Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with question b. Please answer this today. The City of Waterman established a capital projects fund for the construction of an access ramp

Need help with question b. Please answer this today.

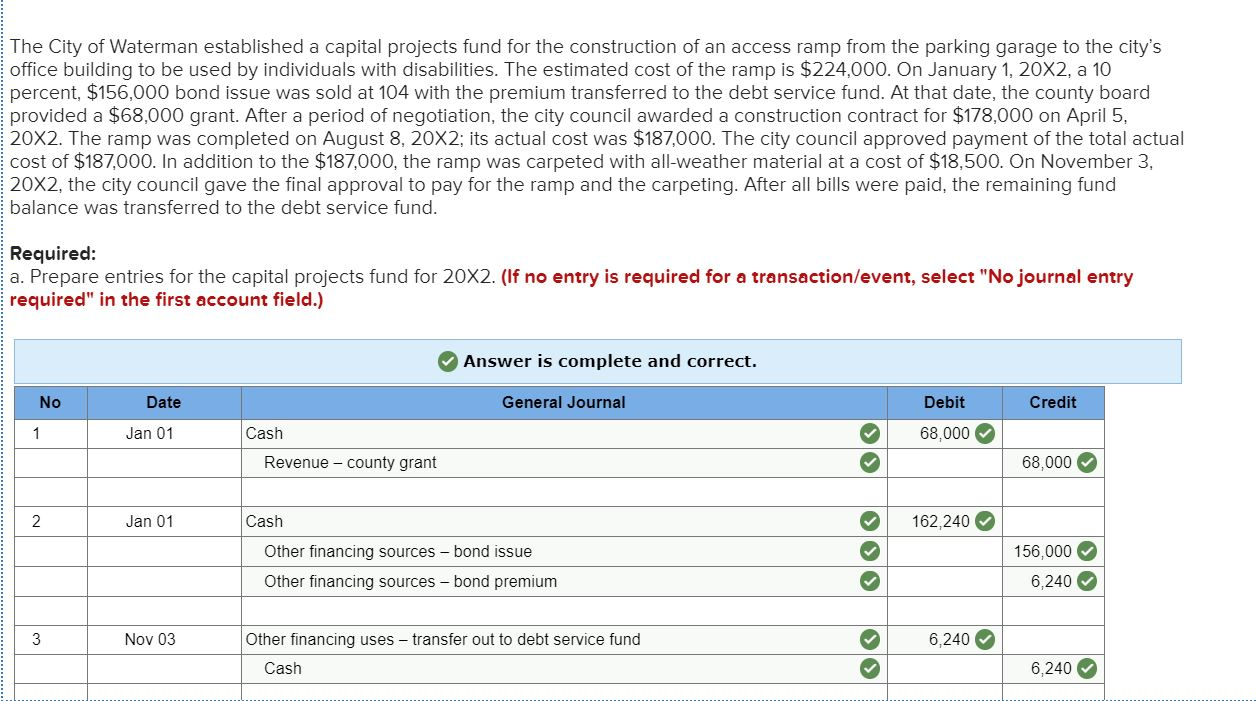

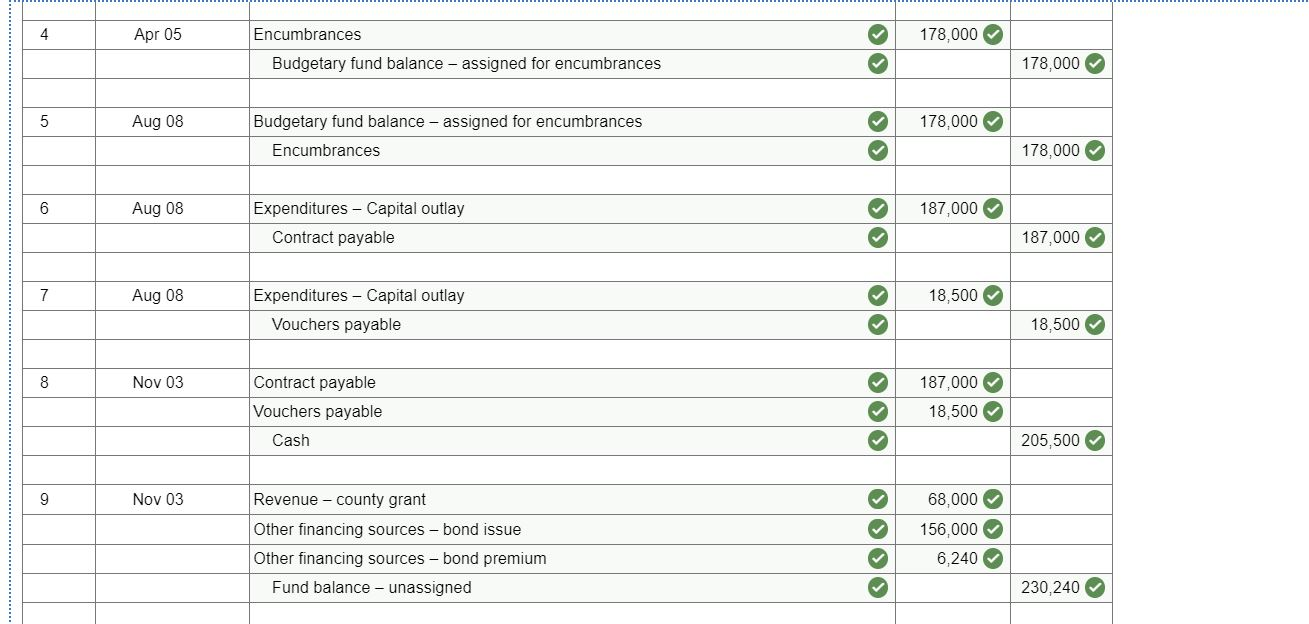

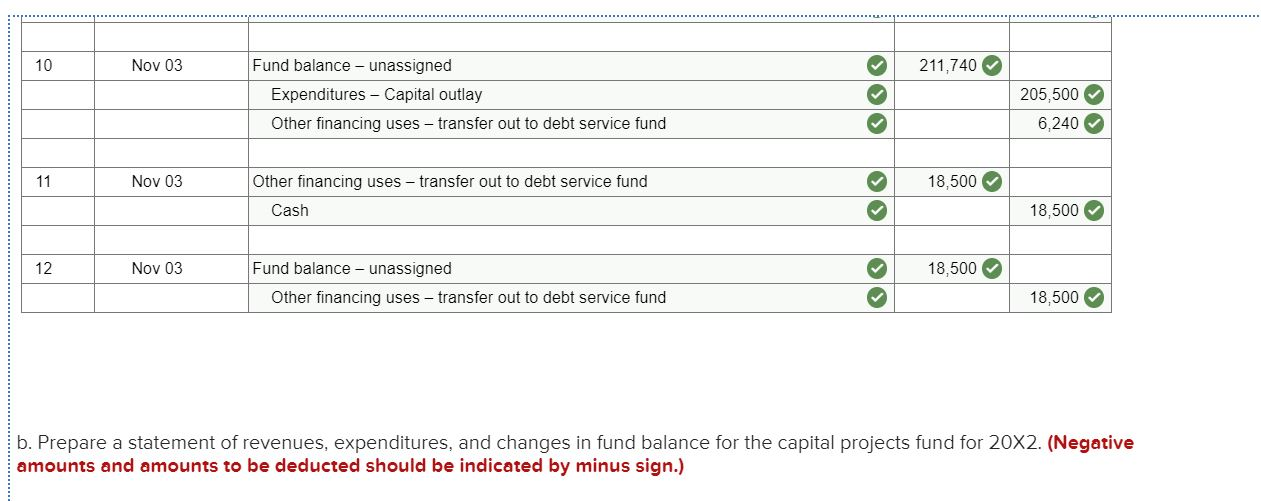

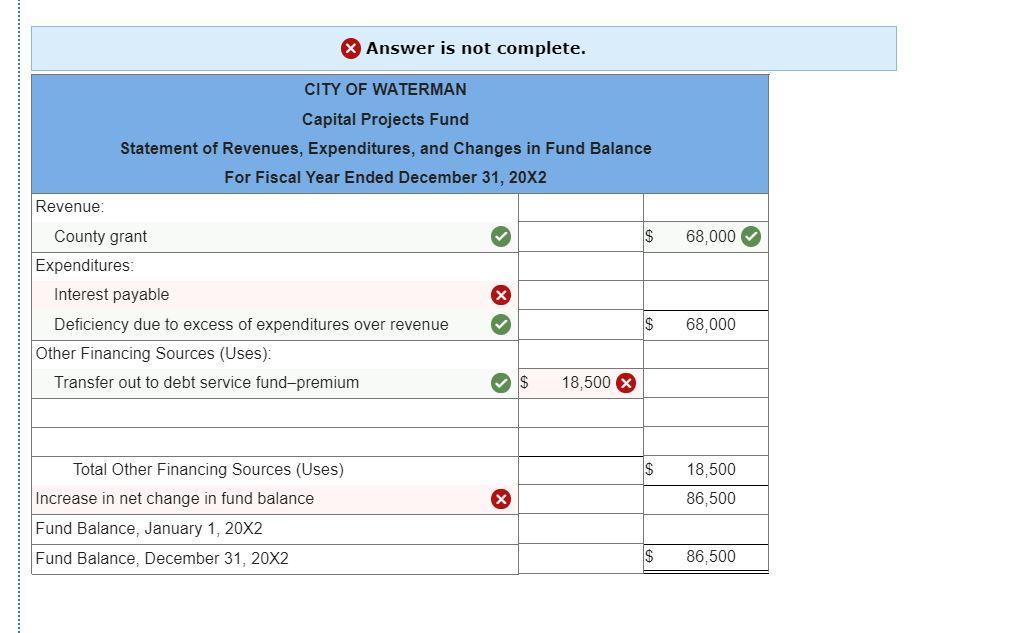

The City of Waterman established a capital projects fund for the construction of an access ramp from the parking garage to the city's office building to be used by individuals with disabilities. The estimated cost of the ramp is $224,000. On January 1, 20X2, a 10 percent, $156,000 bond issue was sold at 104 with the premium transferred to the debt service fund. At that date, the county board provided a $68,000 grant. After a period of negotiation, the city council awarded a construction contract for $178,000 on April 5, 20X2. The ramp was completed on August 8, 20X2; its actual cost was $187,000. The city council approved payment of the total actual cost of $187,000. In addition to the $187,000, the ramp was carpeted with all-weather material at a cost of $18,500. On November 3, 20X2, the city council gave the final approval to pay for the ramp and the carpeting. After all bills were paid, the remaining fund balance was transferred to the debt service fund. period of negox2; its actual coeted with all-we Required: a. Prepare entries for the capital projects fund for 20X2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete and correct. No General Journal Debit Credit Date Jan 01 68,000 Cash