Need help with Part D and E! Thank you!

| Journal Entry: d) Jet Ski training | | | | | | | | |

| 12/31/2020 | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Briefly describe the issue and explain how you decided to handle it. Also show how you calculated any values. | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Journal Entry: e) loan | | | | | | | | | |

| 12/31/2020 | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Briefly describe the issue and explain how you decided to handle it. Also show how you calculated any values. | | |

| | | | | | | | | | | |

| | | |

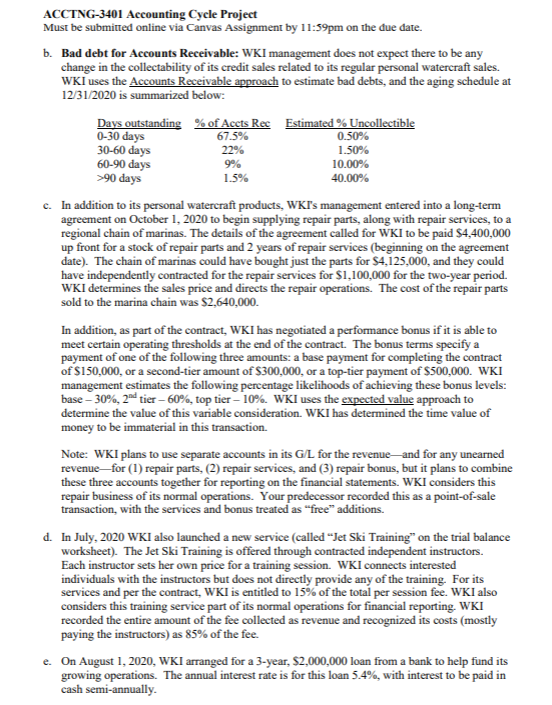

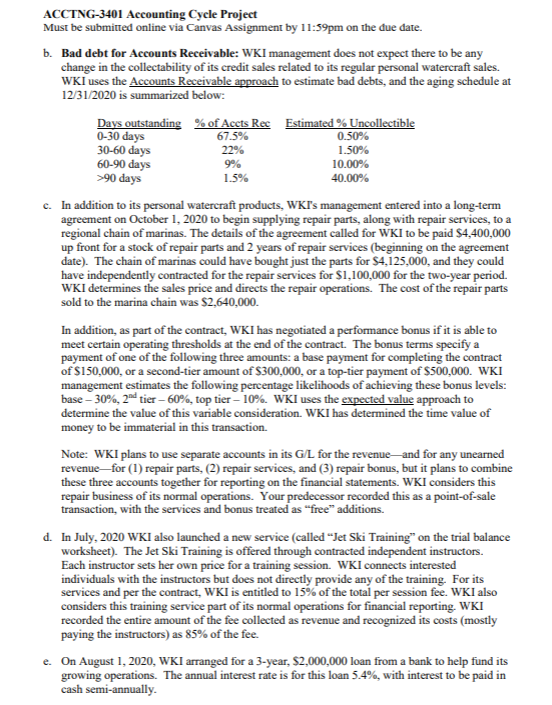

ACCTNG-3401 Accounting Cycle Project Must be submitted online via Canvas Assignment by 11:59pm on the due date. b. Bad debt for Accounts Receivable: WKI management does not expect there to be any change in the collectability of its credit sales related to its regular personal watercraft sales. WKI uses the Accounts Receivable approach to estimate bad debts, and the aging schedule at 12/31/2020 is summarized below: Days outstanding % of Accts Rec Estimated % Uncollectible 0-30 days 67.5% 0.50% 30-60 days 22% 1.50% 60-90 days 9% 10.00% >90 days 1.5% 40.00% c. In addition to its personal watercraft products, WKI's management entered into a long-term agreement on October 1, 2020 to begin supplying repair parts, along with repair services, to a regional chain of marinas. The details of the agreement called for WKI to be paid $4,400,000 up front for a stock of repair parts and 2 years of repair services (beginning on the agreement date). The chain of marinas could have bought just the parts for $4, 125,000, and they could have independently contracted for the repair services for $1,100,000 for the two-year period. WKI determines the sales price and directs the repair operations. The cost of the repair parts sold to the marina chain was $2,640,000 In addition, as part of the contract, WKI has negotiated a performance bonus if it is able to meet certain operating thresholds at the end of the contract. The bonus terms specify a payment of one of the following three amounts: a base payment for completing the contract of $150,000, or a second-tier amount of $300,000, or a top-tier payment of $500,000. WKI management estimates the following percentage likelihoods of achieving these bonus levels: base -30%, 2nd tier - 60%, top tier - 10%. WKI uses the expected value approach to determine the value of this variable consideration. WKI has determined the time value of money to be immaterial in this transaction. Note: WKI plans to use separate accounts in its G/L for the revenue and for any unearned revenuefor (1) repair parts, (2) repair services, and (3) repair bonus, but it plans to combine these three accounts together for reporting on the financial statements. WKI considers this repair business of its normal operations. Your predecessor recorded this as a point-of-sale transaction, with the services and bonus treated as "free" additions. d. In July, 2020 WKI also launched a new service (called Jet Ski Training on the trial balance worksheet). The Jet Ski Training is offered through contracted independent instructors. Each instructor sets her own price for a training session. WKI connects interested individuals with the instructors but does not directly provide any of the training. For its services and per the contract, WKI is entitled to 15% of the total per session fee. WKI also considers this training service part of its normal operations for financial reporting. WKI recorded