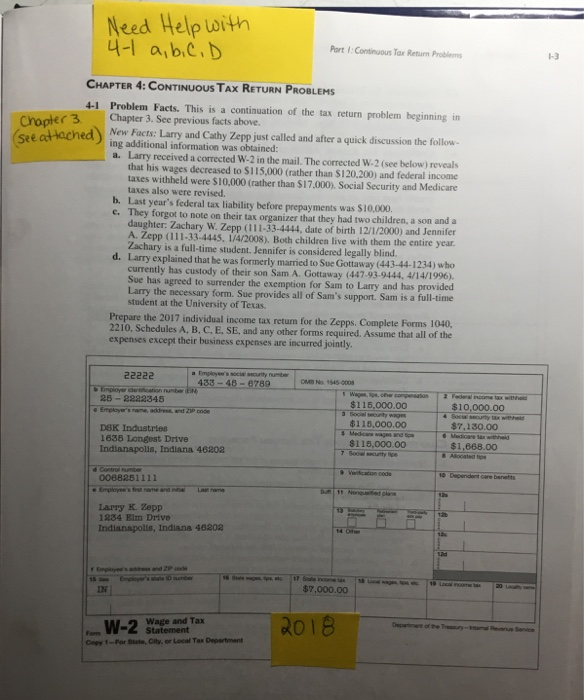

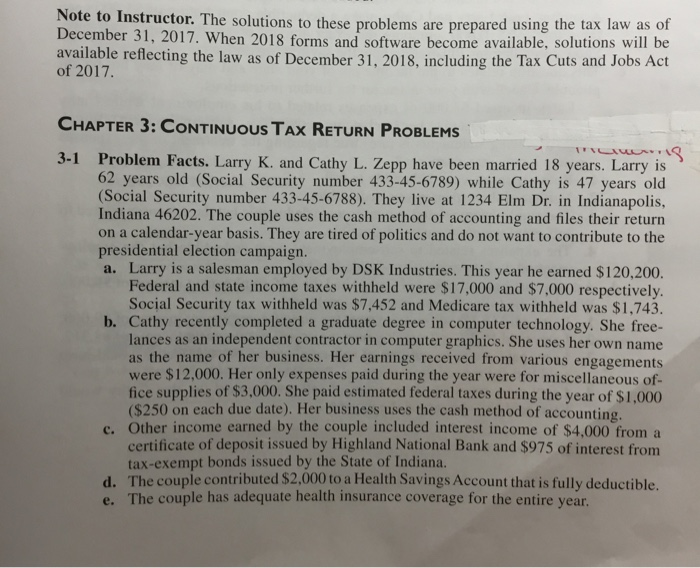

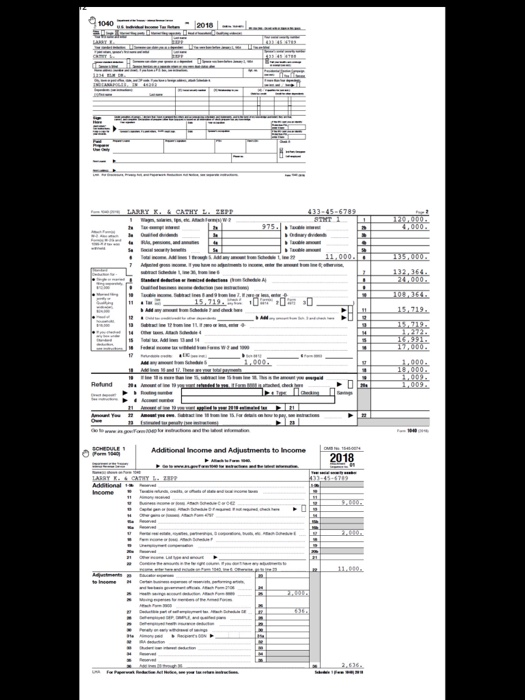

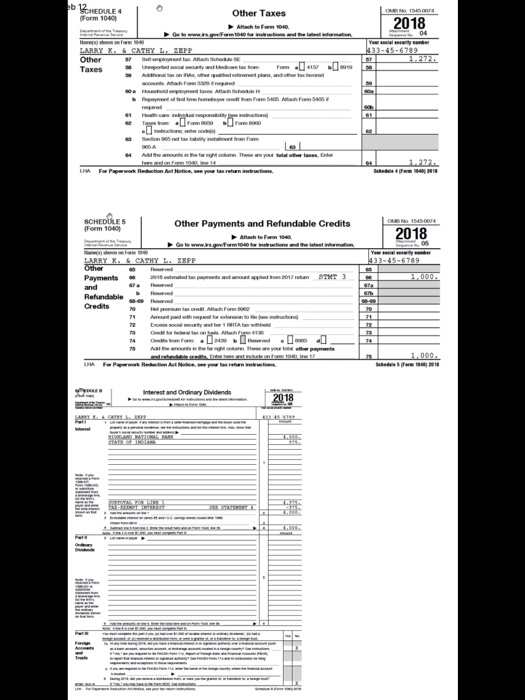

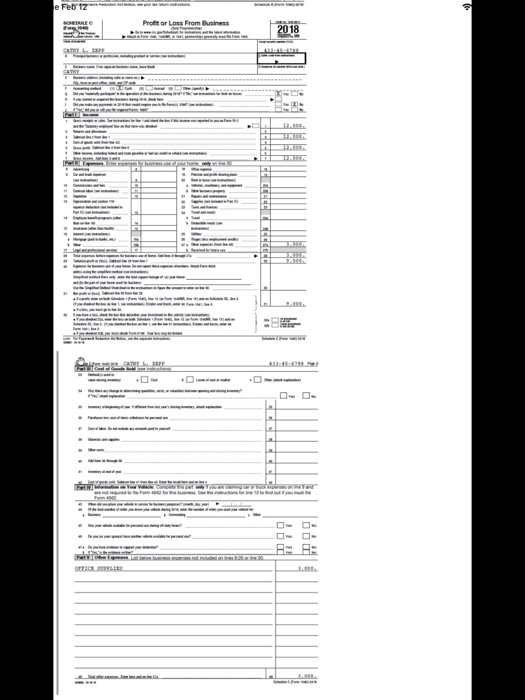

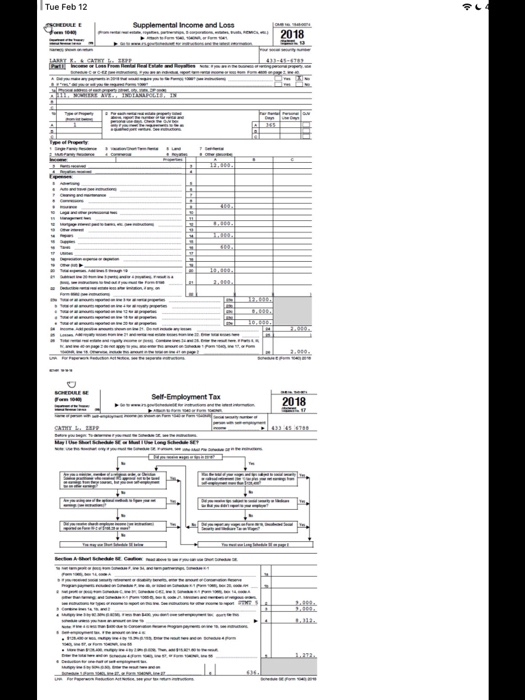

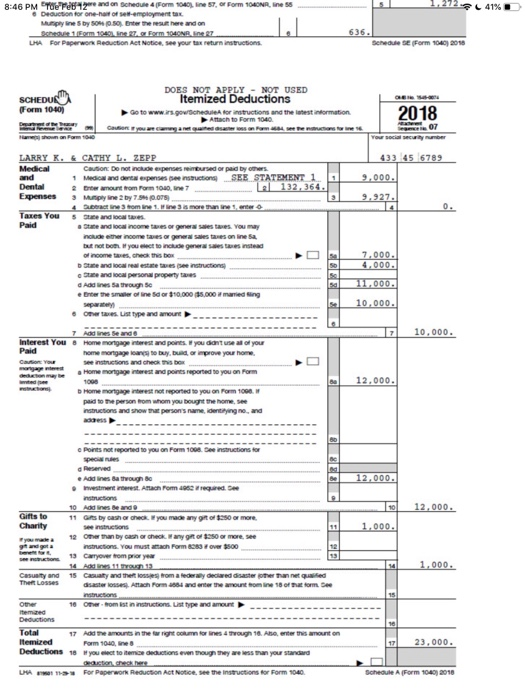

Need Help with nes uI aibiC.D Port I: Continuous Tax Retun Proble 1-3 CHAPTER 4: CONTINUOUS TAX RETURN PROBLEMS 4-1 Problem Facts. This is a continuation of the tax return problem beginning in Chooter3 Chapter 3. See previous facts above. d New Facts: Larry and Cathy Zepp just called and after a quick discussion the follow ing additional information was obtained: a. Larry received a corrected W-2 in the mail. The corrected W-2 (see below) reveals that his wages decreased to $115,000 (rather than $120.200) and federal income taxes withheld were $10,000 (rather than $17.000) Social Security and Medicare taxes also were revised. b. Last year's federal tax liability before prepayments was $10,000. orgot to note on their tax organizer that they had two children, a son and a daughter: Zachary W. Zepp (111-33-4444, date of birth 12/1/2000) and Jennifer A. Zepp (111-33-4445, 1/4/2008), Both children live with them the entire year Zachary is a full-time student. Jennifer is considered legally blind d. Larry explained that he was formerly married to Sue Gottaway (44344 1234) who currently has custody of their son Sam A. Gottaway (447-93-9444, 4/14/1996). Sue has agreed to surrender the exemption for Sam to Lary and has provided Larry the necessary form. Sue provides all of Sam's support. Sam is a full-time student at the University of Texas. Prepare the 2017 individual income tax retun for the Zepps. Complete Forms 1040, 2210, Schedules A, B. C. E, SE, and any other forms required. Assume that all of expenses except their business expenses are incurred jointly. 