Need help with questions 1-8. Step by Step will be helpful.

Open T-accounts and enter opening balances as of August 31,2017 from Trial Balanve given at the beginning?

Update T-Accounts with the transactions for september through November?

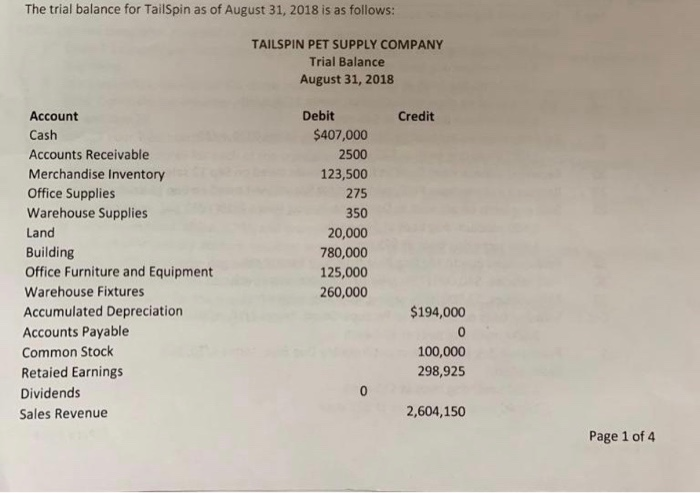

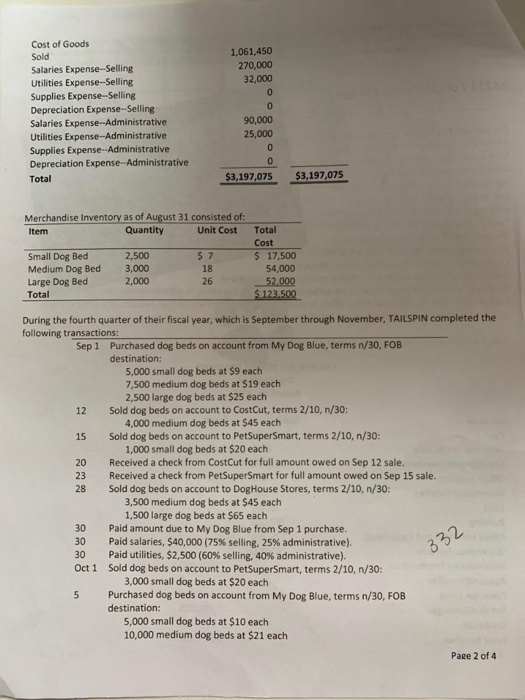

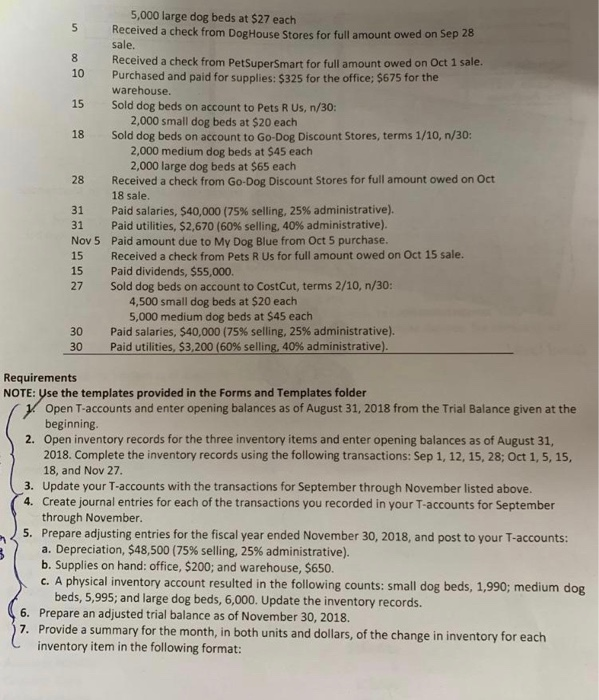

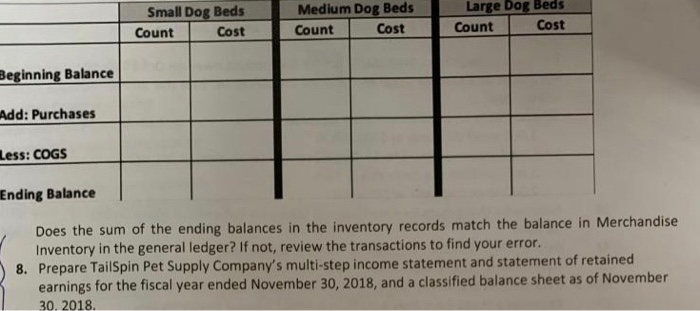

The trial balance for TailSpin as of August 31, 2018 is as follows: TAILSPIN PET SUPPLY COMPANY Trial Balance August 31, 2018 Debit Account Cash Accounts Receivable Merchandise Inventory Office Supplies Warehouse Supplies Land Building Office Furniture and Equipment Warehouse Fixtures Accumulated Depreciation Accounts Payable Common Stock Retaied Earnings Dividends Credit $407,000 2500 123,500 275 350 20,000 780,000 25,000 260,000 $194,000 100,000 298,925 Sales Revenue 2,604,150 Page 1 of 4 Cost of Goods Sold Salaries Expense-Selling Utilities Expense-Selling Supplies Expense-Selling Depreciation Expense- Selling Salaries Expense-Administrative Utilities Expense-Administrative Supplies Expense-Administrative Depreciation ExpenseAdministrative Total 1,061,450 270,000 32,000 90,000 25,000 $3,197,075$3,197,075 Merchandise Inventory as of August 31 consisted of Item QuantityUnit Cost Total Cost Small Dog Bed Medium Dog Bed Large Dog Bed Total 2,500 3,000 2,000 $ 17,500 18 26 54,000 During the fourth quarter of their fiscal year, which is September through November, TAILSPIN completed the following transactions: Purchased dog beds on account from My Dog Blue, terms n/30, FOB destination: Sep 1 5,000 small dog beds at $9 each 7,500 medium dog beds at $19 each 2,500 large dog beds at $25 each Sold dog beds on account to CostCut, terms 2/10, n/30: 12 4,000 medium dog beds at $45 each 15 Sold dog beds on account to PetSuperSmart, terms 2/10, n/30: 20 23 28 1,000 small dog beds at $20 each Received a check from CostCut for full amount owed on Sep 12 sale. Received a check from PetSuperSmart for full amount owed on Sep 15 sale. Sold dog beds on account to DogHouse Stores, terms 2/10, n/30: 3,500 medium dog beds at $45 each 30 30 30 Oct 1 1,500 large dog beds at $65 each Paid amount due to My Dog Blue from Sep 1 purchase. Paid salaries, $40,000 (75% selling, 25% administrative). Paid utilities. S2.500 (60% selling, 40% administrative). Sold dog beds on account to PetSuperSmart, terms 2/10, n/30: 3,000 small dog beds at $20 each 5 Purchased dog beds on account from My Dog Blue, terms n/30, FOB destination: 5,000 small dog beds at $10 each 10,000 medium dog beds at $21 each Page 2 of 4 5,000 large dog beds at $27 each Received a check from DogHouse Stores for full amount owed on Sep 28 