Revenue - county grant 68,000 Jan 01 162,240 Cash Other financing sources - bond issue Other financing sources - bond premium 156,000 6,240 Nov 03 6,240 Other financing uses - transfer out to debt service fund Cash 6.240 Apr 05 178,000 Encumbrances Budgetary fund balance - assigned for encumbrances 178,000 Aug 08 178,000 Budgetary fund balance - assigned for encumbrances Encumbrances 178,000 Aug 08 187,000 Expenditures - Capital outlay Contract payable 187,000 Aug 08 18,500 Expenditures - Capital outlay Vouchers payable 18,500 Nov 03 Contract payable Vouchers payable Cash 187,000 18,500 205,500 Nov 03 Revenue - county grant Other financing sources - bond issue Other financing sources - bond premium Fund balance - unassigned 68,000 156,000 6,240 230,240 Nov 03 211,740 Fund balance - unassigned Expenditures - Capital outlay Other financing uses - transfer out to debt service fund 205,500 6,240 Nov 03 18,500 Other financing uses - transfer out to debt service fund Cash 18,500 Nov 03 18,500 Fund balance - unassigned Other financing uses - transfer out to debt service fund 18,500 b. Prepare a statement of revenues, expenditures, and changes in fund balance for the capital projects fund for 20X2. (Negative amounts and amounts to be deducted should be indicated by minus sign.) Answer is not complete. CITY OF WATERMAN Capital Projects Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For Fiscal Year Ended December 31, 20X2 Revenue: County grant $ 68,000 Expenditures: $ 68,000 Interest payable Deficiency due to excess of expenditures over revenue Other Financing Sources (Uses): Transfer out to debt service