433-48-6789 M No. 1545 000 25-2222345 $10,000.00 $115,000.00 social security wag $115,000.00 DSK Industries 1635 Longest Drive Indianapolls, Indiana 46202 $7,130.0o Medicare tas $1,668.00 $115,000.00 0068251111 Larry K. Zepp 1234 Elm Drive Indianapolls, Indiana 46202 $7,000.00 IN Wage and Tax Statement Copy 1-For State, City, or Local Tax Department Note to Instructor. The solutions to these problems are prepared using the tax law as of December 31, 2017. When 2018 forms and software become available, solutions will be available reflecting the law as of December 31, 2018, including the Tax Cuts and Jobs Act of 2017 CHAPTER 3: CONTINUOus TAx RETURN PROBLEMS 3-1 Problem Facts. Larry K. and Cathy L. Zepp have been married 18 years. Larry is 62 years old (Social Security number 433-45-6789) while Cathy is 47 years old Social Security number 433-45-6788). They live at 1234 Elm Dr. in Indianapolis, Indiana 46202. The couple uses the cash method of accounting and files their return on a calendar-year basis. They are tired of politics and do not want to contribute to the presidential election campaign. a. Larry is a salesman employed by DSK Industries. This year he earned $120,200. Federal and state income taxes withheld were $17,000 and $7,000 respectively Social Security tax withheld was $7,452 and Medicare tax withheld was $1,743 b. Cathy recently completed a graduate degree in computer technology. She free- lances as an independent contractor in computer graphics. She uses her own name as the name of her business. Her earnings received from various engagements Her only expenses paid during the year were for miscellaneous of- fice supplies of $3,000. She paid estimated federal taxes during the year of $1,000 were $12,000. ($250 on each due date). Her business uses the cash method of accounting tax-exempt bonds issued by the State of Indiana c. Other income earned by the couple included interest income of $4,000 from a certificate of deposit issued by Highland National Bank and $975 of interest from The couple contributed $2,000 to a Health Savings Account that is fully deductible d. e. The couple has adequate health insurance coverage for the entire year 2018 2018 Other Taxes 2018 Form 1040 Taxes Other Payments and Refundable Credits Form 100 Credits nterest and Ordinary Dividends Profit or Loss From Business scnedue SE(Form 1040) 201 DOES NOT APPLYNOT USED 2018 Medical Medica and derta expenses pee instuctions SEE STATEMENT 1 Dental ExpensesMmply ine 