sale. Received a check from PetSuperSmart for full amount owed on Oct 1 sale Purchased and paid for supplies: $325 for the office; $675 for the 8 10 15 18 warehouse. Sold dog beds on account to Pets R Us, n/30: 2,000 small dog beds at $20 each Sold dog beds on account to Go-Dog Discount Stores, terms 1/10, n/30: 2,000 medium dog beds at $45 each 2,000 large dog beds at $65 each Received a check from Go-Dog Discount Stores for full amount owed on Oct 18 sale Paid salaries, $40,000 (75% selling, 25% administrative). Paid utilities, $2,670 (60% selling, 40% administrative) Paid amount due to My Dog Blue from Oct 5 purchase. Received a check from Pets R Us for full amount owed on Oct 15 sale. Paid dividends, $55,000. Sold dog beds on account to CostCut, terms 2/10, n/30: 28 31 31 Nov 5 15 15 27 4,500 small dog beds at $20 each 5,000 medium dog beds at $45 each 30 30 Paid salaries, $40,000 (75% selling, 25% administrative). Paid utilities. S3200 (60% selling, 40% administrative). Requirements NOTE: Use the templates provided in the Forms and Templates folder Open T-accounts and enter opening balances as of August 31, 2018 from the Trial Balance given at the beginning Open inventory records for the three inventory items and enter opening balances as of August 31, 2018. Complete the inventory records using the following transactions: Sep 1, 12, 15, 28; Oct 1, 5, 15, 18, and Nov 27. 2. 3. Update your T-accounts with the transactions for September through November listed above. 4. Create journal entries for each of the transactions you recorded in your T-accounts for September through November. Prepare adjusting entries for the fiscal year ended November 30, 2018, and post to your T-accounts: a. Depreciation, $48,500 (75% selling, 25% administrative). b. Supplies on hand: office, $200; and warehouse, $650. c. A physical inventory account resulted in the following counts: small dog beds, 1,990; medium dog 5. beds, 5,995; and large dog beds, 6,000. Update the inventory records. 6. Prepare an adjusted trial balance as of November 30, 2018. 7. Provide a summary for the month, in both units and dollars, of the change in inventory for each inventory item in the following format: Dog Beds Small Dog Beds Cost Medium Dog Beds Count Large Count Cost Cost Count Beginning Balance Add: Purchases Less: COGS Ending Balance , Does the sum of the ending balances in the inventory records match the balance in Merchandise Inventory in the general ledger? If not, review the transactions to find your error. 8. Prepare TailSpin Pet Supply Company's multi-step income statement and statement of retained earnings for the fiscal year ended November 30, 2018, and a classified balance sheet as of November 30. 2018