fund-premium $ 18,500 $ 18,500 86,500 Total Other Financing Sources (Uses) Increase in net change in fund balance Fund Balance, January 1, 20X2 Fund Balance, December 31, 20X2 $ 86,500 The City of Waterman established a capital projects fund for the construction of an access ramp from the parking garage to the city's office building to be used by individuals with disabilities. The estimated cost of the ramp is $224,000. On January 1, 20X2, a 10 percent, $156,000 bond issue was sold at 104 with the premium transferred to the debt service fund. At that date, the county board provided a $68,000 grant. After a period of negotiation, the city council awarded a construction contract for $178,000 on April 5, 20X2. The ramp was completed on August 8, 20X2; its actual cost was $187,000. The city council approved payment of the total actual cost of $187,000. In addition to the $187,000, the ramp was carpeted with all-weather material at a cost of $18,500. On November 3, 20X2, the city council gave the final approval to pay for the ramp and the carpeting. After all bills were paid, the remaining fund balance was transferred to the debt service fund. period of negox2; its actual coeted with all-we Required: a. Prepare entries for the capital projects fund for 20X2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete and correct. No General Journal Debit Credit Date Jan 01 68,000 Cash Revenue - county grant 68,000 Jan 01 162,240 Cash Other financing sources - bond issue Other financing sources - bond premium 156,000 6,240 Nov 03 6,240 Other financing uses - transfer out to debt service fund Cash 6.240 Apr 05 178,000 