Answered step by step

Verified Expert Solution

Question

1 Approved Answer

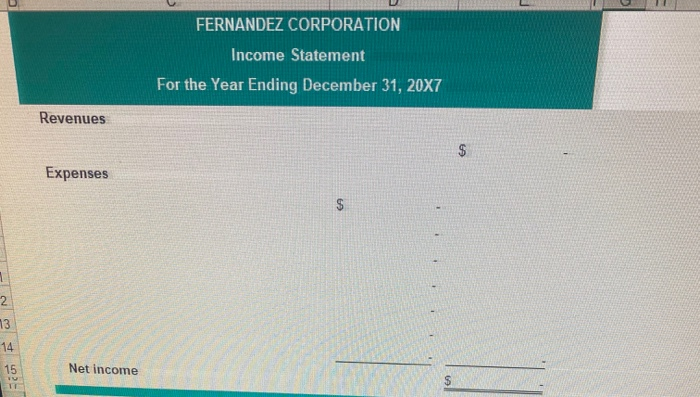

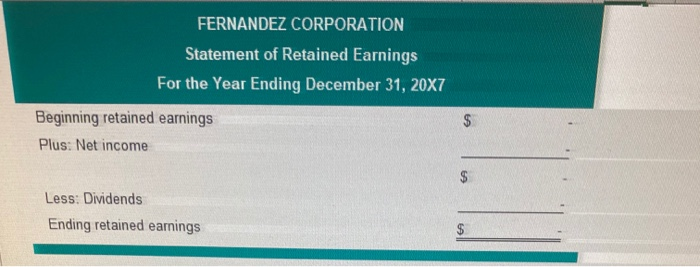

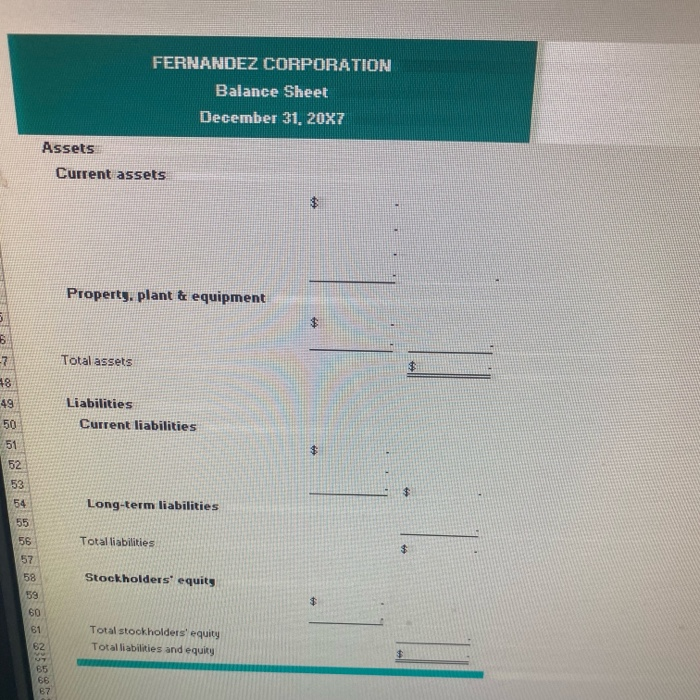

Need help with part G. FERNANDEZ CORPORATION Income Statement For the Year Ending December 31, 20X7 Revenues $ Expenses $ 2 13 14 15 Net

Need help with part G.