2 by 7 5(0.075 Paid 0,000 12.000 a3e5 12,000. Gifts to Ove-rom st in instructions List type and amourt temized 23,000 Gchedule A (Form 1040) 2018 Need Help with nes uI aibiC.D Port I: Continuous Tax Retun Proble 1-3 CHAPTER 4: CONTINUOUS TAX RETURN PROBLEMS 4-1 Problem Facts. This is a continuation of the tax return problem beginning in Chooter3 Chapter 3. See previous facts above. d New Facts: Larry and Cathy Zepp just called and after a quick discussion the follow ing additional information was obtained: a. Larry received a corrected W-2 in the mail. The corrected W-2 (see below) reveals that his wages decreased to $115,000 (rather than $120.200) and federal income taxes withheld were $10,000 (rather than $17.000) Social Security and Medicare taxes also were revised. b. Last year's federal tax liability before prepayments was $10,000. orgot to note on their tax organizer that they had two children, a son and a daughter: Zachary W. Zepp (111-33-4444, date of birth 12/1/2000) and Jennifer A. Zepp (111-33-4445, 1/4/2008), Both children live with them the entire year Zachary is a full-time student. Jennifer is considered legally blind d. Larry explained that he was formerly married to Sue Gottaway (44344 1234) who currently has custody of their son Sam A. Gottaway (447-93-9444, 4/14/1996). Sue has agreed to surrender the exemption for Sam to Lary and has provided Larry the necessary form. Sue provides all of Sam's support. Sam is a full-time student at the University of Texas. Prepare the 2017 individual income tax retun for the Zepps. Complete Forms 1040, 2210, Schedules A, B. C. E, SE, and any other forms required. Assume that all of expenses except their business expenses are incurred jointly. 433-48-6789 M No. 1545 000 25-2222345 $10,000.00 $115,000.00 social security wag $115,000.00 DSK Industries 1635 Longest Drive Indianapolls, Indiana 46202 $7,130.0o Medicare tas $1,668.00 $115,000.00 0068251111 Larry K. Zepp 1234 Elm Drive Indianapolls, Indiana 46202 $7,000.00 IN Wage and Tax Statement Copy 1-For State, City, or Local Tax Department Note to Instructor. The solutions to these problems are prepared using the tax law as of December 31, 