Encumbrances Budgetary fund balance - assigned for encumbrances 178,000 Aug 08 178,000 Budgetary fund balance - assigned for encumbrances Encumbrances 178,000 Aug 08 187,000 Expenditures - Capital outlay Contract payable 187,000 Aug 08 18,500 Expenditures - Capital outlay Vouchers payable 18,500 Nov 03 Contract payable Vouchers payable Cash 187,000 18,500 205,500 Nov 03 Revenue - county grant Other financing sources - bond issue Other financing sources - bond premium Fund balance - unassigned 68,000 156,000 6,240 230,240 Nov 03 211,740 Fund balance - unassigned Expenditures - Capital outlay Other financing uses - transfer out to debt service fund 205,500 6,240 Nov 03 18,500 Other financing uses - transfer out to debt service fund Cash 18,500 Nov 03 18,500 Fund balance - unassigned Other financing uses - transfer out to debt service fund 18,500 b. Prepare a statement of revenues, expenditures, and changes in fund balance for the capital projects fund for 20X2. (Negative amounts and amounts to be deducted should be indicated by minus sign.) Answer is not complete. CITY OF WATERMAN Capital Projects Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For Fiscal Year Ended December 31, 20X2 Revenue: County grant $ 68,000 Expenditures: $ 68,000 Interest payable Deficiency due to excess of expenditures over revenue Other Financing Sources (Uses): Transfer out to debt service fund-premium $ 18,500 $ 18,500 86,500 Total Other Financing Sources (Uses) Increase in net change in fund balance Fund Balance, January 1, 20X2 Fund Balance, December 31, 20X2 $ 86,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started