the entire amount of the fee collected as revenue and recognized its costs (mostly paying the instructors) as 85% of the fee. e. On August 1, 2020, WKI arranged for a 3-year, $2,000,000 loan from a bank to help fund its growing operations. The annual interest rate is for this loan 5.4%, with interest to be paid in cash semi-annually. ACCTNG-3401 Accounting Cycle Project Must be submitted online via Canvas Assignment by 11:59pm on the due date. b. Bad debt for Accounts Receivable: WKI management does not expect there to be any change in the collectability of its credit sales related to its regular personal watercraft sales. WKI uses the Accounts Receivable approach to estimate bad debts, and the aging schedule at 12/31/2020 is summarized below: Days outstanding % of Accts Rec Estimated % Uncollectible 0-30 days 67.5% 0.50% 30-60 days 22% 1.50% 60-90 days 9% 10.00% >90 days 1.5% 40.00% c. In addition to its personal watercraft products, WKI's management entered into a long-term agreement on October 1, 2020 to begin supplying repair parts, along with repair services, to a regional chain of marinas. The details of the agreement called for WKI to be paid $4,400,000 up front for a stock of repair parts and 2 years of repair services (beginning on the agreement date). The chain of marinas could have bought just the parts for $4, 125,000, and they could have independently contracted for the repair services for $1,100,000 for the two-year period. WKI determines the sales price and directs the repair operations. The cost of the repair parts sold to the marina chain was $2,640,000 In addition, as part of the contract, WKI has negotiated a performance bonus if it is able to meet certain operating thresholds at the end of the contract. The bonus terms specify a payment of one of the following three amounts: a base payment for completing the contract of $150,000, or a second-tier amount of $300,000, or a top-tier payment of $500,000. WKI management estimates the following percentage likelihoods of achieving these bonus levels: base -30%, 2nd tier - 60%, top tier - 10%. WKI uses the expected value approach to determine the value of this variable consideration. WKI has determined the time value of money to be immaterial in this transaction. Note: WKI plans to use separate accounts in its G/L for the revenue and for any unearned revenuefor (1) repair parts, (2) repair services, and (3) repair bonus, but it plans to combine these three accounts together for reporting on the financial statements. WKI considers this repair business of its normal operations. Your predecessor recorded this as a point-of-sale transaction, with the services and bonus treated as "free" additions. d. In July, 2020 WKI also launched a new service (called Jet Ski Training on the trial balance worksheet). The Jet Ski Training is offered through contracted independent instructors. Each instructor sets her own price for a training session. WKI connects interested individuals with the instructors but does not directly provide any of the training. For its services and per the contract, WKI is entitled to 15% of the total per session fee. WKI also considers this training service part of its normal operations for financial reporting. WKI recorded the entire amount of the fee collected as revenue and recognized its costs (mostly paying the instructors) as 85% of the fee. e. On August 1, 2020, WKI arranged for a 3-year, $2,000,000 loan from a bank to help fund its growing operations. The annual interest rate is for this loan 5.4%, with interest to be paid in cash semi-annually