2017. When 2018 forms and software become available, solutions will be available reflecting the law as of December 31, 2018, including the Tax Cuts and Jobs Act of 2017 CHAPTER 3: CONTINUOus TAx RETURN PROBLEMS 3-1 Problem Facts. Larry K. and Cathy L. Zepp have been married 18 years. Larry is 62 years old (Social Security number 433-45-6789) while Cathy is 47 years old Social Security number 433-45-6788). They live at 1234 Elm Dr. in Indianapolis, Indiana 46202. The couple uses the cash method of accounting and files their return on a calendar-year basis. They are tired of politics and do not want to contribute to the presidential election campaign. a. Larry is a salesman employed by DSK Industries. This year he earned $120,200. Federal and state income taxes withheld were $17,000 and $7,000 respectively Social Security tax withheld was $7,452 and Medicare tax withheld was $1,743 b. Cathy recently completed a graduate degree in computer technology. She free- lances as an independent contractor in computer graphics. She uses her own name as the name of her business. Her earnings received from various engagements Her only expenses paid during the year were for miscellaneous of- fice supplies of $3,000. She paid estimated federal taxes during the year of $1,000 were $12,000. ($250 on each due date). Her business uses the cash method of accounting tax-exempt bonds issued by the State of Indiana c. Other income earned by the couple included interest income of $4,000 from a certificate of deposit issued by Highland National Bank and $975 of interest from The couple contributed $2,000 to a Health Savings Account that is fully deductible d. e. The couple has adequate health insurance coverage for the entire year 2018 2018 Other Taxes 2018 Form 1040 Taxes Other Payments and Refundable Credits Form 100 Credits nterest and Ordinary Dividends Profit or Loss From Business scnedue SE(Form 1040) 201 DOES NOT APPLYNOT USED 2018 Medical Medica and derta expenses pee instuctions SEE STATEMENT 1 Dental ExpensesMmply ine 2 by 7 5(0.075 Paid 0,000 12.000 a3e5 12,000. Gifts to Ove-rom st in instructions List type and amourt temized 23,000 Gchedule A (Form 1040) 2018