24: Received cash of $800 for providing personalized styling services to customers. 25: Paid Fashionist account in full. 26: Weekend sales totaled $23,625 the cost of the inventory sold was $14,175. Sales were all on major thind-party credit cards so Cash is recorded right away. The credit card fee is 3% of the sales total. 27: Mrs. Smith came in for her prepaid styling consultation. 28: A friend suggested I use in-house credit for certain, large, customers as it may help increase sales. I made the followine direct sales using in-house credit. 29: Customer Jermina returned $300 of merchandise, with a cost of $180. The mercnandise is resalable. Jermina paid her bill in full. An attorney for Lucy Dolittle notified me that Ms. Dolittle is in personal bankruptcy. Pay Day! My employees are paid $20 per hour, and each worked 60 hours for the month. And I paid myself a monthly salary of $5,000. the rest my business with $55,000 cash, $15,000 of which was my personal savings, and 2: Paid landlord $22,500 for March rent. 3: Setup new space by purchasing the followine iteme tho hwai.narn watat ...rd. 6: Purchased inventory on account from suppliers, see detail below: 7: Hired two employees that will start March 9th and be paid at the end of the month. 9: Purchased $550 of seasonal dcor and balloons for grand opening on March 10th. 10: Grand opening of store! Had many guests in attendance - the president of the Los Gatos Chamber of Commerce and local newspaper! Sold $1,125 worth of gift cards! 12: Weekend sales totaled to $21,250 the cost of the inventory sold was $12,750. Sales were all on major third-party credit cards, so Cash is recorded right away. The credit card fee is 3% of the sales total. cash wit be recorc 18: Cecily charges \$1oo per hour with a two-hour minimum appointment block for her personalized styling consultations. On this day, Mrs. Smith and Ms. Greives each put deposits down for the minimum service. 19: Weekend sales totaled $13,950 the cost of the inventory sold was $8,370. Sales were all on major third-party credit cards, so Cash is recorded right away. The credit card fee is 3% of the sales total. 20: Paid Rebel Apparel account in full. 21: Returned s500 of merchandise to supplier Fashionistas as it was found to be the wrong color from the original order. 24: Received cash of $800 for providing personalized styling services to customers. 25: Paid Fashionist account in full. 26: Weekend sales totaled $23,625 the cost of the inventory sold was $14,175. Sales were all on major thind-party credit cards so Cash is recorded right away. The credit card fee is 3% of the sales total. 27: Mrs. Smith came in for her prepaid styling consultation. 28: A friend suggested I use in-house credit for certain, large, customers as it may help increase sales. I made the followine direct sales using in-house credit. 29: Customer Jermina returned $300 of merchandise, with a cost of $180. The mercnandise is resalable. Jermina paid her bill in full. An attorney for Lucy Dolittle notified me that Ms. Dolittle is in personal bankruptcy. Pay Day! My employees are paid $20 per hour, and each worked 60 hours for the month. And I paid myself a monthly salary of $5,000 thank you for you your support

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started