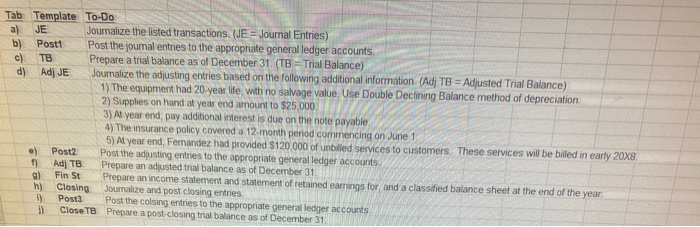

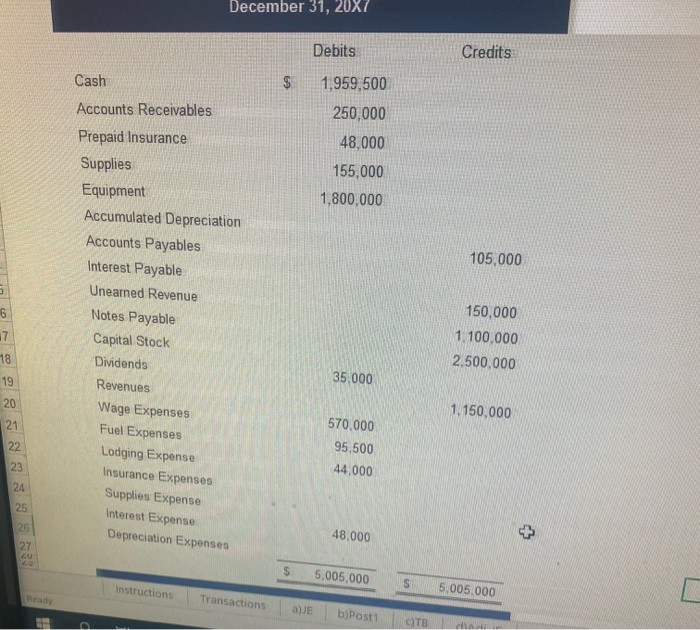

FERNANDEZ CORPORATION Income Statement For the Year Ending December 31, 20X7 Revenues $ Expenses $ 2 13 14 15 Net income $ IT FERNANDEZ CORPORATION Statement of Retained Earnings For the Year Ending December 31, 20X7 $ Beginning retained earnings Plus: Net income $ Less: Dividends Ending retained earnings $ FERNANDEZ CORPORATION Balance Sheet December 31, 20X7 Assets Current assets Property, plant & equipment $ 6 Total assets -7 8 49 Liabilities Current liabilities 50 51 52 53 54 Long-term liabilities 55 56 Total liabilities $ 57 58 Stockholders' equity 59 60 $ 61 Total stockholders' equity Total liabilities and equity 62 65 66 ? Tab Template To-Do a) JE Journalize the listed transactions (JE = Journal Entries) b) Post1 Post the journal entries to the appropriate general ledger accounts c) TB Prepare a trial balance as of December 31. (TB = Trial Balance) d) Adj JE Journalize the adjusting entries based on the following additional information (Adj TB = Adjusted Trial Balance) 1) The equipment had 20-year life with no salvage value. Use Double Declining Balance method of depreciation 2) Supplies on hand at year end amount to $25.000 3) At year end pay additional interest is due on the note payable 4) The insurance policy covered a 12 month period commencing on June 1 5) At year end, Fernandez had provided $120,000 of unbilled services to customers. These services will be billed in early 20X8. e) Post2 Post the adjusting entries to the appropriate general ledger accounts 1) Ad TB Prepare an adjusted trial balance as of December 31 g) Fin St Prepare an income statement and statement of retained earnings for and a classified balance sheet at the end of the year h) Closing Journalize and post closing entries 0) Post3 Post the colsing entries to the appropriate general ledger accounts Close TB Prepare a post-closing trial balance as of December 31 December 31, 20X7 Debits Credits $ 1,959,500 250,000 48,000 155,000 1,800,000 105,000 Cash Accounts Receivables Prepaid Insurance Supplies Equipment Accumulated Depreciation Accounts Payables Interest Payable Unearned Revenue Notes Payable Capital Stock Dividends Revenues Wage Expenses Fuel Expenses Lodging Expense Insurance Expenses Supplies Expense U 6 7 150,000 1.100.000 2,500,000 18 19 35,000 20 1,150.000 21 22 570.000 95,500 44,000 23 24 25 26 Interest Expense Depreciation Expenses 48,000 27 S 5,005,000 S Instructions 5,005,000 Ready Transactions a)JE b) Post1 TB Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started