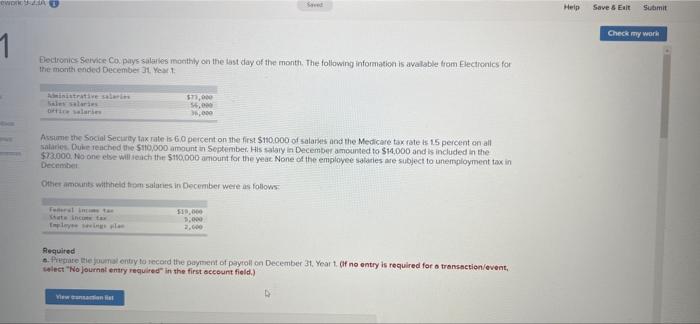

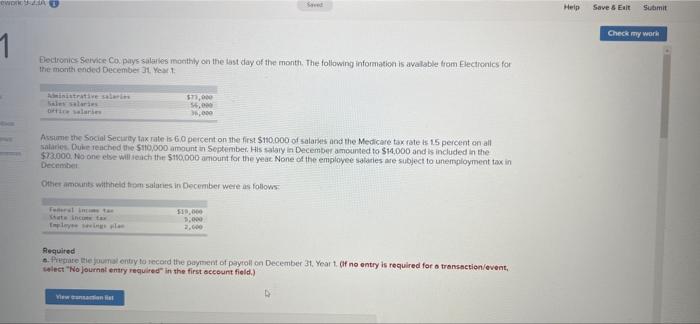

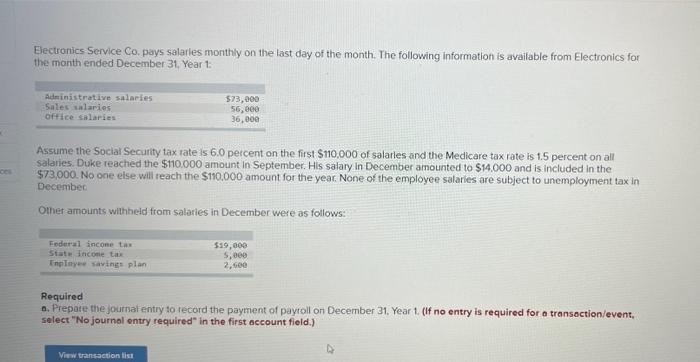

OWO Help Save & Edit Submit Check my werk 1 Electronics Service Co. pays saates monthly on the last day of the month. The following information is available from Electronics for the month ended December 31 Year Ministratives Blessis Hilari $1,000 5.000 9,000 Assume the Social Security tax rate is 60 percent on the first $110.000 of salaries and the Medicare tax rate is 15 percent on all Salaries. Duke reached the $110,000 amount in September. His salary in December amounted to $14,000 and is included in the $72,000. No one else will teach the $110.000 amount for the year None of the employee salaries are subject to unemployment tax in December Other amounts withheld from salonies in December were as follows Flint SIN.000 1.000 2.600 Ty Required .. Prepare the journal entry to record the payment of payroll on December 31 Year 1 of no entry is required for a transaction/event, select "No journal entry required in the first account field.) View b. Prepare the journal entry to record the payroll tax expense for Electronics Service Co. for December Year 1. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transactions Journal entry worksheet > Record the entry for payroll tax expense for Electronics Servico, for December Year 1 Electronics Service Co. pays salaries monthly on the last day of the month. The following information is available from Electronics for the month ended December 31 Yeart: Administrative salaries Sales salaries Office salaries 573,000 56,000 36.000 Assume the Social Security tax rate is 6.0 percent on the first $110,000 of salarles and the Medicare tax rate is 1.5 percent on all salaries. Duke reached the $110.000 amount in September. His salary in December amounted to $14.000 and is included in the $73,000. No one else will teach the $110.000 amount for the year. None of the employee salaries are subject to unemployment tax in December Other amounts withheld from salaries in December were as follows: Federal income tax State income tax Enplay savings plan $19,000 5,000 2,600 Required a. Prepare the journal entry to record the payment of payroll on December 31, Year 1 (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Cena View general journal b. Prepare the journal entry to record the payroll tax expense for Electronics Service Co. for December Year 1 of no entry is required for a transaction/event, select "No journal entry required in the first account field.) View trasie Journal entry worksheet > Record the entry for payroll tax epide for Electronics Service Co for December 1 GE Prov 101 ! Next pe here to search O e