Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information shows the financial status and the transaction in December 2021 of a construction material company XYZ a. Sold $35,000 of material in

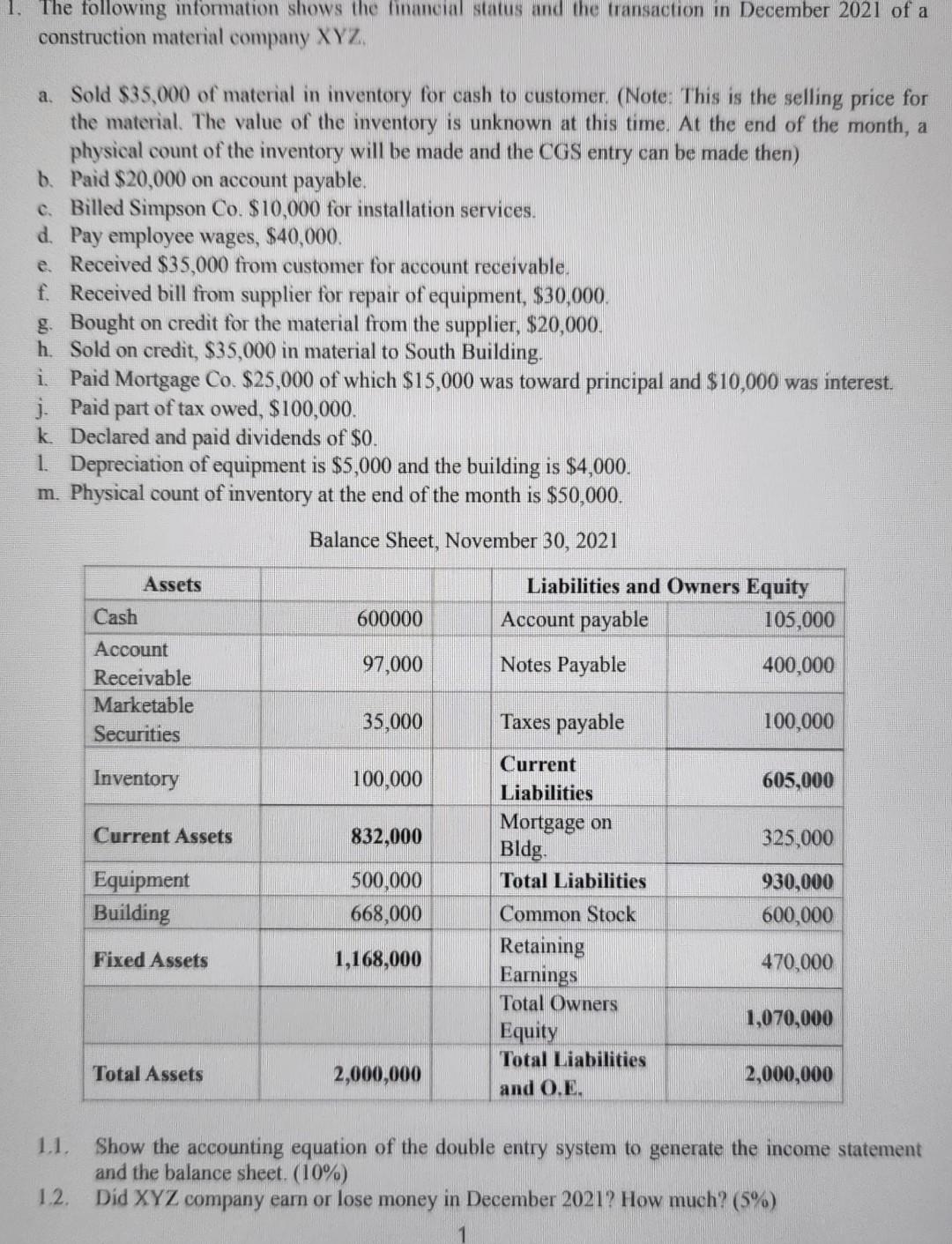

The following information shows the financial status and the transaction in December 2021 of a construction material company XYZ a. Sold $35,000 of material in inventory for cash to customer. (Note: This is the selling price for the material. The value of the inventory is unknown at this time. At the end of the month, a physical count of the inventory will be made and the CGS entry can be made then) b. Paid $20,000 on account payable. c. Billed Simpson Co. $10,000 for installation services. d. Pay employee wages, $40,000. e Received $35,000 from customer for account receivable. f. Received bill from supplier for repair of equipment, $30,000. g. Bought on credit for the material from the supplier, $20,000. h. Sold on credit, $35,000 in material to South Building. i. Paid Mortgage Co. $25,000 of which $15,000 was toward principal and $10,000 was interest. j. Paid part of tax owed, $100,000. k Declared and paid dividends of $0. 1 Depreciation of equipment is $5,000 and the building is $4,000. m. Physical count of inventory at the end of the month is $50,000. Balance Sheet, November 30, 2021 Assets 600000 Cash Account Receivable Marketable Securities Liabilities and Owners Equity Account payable 105,000 Notes Payable 400,000 97,000 35,000 Taxes payable 100,000 Inventory 100,000 605,000 Current Assets 832,000 325,000 Equipment Building 500,000 668,000 1,168,000 Current Liabilities Mortgage on Bldg. Total Liabilities Common Stock Retaining Earnings Total Owners Equity Total Liabilities and O.E. 930,000 600,000 Fixed Assets 470,000 1,070,000 Total Assets 2,000,000 2,000,000 1.1. Show the accounting equation of the double entry system to generate the income statement and the balance sheet. (10%) Did XYZ company earn or lose money in December 2021? How much? (5%) 1.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started